Understanding Organic Pricing and Costs of Production

By Jeff Schahczenski, NCAT Agriculture and Natural Resource Economist, and Emily Post, NCAT Agricultural Specialist

Abstract

This publication provides resources to compare organic and non-organic agricultural prices, discusses organic production costs, and offers tips on how to set organic crop prices. Case studies summarize insights gained from organic farmers and ranchers.

Contents

Introduction

Higher Organic Prices

Lower Organic Production Costs

Organic Profitability

Organic Pricing Strategy: How to Set Organic Prices

Case Studies

Summary

References

Further Resources

Introduction

In recent years, growth in organic food sales in the United States outpaced growth in overall food sales, despite the economic downturn. The organic food industry reached almost $52 billion in sales in 2018 (OTA, 2019). This increased demand continues to motivate some farmers to transition to organic production. Financial, human-health, and environmental benefits can be gained from transitioning to organic farming. These benefits are due to higher product prices, as well as growing value-added, intermediated, and institutional markets. (Intermediated markets include sales directly to restaurants, grocers, schools, universities, food hubs, and other institutions.) Furthermore, using organic production practices leads to an absolute reduction in the use of synthetic chemicals and fertilizers, which can reduce toxic chemical exposure, lower input costs, and lessen industrial agriculture’s sources of climate-degrading emissions. A 2015 U.S. Department of Agriculture (USDA) Economic Research Service (ERS) study suggests that the profit potential of organic farming is significant (McBride et al., 2015). This study examined the profitability of corn, wheat, and soybean production and found “that significant economic returns are possible from organic production of these crops.”

The key to profitable organic farming is to set prices for organic crops that exceed production costs, including reasonable return to labor and management, which are often undervalued. This publication explores what is known and not known about organic pricing and the costs of organic production. The aim is to assist farmers and ranchers who are exploring organic production, transitioning to organic production, or are already organic producers to better understand the economic and market potential and challenges of organic farming.

Higher Organic Prices

There are several factors that motivate farmers to certify crops as organic: environmental stewardship, lifestyle, and family and personal health, as well as higher crop and livestock prices (Peterson et al., 2012). Although growing organically provides for certain lifestyle benefits and fosters environmental stewardship, farmers still need to know if organic prices over time offer enough of an incentive to motivate significant change in farming and ranching practices and to undergo organic certification. Of equal importance is understanding how production costs compare between organic and nonorganic growing, in order to better evaluate the economic potential of both systems in the long run.

Organic Prices

Several sources of information compare organic and non-organic crop prices within similar regions of production and markets, allowing suppliers and consumers to better gauge organic prices. The USDA Agricultural Marketing Service (AMS), Maine Organic Farmers and Gardeners Association (MOFGA), the Organic Farmers’ Agency for Relationship Marketing (OFARM), Mercaris, Organic Grain Research and Information Network (OGRAIN), and the Organic Trade Association (OTA) all provide some organic price data, with several limitations. A description of each source of price information appears below. These sources may be used to compare organic prices in your area and to look at markets in other areas of the country or world, if exporting.

Agricultural Marketing Service (AMS) Market News Reports

The USDA AMS has published current prices and sales information on non-organic farm commodities for the past 90 years, and its postings now include some organic price data. The retail price data comes from advertised prices and is averaged nationally and sometimes by city or region. A weekly summary can be found online at AMS Weekly Organic Prices Summary. An additional report, AMS Organic Specialty Crop Prices, provides price data for horticultural and specialty crops. Table 1 shows an example of national price-premium data for organic dairy products in July 2012.

Although a good source of data for some products, AMS does not have very good data on organic grain and other row crops. For instance, the AMS National Organic Grain and Feedstuffs Report only has pricing data on organic feed-grade yellow corn, soybeans, and hay. There may be future efforts to provide more data for other crops such as dry beans, but as of January 2019, this data is not available from AMS.

| AMS Dairy Retail Report Vol. 79 – No. 30 – Thursday, July 26, 2012 | ||||

| National Average | ||||

| Conventional | Organic | Price premium | ||

| Commodity | Pack size | Wtd Ave* | Wtd Ave* | Percentage |

| Butter | 1 lb | $2.34 | $4.32 | 85% |

| Cheese (natural varieties) | 8 oz block | $2.20 | $3.00 | 36% |

| Cheese (natural varieties) | 8 oz shredded | $2.16 | $2.50 | 16% |

| Milk | half gallon | $1.82 | $3.64 | 100% |

| Milk | gallon | $2.82 | $5.99 | 112% |

| Sour cream | 16 oz | $1.45 | $4.49 | 210% |

| Yogurt | 32 oz | $2.15 | $2.99 | 39% |

| Average premium | 85% | |||

| *based on retail store advertising throughout the country | ||||

Maine Organic Farmers and Gardeners Association (MOFGA) Organic Price Reports

MOFGA is the oldest state-based organic certification and education organization in the United States. It has a long history of tracking organic prices of mostly horticultural products in the state of Maine. In 2018, MOFGA published prices based on both direct consumer and wholesale marketing. These are provided by MOFGA members and other sources. MOFGA also provides additional agricultural services and educational opportunities and is engaged in state and federal public policy issues concerning organic and sustainable agriculture.

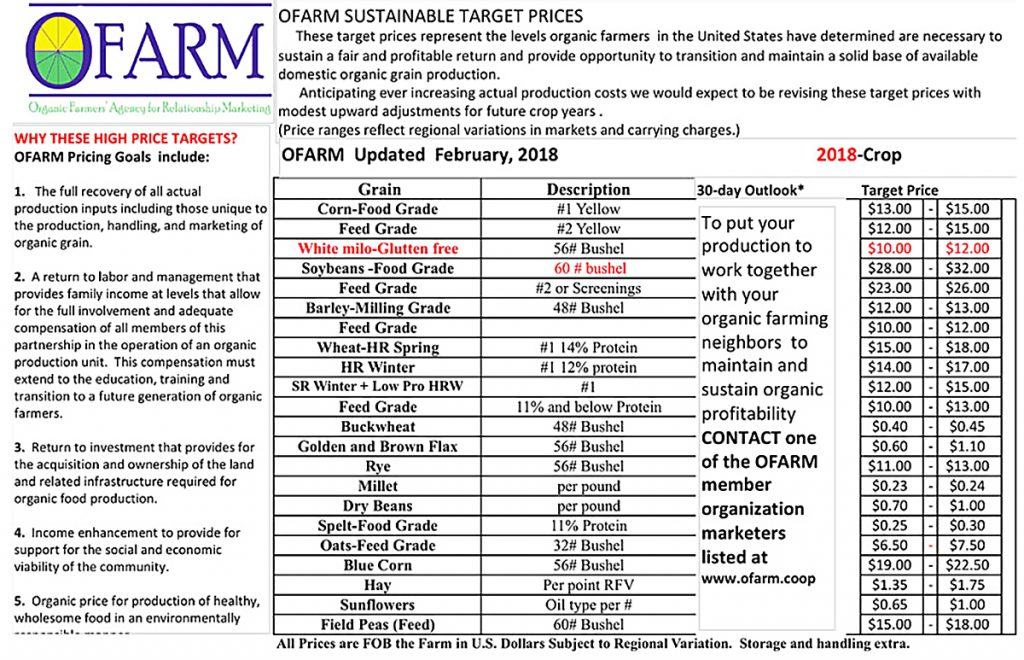

Table 2. Source: OFARM

Organic Farmers Agency for Relationship Marketing (OFARM)

OFARM is an organization of producer groups working together to increase their pricing leverage and contract sale pricing, which they term relationship marketing. As part of this effort, OFARM tracks organic prices for grains and attempts to identify “sustainable target prices” for members’ products. To date, this group has concentrated its efforts on organic grain, dairy, and livestock prices.

OFARM’s list of target prices for the current year can be viewed on its website by following the connecting links to livestock, grain, and dairy. Table 2 is a copy the 2018 annual target prices. OFARM hopes to expand the concept of relationship marketing beyond grains, livestock, and dairy farms in the future.

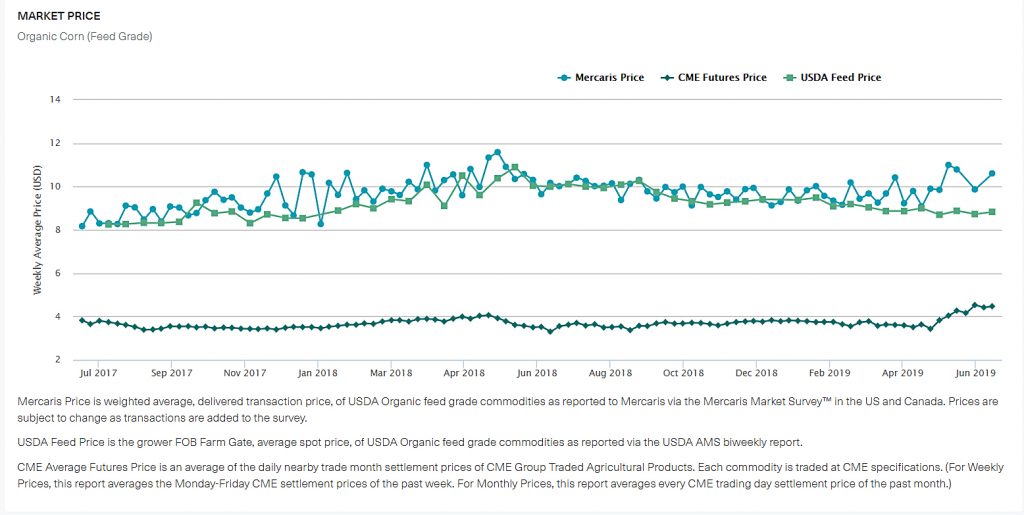

Mercaris, Inc.

Mercaris is a private market-intelligence provider and online trading platform for organic, transitional organic, non-GMO, and organic certified agricultural commodities. Mercaris provides national and regional pricing for organic and non-GMO field crops. Mercaris pricing data is derived from the Mercaris Market Survey, in which more than 50 first handlers in the United States and Canada report contracted delivered transaction prices for USDA Organic feed-grade commodities. The company name derives from two Latin words: mercatus, which means gathering for the purposes of commerce or markets, and mercari, meaning trade. This market information service has a limited free version and multiple paid versions selling different types of information packages. For instance, one can purchase, as part of a package, conventional versus organic weekly price reports on such major commodity crops as corn, soybeans, and wheat. Mercaris also offers organic crop import data, which can be valuable in understanding import price competition and overall domestic demand. An example of organic corn-import price data provided by Mercaris is shown in Table 3 below.

Table 3. Monthly Average Organic Field Corn Prices. Source: Mercaris, 2019

Organic Grain Research and Information Network (OGRAIN)

OGRAIN is a networking listserv sponsored through a project of the University of Wisconsin-Madison. It is designed to support organic grain farmers with up-to-date research and technical information. OGRAIN also sponsors an annual conference and field days. The information is specific to grain farms in the Midwest but has value to current and potential organic grain farms nationwide. OGRAIN and other sponsors recently published Turning Grain into Dough (2019), which assists with financial management of organic grain farms. The publication is a companion to an online financial-planning tool, the Organic Grain Compass (see Further Resources section). This tool helps with enterprise budgeting, cash-flow prediction, and calculating the internal rate of return on investment in organic grain production in the Midwest. The tool is very useful, particularly for financial planning during the organic transition years.

Organic Trade Association (OTA)

OTA’s mission is to “promote and protect ORGANIC with a unifying voice that serves and engages its diverse members from farm to marketplace” (OTA, 2019). Membership includes just about anyone involved in the organic food and non-food sectors, including farmers, ranchers, processors, organic certifiers, farming associations, distributors, importers, exporters, consultants, and retailers. All members engage in creating national policy as well as educating Congress and others to promote organic agriculture. The resources available on OTA’s website regarding prices and market development include an annual organic industry survey and special reports. For instance, a report on organic trade data from 2011 to 2016 gives a comprehensive overview of import and export trade volumes and prices.

Higher Prices and Thin and Distinct Markets

Organic markets and prices are not necessarily linked, and, indeed, organic markets have “unique characteristics when compared with their conventional counterparts” (Nemati and Saghaian, 2016; Skorbiansky and Ferreira, 2017). Generally, organic products receive higher prices than their non-organic counterparts in most sales venues and most markets. It is important to know which market venues to target and when to sell, so as to get the highest price available.

Price Premiums

Higher prices are often called “price premiums,” but they are simply higher prices due either to higher demand relative to supply, or simply the desire and ability by some segment of the consuming public to pay higher prices for the attributes that certified organic products offer. See Aschemann-Witzel and Zielke (2017) for an excellent discussion of consumer price preferences for organic food.

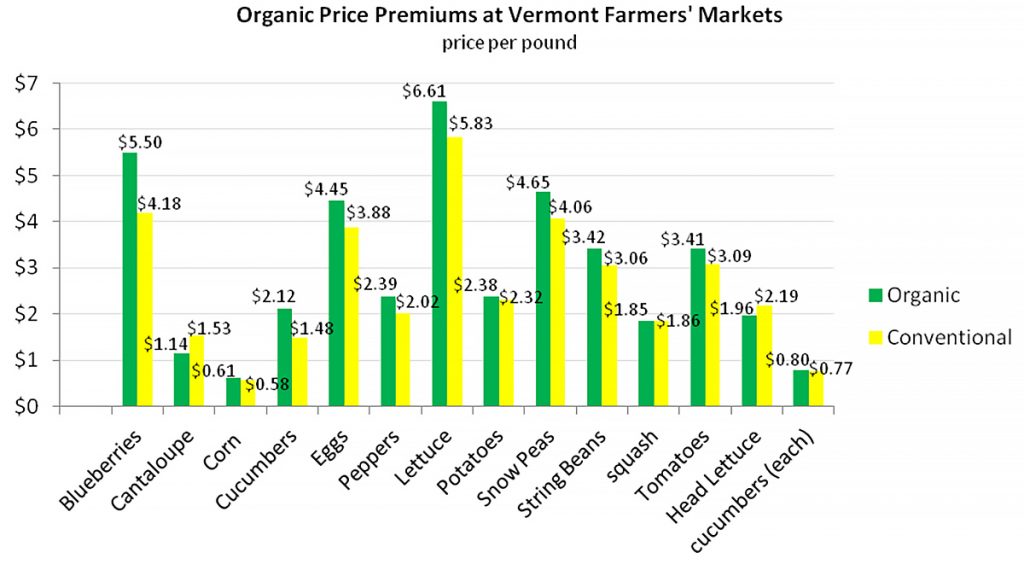

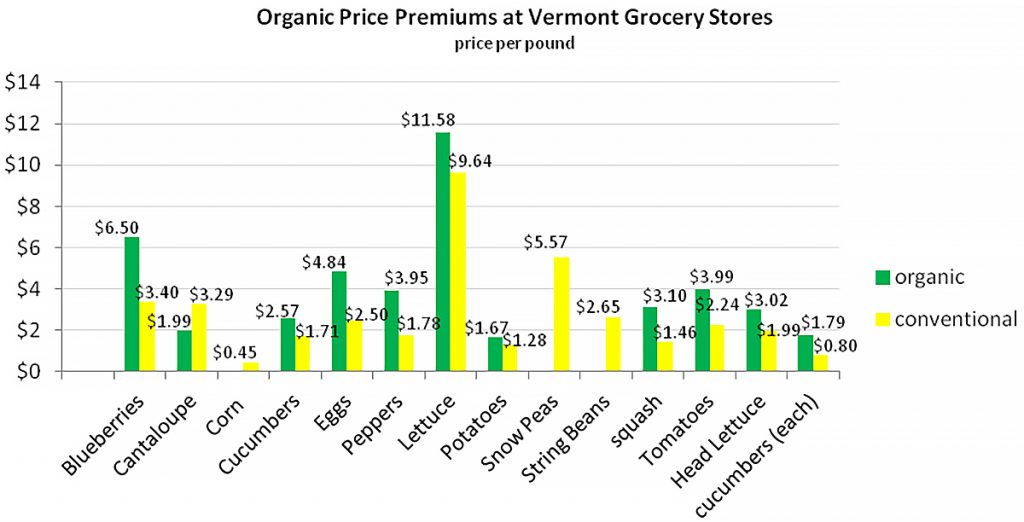

Organic Horticultural Markets

In January of 2011, the Northeast Organic Farming Association of Vermont (NOFA-Vermont) published a price-comparison study between conventional and organic produce at farmers markets and grocery stores (Claro, 2011). Aside from cantaloupe, squash, and head lettuce, organic produce was more expensive than conventional produce at farmers markets in Vermont. At grocery stores, organic cantaloupe was the only item less expensive than the conventionally grown counterpart. Figures 1 and 2 illustrate higher prices for organics in farmers markets and grocery stores.

Higher prices exist not only for organic versus non-organic crops, but also arise from the venue where the product is sold: farmers markets, grocery stores, or wholesale to restaurants. For many producers, direct sales are best because the farmer receives the entire markup. However, it is important to account for the time and labor to participate in direct marketing, in order to weigh the benefits and challenges involved fairly.

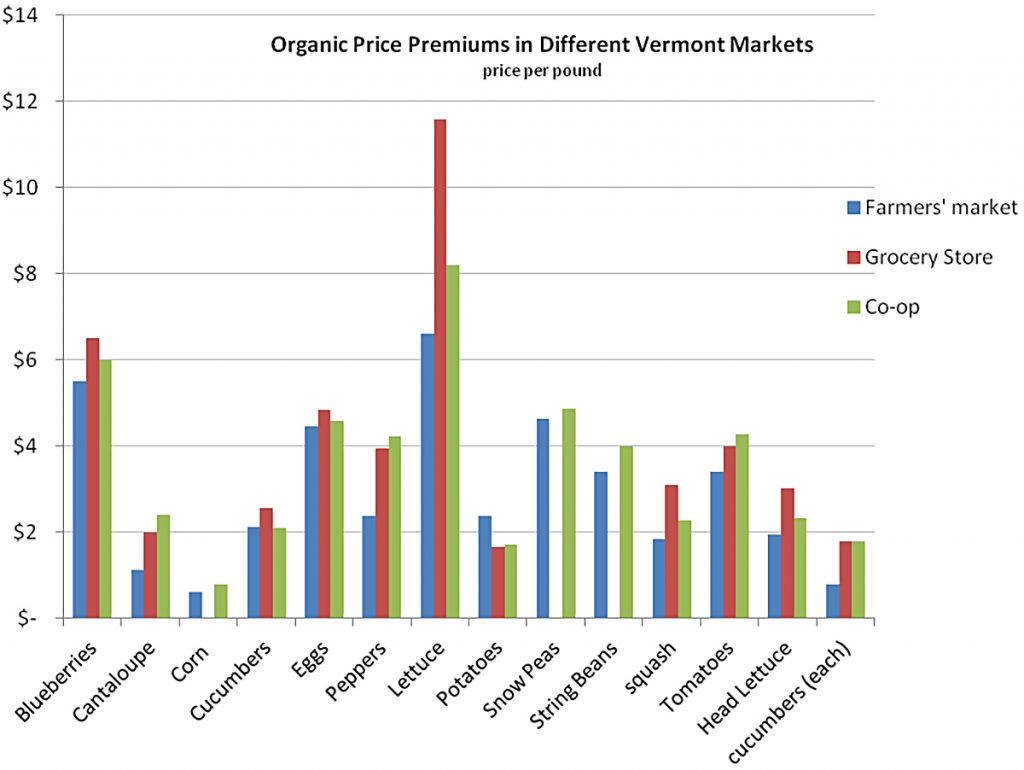

The NOFA-Vermont study mentioned earlier also found that when comparing organic prices at farmers markets, grocery stores, and co-ops, of 14 fruits or vegetables tracked, all but potatoes were cheapest to buy at the farmers market.

On average, produce was 38% less expensive at farmers markets than at grocery stores and 28.7% cheaper at farmers markets than at co-ops (Claro, 2011). There is a perception that produce is expensive to buy at farmers markets, but this study shows otherwise. The implications are important for consumers and producers. Figure 3 shows price differences from the study.

Figure 1. Higher Organic Prices Received by Farmers at Farmers Markets in Vermont, 2010 Data. Source: Created from Vermont Farmers’ Markets and Grocery Stores: A Price Comparison. NOFA-VT.

Figure 2. Higher Organic Price Differences at Grocery Stores in Vermont, 2010 Data. Source: Created from Vermont Farmers’ Markets and Grocery Stores: A Price Comparison. NOFA-VT.

Figure 3. Higher Organic Prices in Different Vermont Markets, 2010 Data. Source: Created from Vermont Farmers’ Markets and Grocery Stores: A Price Comparison. NOFA-VT.

Producers impressed by the farmers markets’ higher prices for organic products must remember that the costs of travel and labor in setting up and selling do add to costs of marketing directly. Furthermore, though organic products generally command higher prices, the question still remains as to whether they carry a high enough price to cover the cost of certified organic production.

Additional recent (2016) data has shown that, at the retail food level, organic food price premiums were more than 20% of their non-organic equivalents based on research conducted on 17 food products from 2004 to 2010 (Carlson and Jaenicke, 2016). Only three of the 17 organic food products in this study showed a decline over this period, but organic prices still remained higher than equivalent non-organic products. However, it is not possible to know if these retail prices for organic food are reflected in wholesale markets or necessarily benefit organic farmers.

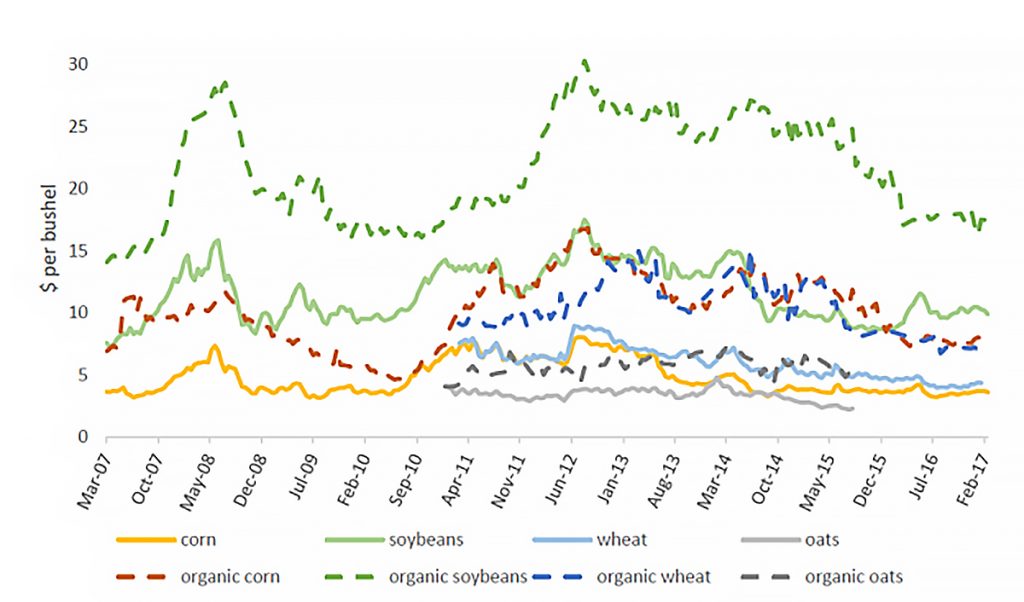

Organic Field Crop Markets

Organic field crop market prices are often significantly higher than their non-organic counterparts. Research by Skorbiansky and Ferreira in 2017 provides data on price differentials for corn, soybeans, wheat, and oats. Figure 4 shows this data.

Figure 4. Non-Organic (conventional) and Organic Grain Prices in $/bu., 2007-2017. Source: Skorbiansky and Ferreira, 2017, p. 22

However, despite some evidence that these organic and non-organic field crop prices may be partly related and move together to some degree, these authors argue that the continued relative higher prices of organic grains suggest that prices in general more than cover economic costs. This conclusion leads to another issue concerning organic crop price variability and organic farmer income that has to do with the issue of what economists call “thin” markets.

Organic crop markets are often referred to as “thin” markets, which means there are few purchasers of organic field crops and the volume of organic field crops traded in the market is low. Though organic agriculture is more often considered to have thin markets, there has been evidence of a general “thinning” of agriculture/food markets (Adjemain et al., 2016). In broad terms, thin agricultural markets are often also concentrated markets, where the prices of products are not transparent because the information about market prices and trends is controlled by a few buyers in the market.

Market concentration is measured by the degree to which farmers, processors, wholesalers, and retailers control market supply. In non-organic commodity agriculture, market concentration is high in seed suppliers, agrichemical companies, livestock genetics, livestock buyer markets, various commodity-processing companies (e.g., soybean processing), and breakfast cereal manufacturing (Hendrickson et al., 2017). Market thinness in organic agriculture means that market price transparency is very limited and supply and demand of organic products do not adjust efficiently. Thus, product surpluses and gluts are more likely, creating greater price volatility. Price volatility, in turn, could make it difficult for current and transitioning organic farmers and ranchers to sustain profitability.

Lower Organic Production Costs

There have been several studies looking into production costs of organic versus non-organic crops, and some findings do show higher production costs for certain organic crops and livestock products. However, other studies have found very similar production costs when comparing organic and non-organic production systems. Researchers from Purdue University found that costs for organic soybeans and corn are lower than non-organic costs for the same crops, although not all labor costs were considered. They found that yields for organic soybeans and corn were lower than non-organic but that the higher organic prices make up for the lower yield (Clark and Alexander, 2010).

UC Davis publishes “cost and return” studies for a variety of non-organic and organic crops grown in California. A farmer can look at sample cost reports for pears, for example, and compare production costs for both organic and conventional fruit.

A recent (2019) study of organic blueberry production in Chile is perhaps one of the best holistic looks at organic and non-organic costs of production (Montalba et al., 2019). In this meticulous study, the authors not only compared organic and non-organic blueberries but further divided the organic blueberry farmers into two groups, which they labeled according to management practices. The two kinds of organic farmers were termed “organic input substitution farms” and “organic agroecological farms.” These two types were both certified organic farms, but the input-substitution organic farms followed certification rules strictly, not always in terms of the broader principles of the organic movement. Organic agroecological farms, on the other hand, pursued more ecologically oriented systems approaches, including other social objectives like improving human health and fair treatment of farm workers. This division of organic farmers is also discussed by Dr. Julie Guthman in her book Agrarian Dreams: The Paradox of Organic Farming in California. Guthman calls this division the “bifurcation” of organic agriculture, where some organic farmers use the same practices as non-organic farmers (input substitution) and others “remained dedicated to agroecological techniques and smaller farm models” (Guthman, 2014).

The results of the research in Chile demonstrated that blueberry yields were about the same across all three types of farms, but the organic agroecological system had the highest yield, followed by the organic input-substitution system and finally the non-organic system. The Organic Agroecological system had the lowest variable production costs, at $2,266 dollars per hectare per year, followed by the non-organic system at $2,753 dollars per hectare per year. Interestingly, the organic input-substitution system had the highest production costs at $3,364 dollars per hectare per acre. Though it was not discussed in this study, the general higher price for organic blueberries likely compensated for these higher costs and most likely indicates even higher profitability of the organic agroecological system.

The study is limited because of its concentration on only one type of crop and its location in a specific ecology in Chile, but it nonetheless indicates that organic agroecological management may be a better option for farmers. However, the researchers note that learning how to be a good organic agroecological farmer is not simple and likely requires the acquisition of new types of skills and knowledge.

The Rutgers New Jersey Agricultural Experiment Station prepared several organic crop budgets to be used as references to plan personal crop budgets. The costs used in each comparison were estimated from average labor costs, average input costs, averaged land costs, and averages of other costs. The budgets do not reveal individual farm data. Budgets are posted for field crops, fruits, vegetables, and livestock. These budgets provide cost information for one acre of production and include variable and fixed costs such as the following:

-

- Soil amendments

- Pest management

- Labor

- Irrigation

- Machinery repair and fuel

- Marketing

- Machinery and equipment

- Land

Another study that has some of the best data from actual organic and non-organic farms over five years is provided by the Minnesota Department of Agriculture (MDA, 2011). From 2006-2010, the average cash expense for the 44 to 54 organic farms sampled was $523 per acre, while the much larger sample of between 2,317 and 2,503 non-organic farms showed expenses of $634 per acre. Operating profit margins for the organic farms ranged from -2.9% to 20% for this period, while those for non-organic farms ranged from 7.9% to 27.5%, suggesting a greater profitability for non-organic farms. However, the data also show that some organic farms are clearly as profitable as, or more profitable than, some conventional farms. Finally, the study also suggested that non-organic farmers must make at least 20% margins to stay profitable and that organic farmers need to make slightly higher 25% to 30% profit margins to account for lower sales volumes (MDA, 2011). The important point is that profitability is not easily guaranteed in either organic or non-organic production systems.

Karen Klonsky, a Cooperative Extension agent with the Department of Agriculture and Resource Economics at the University of California, Davis, did a comparison of organic and non-organic production systems in California (2012). She modeled the cost of production and resource use for individual farms and applied the costs to hypothetical commercial organic and non-organic farms. She looked at field crops (alfalfa, processing tomatoes, and corn), vegetables (broccoli and lettuce), fruit (raisin grapes and strawberries), and tree nuts (almonds and walnuts) and compared the differences in fertility and pest- and weed-control costs, which include materials, labor, fuel, lube, and repairs on used equipment.

The study found that fertilizer costs are higher for organic production for all crops except alfalfa. Organic broccoli and organic lettuce had the highest cost difference at $632 and $910 for organic broccoli and lettuce compared to non-organic versions at $260 and $382, respectively. Because organic production doesn’t allow herbicides, weed control costs were higher for all organically grown crops dependent on hand weeding, and lower for corn and alfalfa that don’t require hand weeding.

Overall, production costs for fertility, weed control, and pest and disease control for organic production systems are more than costs for non-organic systems, with strawberries and lettuce as the exceptions due to fumigation costs of strawberries and the use of synthetic pesticides in lettuce.

The similarity between these studies was that the cost for organic pest control is higher than non-organic methods because the allowed substances used in organic production are generally more costly. However, many organic farmers are trying very hard to move away from costly inputs that are mere substitutes for non-approved and generally more toxic non-organic pest control methods. Utilizing cultural practices such as crop rotations and improving beneficial- and predator-insect habitat can ultimately lower the costs of inputs in organic production.

Another issue is whether the cost of labor is higher in organic production systems. Most of the studies reviewed did not note higher labor inputs, despite the fact that the extra recordkeeping required for organic certification may be a source of cost difference.

Another cost difference found in the comparison studies arose from the marketing and distribution or brokerage fees. Because a more-developed infrastructure exists for sales of non-organic products, farmers can more easily take their products to existing markets. In contrast, organic producers often spend extra time to market and distribute their products.

Organic Profitability

Given that organic prices are higher and organic production costs are lower, it would seem axiomatic that organic farming is more profitable than non-organic farming.

A 2014 global meta-analysis has suggested that certified organic field crop farming systems are financially competitive with non-organic systems even if organic price benefits decline (Crowder and Reganold, 2015). In particular, the USDA Economic Research Service (ERS) has offered evidence that certified organic field crop farms may be able to earn greater returns than similarly situated non-organic farms (McBride et al., 2015). Unlike previous global meta-analyses, the ERS study found that the profit potential of organic field crop production was highly associated with higher organic prices for their products. However, this study only looked at national data from 2011 to 2014 and only for three field crop enterprises: corn, soybeans, and wheat.

Despite growing evidence, the profit potential of organic production is still not well understood, and it is therefore an important area for further research. Another area of research that is critical to more complete understanding of organic profitability is better knowledge of the longer-run stability of prices and product demand in organic markets. Although there is some older research on this topic regarding produce, there is none for field crop markets.

Produce farmers in California report insufficient access to stable markets for organic products as one of the largest barriers to economic viability. This older study also found that information and technical assistance are important, because non-organic farmers who adopt organic farming by simply substituting organic inputs for conventional are likely to be unsuccessful (Strochlic and Sierra, 2007).

Another, more recent, study by Delbridge and King (2016) used a dynamic programming model based on Midwest organic field crop data that showed organic field crop production is conceptually more attractive to smaller farms when compared to larger farms. Furthermore, the profitability of organic field crop farmers in Minnesota is highly sensitive to the higher prices of organic products. Thus, if organic field crop farmers anticipate declining organic prices in the medium and long term, they may be less willing to continue organic management. However, very recent research suggests that the rate of “surrendering” of organic certificates is quite low (Skorbiansky and Ferreira, 2018). Nonetheless, if current organic farmers have these negative views of future prices, they may be preparing to exit organic production or are not confident enough to expand supply.

Organic Pricing Strategy: How to Set Organic Prices

A frequently asked question is how to price organic crops and livestock. Does pricing depend on production costs, market prices, or putting a price premium on top of non-organic crop and livestock prices? Does it depend on debt capital, what commodity you’re selling, volume, or a combination of these factors? After we interviewed experts in the field and successful farmers, it appears that the number-one factor in effective pricing is quantifying your costs and selling above those costs. It can be difficult to quantify production costs accurately and estimate profits from sales, but knowing production costs is key to staying in business. You must make sure that you’re making more than you’re spending and also know whether your investment in time and money is providing an adequate return.

Organic pricing strategies vary between farmers. Some farmers quantify production costs and add a price margin to assure a reasonable profit margin. Some price according to local market prices. Most farmers likely use a combination of both approaches. Pricing also depends on what market outlet you use—whether you’re selling directly at a farmers market, or to a retailer such as a grocery store or restaurant.

In better understanding how diversified farms do and could improve pricing strategies, Becot et al. found that careful record keeping is essential; that that real-time recording of production, production costs, and pricing is critical; and, finally, that precision in tracking labor costs and market price changes is often not present. However, with new tools like smart phones, these tasks are becoming easier.

There are other factors that impact pricing:

-

- Harvesting costs

- Quality and selection of products

- Location and market

- Customer income/ demographic

- Sales volume offered

- Supply and demand in your market

- Market price in your area

Your pricing strategy speaks volumes about your business. You will quickly earn a reputation as fair and ethical if you have a good pricing strategy. The alternative is to be known as cheap, dishonest, and desperate among consumers and competitors. Your pricing strategy should be consistent, accurate, and reliable. Many people want farmers to have a good quality of life and are willing to pay a fair price for quality products, so price according to what you are spending and add a reasonable markup.

Production-Costs Recordkeeping

Good recordkeeping is the best way to determine good pricing. If you know how much it costs to produce each item and each item’s corresponding sales price, you can determine which products you should continue to produce and which don’t make sense to sell because you lose money on them. It is important to calculate expenses frequently so you can keep track of how costs change over time. Don’t be afraid to adjust your prices halfway through the season if costs go up significantly. If you don’t, you’re doing a disservice to your customers, because you won’t be in business long-term.Operating costs (labor, seeds, irrigation, fertilizers, cover crops, etc.), fixed costs (land, equipment), and return on investment are considered when evaluating a farming business. For more information, consult the ATTRA publication Evaluating a Farming Enterprise.

Recordkeeping Resources

Software such as AgSquared can help with financial recordkeeping, crop rotation planning, and farm management.

There are some pricing strategies that may help if you are charging a fair price but not making enough profit:

-

- Produce more

- Focus on the products that are generating the most profit

- Decrease expenses

Redefine your niche, customers, or marketing (repackage products in different sizes or by the bunch to get away from the same volume as competitors).

Tips for Farmers to Be Profitable and Stay in Business through the Medium- to Long-Run

The goal is to price to stay in business. Following are some tips to consider:

- Be aware when prices and costs change; be flexible and change prices accordingly.

- Get new things to market so you don’t look like everyone else.

- Keep a close eye on costs but don’t compromise quality; if you have an exceptional product people will pay for it.

- Do market research, know who the customers are and what they want, and educate them about production costs.

Case Studies

Chinook Farms

Snohomish, Washington

Chinook Farms produces organic vegetables and grains, as well as grass-finished beef and poultry.

Eric Fritch, owner of Chinook Farms, records all costs, in order to know how he should set prices. He has two full-time employees who must be paid salaries, but some costs of labor can’t easily be planned—for instance, 38 hours of labor spent in response to elk-herd damage. Fritch doesn’t set prices based on farmers market prices per se but says there is etiquette involved in being aware of them. “It’s frowned upon if someone comes in and undercuts others. Not good for that farmer either, because buyers become suspicious of the produce, wondering what are they doing to sell so cheap,” Fritch says. He says you don’t have to be the lowest guy on the block if your product has some kind of higher value, but also that the value of a local, sustainable farm only goes so far, so you have to take care to price with value and quality in mind.

For meat and grain sales, Fritch first finds interested customers and then the price is determined based on what the customer is willing to pay and what he’s willing to accept. Fritch sells directly to end-consumers to maximize profit. “There’s not enough margin to sell to a wholesaler who then sells to a retailer.”

Kalon Farm

Ashburnham, Massachusetts

Kalon Farm is a small farm a few miles south of the New Hampshire state line that raises grass-finished beef, lamb, and pork. They also sell cage-free eggs and seasonal vegetables and berries. The farm is not certified organic, but they use antibiotic-free feed for chickens and pigs and do not use growth hormones. The cattle and sheep are grass-based and are only fed hay and grass, with no grain. Kalon Farm avoids the use of any type of insecticide, herbicide, or fungicide on the gardens and pastures and relies on crop rotation, on-site composting, cover cropping, and rotational grazing to build soil health.

Keith Kopley breeds, raises, and butchers most of the animals, so he really pays attention to prices and market value, feed costs, and lamb prices during Easter, as these impact demand for good-quality meat. Kalon Farm tries to make a 35% profit at grocery stores, but profit percentage may be lower for bulk orders like half a cow, so for those sales they particularly have to watch costs. Kopley said that veggie prices are more market-driven than meat prices. The farm is close to Boston, so they have to price a little lower because Boston markets are very competitive.

Live Springs Farms

Carrollton, Illinois

Live Springs Farm was a 610-acre biodynamic farm that produced pasture-raised pork, free-range or pastured chicken and eggs, and grass-fed, grass-finished beef. It also produced certified organic grains, hay, and legumes, all grown biodynamically. Biodynamic farming is a system that combines most or all elements of certified organic production with additional inputs and practices designed to maintain soil biological balance.

To price their products, Bobbi Sandwisch and Alex Weber quantified all costs using enterprise budgeting and also scanned competitors’ prices in the market area, including Whole Foods and Trader Joes. After assessing a competitive market value, they added a fair profit percentage onto their products’ prices. Sandwisch believed their crops a higher quality than what is sold at Whole Foods, but kept her prices lower because buying from her was not as convenient for consumers.

When it came to selling eggs, Sandwisch debated charging more but thought the eggs drew in customers who usually bought additional items. Sandwisch and Weber let the profit margin slide to build up a customer base, anticipating profits eventually going up because their costs would go down. For instance, they wouldn’t always be improving infrastructure and building herds.

Certain costs they incurred that their competitors may not have included building new marketing, distribution, handling, and accounting infrastructure comparable to what is already in place for conventional agriculture. Sandwisch said organic feed was a higher cost because local grain elevators don’t carry it, so it had to be shipped from far off. Also, it’s harder for a non-conventional enterprise to get bank loans. Bankers are used to conventional operations and see less risk in them. Because of higher costs, Sandwisch says the best pricing advice is to quantify costs so that you know which items you’re making money on and which you’re not, so you can act accordingly.

Finally, it is important to note that this farm did not survive past 2016. An article noted: “…however we were not able to make the farm financially sustainable, and I could no longer carry the large annual losses. We had hoped to close the farm slowly over the year but internal struggles forced my decision to close the farm quickly.” Even the best-laid plans and efforts do not always lead to long-term success (Riske, 2016).

Summary

Maintaining profitable farming is not easy, whether producing organically or non-organically. Although the costs of production for organic farming may sometimes be higher than costs for similar non-organic farms, yield differences and the lack of fully developed markets for organic products could make profitability more of a challenge for the organic producer. Higher organic prices exist for many crop and livestock products, but it is important to realize that organic prices can be volatile. Also, though not often the case, it is possible for some organic products to fetch lower prices than non-organic products. For instance, from April 2010 through March 2011, market prices for organic soft red winter wheat were either equal to or actually lower than those for its non-organic equivalent (Hayes, 2011). This was due mostly to the exceptional price of non-organic wheat, driven by many market factors.

Finally, it is important to remember that supply and demand drivers in organic markets are probably not the same as in non-organic markets. Pricing in organic markets is not as simple as raising prices by some fixed percentage over equivalent non-organic products. As discussed above, many immature, undeveloped organic markets are “thin” markets where buyers and sellers in the market are few and the number of transactions is relatively low, leading to generally higher market-price volatility. If organic prices are very volatile, it is often hard to have a high level of certainty in the ultimate market prices of your products. However, it does seem that where there are more organic farmers and better access to larger markets, organic markets are becoming less thin and prices are more stable. Finally, with limited, but improving, national sources of organic price and production cost information becoming more available, the economic and marketing risks of organic production may potentially be lowered.

References

Adjemain, M.K., T.L. Saitone, and R.J. Sexton. 2016. A framework to analyze the performance of thinly traded agricultural commodities. American Journal of Agricultural Economics. Vol. 98, No. 2. p. 581-596.

Aschenmann-Witzel, J., and S. Zielke. 2017. Can’t buy me green? A review of consumer perceptions of and behavior toward the price of organic food. The Journal of Consumer Affairs. Spring. p. 211-251.

Becot, F.A., D.S. Conner, J.M. Koloninsky, and V.E. Mendez. 2014. Measuring Costs of Production and Pricing on Diversified Farms: Juggling Decisions amidst Uncertainties.

Brumfield, Robin G. and M.F. Brennan. 1996. Crop Rotational Budgets for Three Cropping Systems in the Northeastern United States. Rutgers New Jersey Agricultural Experiment Station.

Carlson, A. and E. Jaenicke. 2016. Changes in Retail Organic Price Premiums from 2004 to 2010. USDA Economic Research Service (ERS). Economic Research Report No. ERR-209.

Clark, Samuel and Corinne Alexander. 2010. The Profitability of Transitioning to Organic Grain Crops in Indiana. Purdue Agricultural Economics Report. February.

Claro, Jake. 2011. Vermont Farmers’ Markets and Grocery Stores: A Price Comparison. NOFA-VT, Richmond, VT.

Crowder, D.W. and Reganold, J.P. 2015. Financial competitiveness of organic agriculture on a global scale. Proceedings of the National Academy of Sciences. Vol. 112, No. 24. p. 7611-7616.

Dalton, T.J., R. Parsons, R. Kersbergen, G. Rogers, D. Kauppila, L. McCrory, L.A. Bragg, and Q. Wang. 2008. A Comparative Analysis of Organic Dairy Farms in Maine and Vermont: Farm Financial Information from 2004-2006. University of Maine, Maine Agricultural and Forest Experiment Station. Orono, ME. Bulletin 851.

Delbridge, T.A., and R.P. King. 2016. Transitioning to organic crop production: A dynamic programming approach. Journal of Agricultural and Resource Economics. Vol 41, No. 3. p. 481-498.

Guthman, Julie. 2014. Agrarian Dreams: the Paradox of Organic Farming in California, 2nd edition. University of California Press, Berkeley, CA.

Hayes, George. 2011. More Montana Farmers are Venturing Toward the Organic Marketplace. Montana Business Quarterly. Summer. p. 11-14.

Hendrickson, M., P.H. Howard, and D. Constance. 2017. Power, Food and Agriculture: Implications for Farmers, Consumers and Communities. Applied Social Sciences Working Paper, University of Missouri, College of Agriculture, Food & Natural Resources, Columbia, MO.

Klonsky, Karen. 2012. Comparison of Production Costs and Resource Use for Organic and Conventional Production Systems American Journal of Agricultural Economics. Vol. 94, No. 2. p. 314-321.

McBride, W.D., C. Greene, L. Foreman, and M. Ali. 2015. The Profit Potential of Certified Organic Field Crop Production. USDA Economic Research Service (ERS), Report 188.

Minnesota Department of Agriculture (MDA). 2011. Organic Farm Performance in Minnesota.

Montalba, R., L. Vieli, F. Spirito, and E. Munoz. 2019. Environmental and productive performance of different blueberry (Vaccinium corymbosum L.) production regimes: Conventional, organic, and agroecological.

Nemati, M., and S. Saghain. 2018. Dynamics of price adjustments in qualitatively differentiated U.S. markets: The case of organic and non-organic apples. Journal of Agribusiness. Vol. 36, No. 1.

Organic Grain Research and Information (OGRAIN). 2019. Turning Grain into Dough: Farm Financial Management for Organic Grain and Crop Rotation. Prepared by Paul Dietman, Senior Lending Officer, Compeer Financial.

Organic Trade Association (OTA). 2019. Organic Industry Survey.

Peterson, Hikaru Hanawa, Andrew Barkley, Adriana Chacon-Cascante, and Terry L. Kastens. 2012. The motivation for organic grain farming in the United States: profits, lifestyle, or the environment? Journal of Agricultural and Applied Economics. May. p. 137-155.

Richards, Timothy J. 2011. The Economics of the Organic Food System: Discussion. American Journal of Agricultural Economics. Vol. 94, No. 2. p. 322-323.

Riske, Heather. 2016. Live Springs Farm in Carrollton to close. Feast Magazine.

Skorbiansky, S.R., and G. Ferreira. 2018. Analysis of Fraud Incidents in the U.S. Organic Market. Selected paper prepared for presentation at the 2018 Agricultural and Applied Economics Association Annual Meeting, Washington, D.C., August 5-7.

Strochlic, R., and Sierra, L. 2007. Conventional, Mixed and Deregistered Organic Farmers: Entry Barriers and Reasons for Exiting Organic Production in California. California Institute for Rural Studies.

Takele, Etaferahu, B. Faber, M. Gaskell, G. Nigatu, I. Sharabeen. 2007. Sample Costs to Establish and Produce Organic Blueberries in the Coastal Region of Southern California, San Luis Obispo, Santa Barbara, and Ventura Counties, 2007. University of California Cooperative Extension.

Further Resources

California Certified Organic Farmers (CCOF)

The homepage for California Certified Organic Farmers (CCOF) offers a host of useful information. The CCOF handbook can also be downloaded.

The text of The California Organic Foods Act of 2003 can be downloaded from this site, as well as organic sales reports.

Canadian Organic Growers Inc. is Canada’s national membership-based education and networking organization representing farmers, gardeners and consumers in all provinces. Articles from past issues of The Canadian Organic Grower magazine and its predecessors are available online.

Center for Environmental Farming Systems – Organic Research Unit

The Center for Environmental Farming Systems conducts organic research and farming systems research and has a project specific to organic grain production and marketing.

Farm Made: A Guide to On-Farm Processing for Organic Producers

A publication from the Kerr Center that contains information about how organic management can bring many benefits to the farm. One of these is better net income. A major contributing factor to an improved bottom line is the premium that organic commands in most markets. However, as production increases and organic products go mainstream, premiums are likely to decline, and organic farmers are likely to face the same economic pressures as their conventional neighbors. One way to avert this is by adding value to organic crops through on-farm organic processing.

Downloadable financial management tool for organic grain farmers.

Understanding Organic Pricing and Costs of Production

By Jeff Schahczenski, NCAT Agriculture and Natural Resource Economist, and Emily Post, NCAT Agricultural Specialist

Published September 2012, updated November 2019

© NCAT 2019

IP441

Version 110519

This publication is produced by the National Center for Appropriate Technology through the ATTRA Sustainable Agriculture program, under a cooperative agreement with USDA Rural Development. ATTRA.NCAT.ORG.