Knowing the Real Value of Food: Blockchain in a New Sustainable Food Economy

By Jeff Schahczenski, NCAT Agriculture and Natural Resource Economist

Abstract

This publication provides an introduction to blockchain technology as it relates to marketing sustainably produced food products through a supply chain in novel and more transparent ways. Blockchain technology offers promises of a new and disruptive form of algorithmic economic trust. Three case studies explore how blockchain is and is not yet living up to its many promises to build trust in sustainably produced food products with multiple attributes delivered to increasingly discerning consumers.

Introduction

“A cynic is a man who knows the price of everything and the value of nothing.”

—Oscar Wilde, 1892

Getting off the plane at the international airport in Lima, Peru, one cannot help seeing a massive Coca-Cola® six-pack sculpture. Whether a sign of significant multinational global capitalism or simply a surprising reminder of one of the most trusted worldwide brands, the Coca-Cola® brand does represent an embedded trust that no matter where one travels a Coke is a Coke (Ciafone, 2019). Blockchain technology may provide a verifiable means to create a different and simpler level of the trust that brands like Coca-Cola have developed over many years.

One recent (2016) definition of blockchain is “a distributed database of records, or public ledger of all transactions or digital events that have been executed and shared among participating parties” (Crosby et al., 2016).

Blockchain technology, as applied to agricultural product supply chains, offers promises of a new and disruptive form of what has been called algorithmic economic trust and has been even referred to as a trust machine (Anon., 2015; Constantinides et al., 2018). Can blockchain technology usher in a transformation to a new, transparent “sharing” food-supply economy? Several researchers have argued that blockchain, or distributed ledger systems, enhances supply-chain management, creating trust-embedded systems where increased transactional efficiency and transparency allow consumers greater access to highly differentiated and identity-preserved products (Jouanjean, 2019; Hawlitschk et al., 2018). Authors also claim blockchain can clarify how economic value is shared from farmer to consumer (Tripoli and Schmidhuber, 2018).

Here we will explore blockchain technology as applied to agriculture supply-chain management and product marketing. A comparative examination of three case studies of lamb supply chains showcases how blockchain both is and is not living up to its many promises of improved transactional efficiency and transparency. Most importantly, the case studies illustrate when blockchain is likely to provide benefits in building trust in food products with multiple attributes delivered to increasingly discerning consumers.

Blockchain 101

Distributed Ledgers, Immutability, and Crypto-Security

There are three important elements to understanding blockchain technology. First, blockchain technology derives in part from the field of computer science, particularly the sub-field of database management. A distributed database is distinct from a central database in that data is not stored on a single computer or device, but rather on multiple computers and/or devices across a network.

Second, blockchain is also often referred to as a distributed ledger system. This means, in the case of an agriculture supply chain, that each party in the supply chain is in control of a ledger of information. These ledgers are called blocks, hence the name. For example, in the very simple agriculture supply chain shown in Figure 1, each party has control over some information contained in a ledger.

Figure 1. Direct Apple Market Supply Chain

Apple Farmer [ledger data on production topics, yield, cost of production, etc.]↓

Food Hub [ledger data on quantity, sales mark-up, suppliers (farmers), storage, etc.]

↓

Consumer [ledger data on price paid, satisfaction, etc.]

Third, the data in each ledger is, in computer-science terminology, “immutable” or unchangeable. This means, for instance, that the data input into the blockchain by the farmer is unchangeable by other members of the blockchain. Also, depending on the terms of the blockchain establishment, all data is available to all “blocks” in the blockchain. Thus, blockchain is a distributed ledger system with the property of immutability and full “sharing” or transparency of information.

A final characteristic of blockchain is general security, referred to as cryptology. Blockchain is connected and often confused with the development of crypto-currencies such as Bitcoin. The term cryptology is similar to the idea of a secret code. Each transaction in the blockchain supply chain is both verified by other members (known as a distributed consensus) and protected by an embedded security system within the system itself. Hacking into a blockchain requires not only hacking into a particular block, but also all preceding and following blocks.

Another way to think of this is that the blockchain has a kind of embedded trust system, whereby there is no single central authority needed to ensure the validity of transactions within the chain. Rules of governance are based “solely on the correctness of pre-defined rules” (Hawlitschk et al., 2018) and secured by cryptological algorithms and the very nature of the technology itself. Essentially, in the context of agriculture and food, blockchain technology offers the potential to have greater transparency of how food is produced and processed, as well as how economic value is distributed within complex national and global supply chains for all those participating, including the end consumer.

Complexity, Models, and Blockchain Agriculture Supply Chains

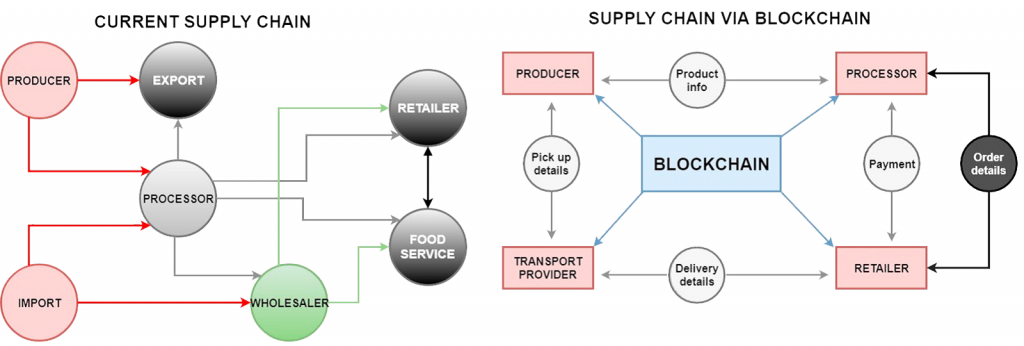

Figure 2 demonstrates a more generic model of an agriculture supply chain in its current and blockchain form. As can be seen, the blockchain model demonstrates its distributed nature, as well as the basic functions of moving food from farmer to plate. The model also shows a more circular model of a market economy rather than a traditional linear view, which is arguably an important change that could lead to more sustainable food systems.

Another way to understand blockchain agricultural supply chains is to think of them as multi-agent systems (MAS). In Figure 2, producer, processor, transport provider, retailer, and the blockchain are agents in the system and, in the blockchain version, all parties can view all parts of the system. Ultimately, the consumer can also view all parts of the system, allowing for greater transparency of the entire chain. This transparency, security, immutability, and embedded trust provide unique, even disruptive, changes to supply-chain management over the current agriculture supply-chain system. As noted in one recent (2018) research paper, blockchain supply chains provide traceability that can give “confidence to the final consumers about the origin of the products, whether they are recycled, whether they are first use, etc.” (Casado-Vara et al., 2018).

Figure 2. Agricultural Supply Chain Models. Source: Casado-Vara et al., 2018

Disruption in Food Supply Chains

In March 2016, Newsweek magazine awarded money to 11 entrepreneurs using blockchain for good, stating, “there is a great deal more to blockchain than cryptocurrencies” (Crosby et al., 2016). Advocates maintain blockchain’s potential to be a disruptive technology (APTTUS, 2017), despite warnings that it may take longer than we expect (Iansiti and Lakhani, 2017). A “disruptive” technology is one that displaces an established technology or creates a completely new industry:

“The blockchain establishes a system of creating a distributed consensus in the digital online world. This allows participating entities to know for certain that a digital event happened by creating an irrefutable record in a public ledger. It opens the door for developing a democratic open and scalable digital economy.” (Crosby et al., 2016).

Consumers increasingly demand information concerning the safety of their food, its origin, and the sustainability of the processes that have produced and delivered it. For instance, Walmart uses blockchain to provide for traceability of produce through its complex supply chain. One principal motivation for this is to more quickly identify sources of product contamination. Though the protection of the health of Walmart produce consumers and brand reputation are critical, there are also other benefits to Walmart. By requiring the farmers and intermediaries that supply produce to Walmart to be in the company’s blockchain system, there is an inherent lowering of broad economic transaction costs related to general supply-chain management that also may be of great importance to Walmart. For example, when blockchain is applied to other areas of business management, proponents claim that business practices are streamlined by making intermediaries such as notaries, banks, and escrow companies obsolete in the field of commercial real estate and in general by supporting self-executing, smart contracts. Smart contracts are computer-generated, self-executing contracts free from human interaction. So, for instance, a farmer delivering grain to a mill would instantly be paid for the grain delivered under the terms of a smart contract that would self-execute upon delivery.

Blockchain applied to food supply chains has also been, in part, about the economic topics of transaction costs and product identity preservation, as well as the role of the individual consumer to express demand for a product. Through blockchain technology, transaction costs can likely be lowered and therefore greater economic “value” created for all participants in the chain. Also, with blockchain technology, the abstract and assumed “perfect information” in “free-market” transactions between buyer and seller may be more closely approximated. Because of the potential high level of information about the entire supply chain embedded in blockchains, the food consumer may again be “king,” even if the level of sovereignty may still be precarious (Birmingham, 1969).

Blockchains have also improved the efficiency of distribution by providing the right information at the right time (Tian, 2016). BeefChain applies blockchain to Wyoming beef sales to preserve identity of the product from farm to consumer. Although similar to the broader topic of “smarter and more accessible data and market information,” identity-preservation blockchain efforts again present more of an intentional effort to use blockchain as a disruptive technology (Tripoli and Schmidhuber, 2018).

One recent example of this “disruption” in agriculture is the start-up Canadian firm Grain Discovery’s claim to have executed the first field corn transaction using blockchain (Grain Discovery, 2019). The transaction was interesting because the original sale of the corn in question was rejected by the farmers’ traditional buyer because it tested for a slightly high level of vomitoxin (caused by mold on corn). However, Grain Discovery could facilitate a new buyer quickly, in part because of their use of the blockchain platform. More broadly, Grain Discovery claims that it is:

“…focused on untangling the complicated supply chain paths for grains. The Grain Discovery platform gives more control to both farmers and buyers and has endless applications, from allowing consumers to see the path their food travelled, to calculating the carbon intensity behind the production of food and biofuels.” (Grain Discovery, 2019)

The Real Value of Lamb: Three Supply-Chain Case Studies

Scope

This exploration is a qualitative comparative examination of three case studies of the potential application of blockchain technology to three different lamb supply chains. This investigation is based on information from informal interviews and provides some insights based on actual challenges of marketing lamb.

The three supply-chain cases all consider direct-marketed lamb, illustrated first by a small-scale business/ranch, Montana Highland Lamb, based in Whitehall, Montana (owners Dave and Jenny Scott). The second case is the wholesale distribution of “locally” grown Montana lamb through a cooperative food hub, the Western Montana Growers Cooperative (WMGC) based in Missoula, Montana. Food hubs are defined by the U.S. Department of Agriculture (USDA) as “a business or organization that actively manages the aggregation, distribution, and marketing of source-identified food products primarily from local and regional producers to strengthen their ability to satisfy wholesale, retail, and institutional demand” (Pressman and Lent, 2013). Another useful term is intermediated markets, i.e., farmers and ranchers selling directly to grocers, restaurants, schools, assisted-living facilities, food hubs, and brokers.

The final case study is one of the traditional generic lamb supply chain, illustrated by a natural grass-fed lamb brand developed by a major national grocery chain. To simplify our discussion, we identify these three supply chains as follows: local direct (LD), regional intermediated (RI), and national retail (NR), respectively.

A direct participatory approach was used to develop these case studies, based on informal interviews that included owners/operators in both the LD and RI case studies. In the NR case study, information was derived from an interview with the meat procurement manager at the major national grocery store, as well as from research on national commercial lamb supply chains.

In all cases, we asked three general questions, followed with various additional topics, depending upon the direction of the conversation as determined by the interviewee. The three questions were as follows:

-

-

- Have you heard of the term blockchain? (If not, we provided a simple explanation of the term and continued to have the interviewee respond to the basic implications of blockchain technology.)

- Do you think your customers want detailed information about the lamb products they purchase, including where the lamb was from; how the lamb was raised; how the pasture was managed to produce the lamb; how humanely the lamb was treated; how the lamb was slaughtered, processed, and packaged; whether the cuts were all from the same lamb; how many miles the end product travelled to get to you the consumer; and, finally, how much of the value of the final lamb was received by the farmer/rancher?

- If blockchain technology can lower transaction costs, improve the efficiency of distribution, and better inform the consumer of the product they purchase, would you be interested in using the technology?

-

Results: The LD Experience

This case study explores blockchain use for direct-marketed lamb by a small business/ranch, Montana Highland Lamb, based in Whitehall, Montana. Major themes include:

Really Knowing Your Lamb Rancher. Montana Highland Lamb offers, for those lucky enough to be living in Montana, a chance to directly know their lamb rancher. For purposes of full disclosure, the author is a patron of Montana Highland Lamb, has visited the ranch, and is familiar with the special system of production used in producing these lambs. Montana Highland Lamb is known for its high-intensity, multi-paddock rotational grazing system, producing 200 lambs per season on 30 acres of irrigated pasture. With a well-designed compost system and pasture management and an emphasis on soil and human health, there appears to be no need for third-party certified labels. Trust for the individual buyer of these lambs comes from direct social and economic bonds built over several years of friendship.

Nonetheless, the LD supply-chain experience at Montana Highland Lamb is not without its production and economic issues. For instance, the ranch is dependent on irrigation based on a water right that in times of severe drought could be limiting. Slaughter, processing, and packaging involve the perennial issue of cost and data retention. Critical data such as weight, frame size, and genetics on each lamb need to be maintained. The lambs have to be sent 250 miles round trip to be processed, and, amazingly, the processor ships back each lamb in a separate box, allowing for data on each to be recorded. Since lamb-processing costs are per head, smaller-framed lambs cost as much as larger-framed lambs to process, thereby creating a known likelihood of economic loss on smaller-framed lambs. Coordinating the individual finished cut-box data and frame size is critical to developing a breeding program that leads to the production of more consistent and larger-framed lambs.

Montana Highland Lamb sells to individual consumers, the Montana State University student cafeteria, high-end restaurants (that may or may not feature the Highland Lamb brand), various rest homes for the elderly where food quality is recognized, and finally, the Western Montana Growers Cooperative. These client relationships are critical and require significant effort and data management.

Blockchain Applicability to the LD Supply Chain. When asked about the applicability of blockchain, the co-owner of Montana Highland Lamb, Dave Scott, could envision blockchain use in improving production and marketing data and possibly broad financial management. Again, the key to financial viability for Montana Highland Lamb is the ability to garner data on each individual lamb, as well as to track the value of the various “cuts” sold. These issues could likely be handled with an improved integrated centralized software system, but because the supply chain is relatively simple, there may be no need for a blockchain system. Interestingly Dave, also works part-time for the National Center for Appropriate Technology and the ATTRA Sustainable Agriculture Program that it manages under a cooperative agreement with the USDA. In that position, Dave has created several publications on the production and direct marketing of lamb and other livestock, as well as a useful spreadsheet-based tool called the “Lambulator”— a cut-yield pricing calculator that helps optimize profitability.

Another important topic that may suggest use of blockchain in LD supply chain centers is the topic of economic profit. Montana Highland Lamb is NOT making a true economic profit. Essentially, the business generates some income over costs, but if that gross income is divided by the actual hours of labor spent, the rate of pay for the operators is well under minimum wage. Even at this low labor rate, there simply is no actual return on invested capital. While it may seem surprising to many as to how a ranching “business” could continue to operate with no—or even negative—profit, in Montana this is not unusual in any given year. For example, net farm income in Montana in 2017 was negative for all farms without federal government support payments (USDA, NASS, 2018).

This is significant because even with the very high level of trust between the rancher and direct or nearly direct consumer of the lambs, Dave and Jenny are reluctant to raise prices for fear of losing customers. One alternative is to expand production, but as that occurs, the probability of maintaining trust in the product possibly diminishes. That is, unless a blockchain system could possibly substitute for the great labor-intensive trust-building effort that goes beyond the current customer base.

Results: The RI Experience

This case study explores blockchain use for wholesale distribution of “locally” grown Montana lamb through a cooperative food hub, the Western Montana Growers Cooperative (WMGC), based in Missoula, Montana. Major themes include the following:

Lost in Translation? The WMGC is first and foremost a cooperative of farmers and ranchers who want to pool their products to increase sales through the WMGC Community Supported Agriculture (CSA), grocery stores, restaurants, and institutions (such as schools, colleges, and hospitals). Community Supported Agriculture “consists of a community of individuals who pledge support to a farm operation so that the farmland becomes, either legally or spiritually, the community’s farm, with the growers and consumers providing mutual support and sharing the risks and benefits of food production” (Prial 2019). The WMGC sells their products mostly in western Montana, but also covers markets in Northern Idaho, Eastern Washington, and the city of Portland, Oregon. The mission of the WMGC is “to provide communities within the western Montana region with a wide range of fresh, quality products from western Montana independently owned ranches and farms.” The WMGC, while a classic food hub or intermediated market, in some sense is simply a wholesaler of locally/regionally produced food. There are several issues relevant to this type of operation and the sale of lamb.

First, the WMGC currently sells lamb acquired from four major suppliers: Montana Highland Lamb, Lifeline Produce, Montana Natural Lamb, and Will Tusik, as well as other small ranchers as needed to meet demand. Despite the WMGC having individual brands associated with other livestock products, such as beef, bison, bone broth, eggs, cheese, butter, and milk, the lamb is only portrayed as “generic” lamb. Thus, the particular rancher is, in a sense, lost in translation.

Second, the WMGC tracks several important attributes (stated as “values”) of the products they sell. These are: cooperation, appropriate technology, land stewardship, and social equity. While these are all very noble values, there is no easy way to independently verify that these values are met. For instance, the WMGC sells certified organic eggs via the branded Mission Mountain Organic Eggs, as well as eggs labeled “cage free,” “free ranging,” and “fed a 100% vegetarian diet free of antibiotic stimulants, steroids, or hormones” from Spencer’s Valley View Farm. Although organic is a third-party verified, legally enforced label, the claim of “cage free” is not, making it more difficult to verify.

Finally, without further investigation and direct contact with the WMGC staff, it is impossible for an individual or commercial buyer of the lamb to know any product attributes of the lamb being sold, other than the producer’s general commitment to the values stated above. Even the crucial, overall value of “buying local” is not clear when it comes to lamb.

Blockchain Applicability to the RI Supply Chain. In interviewing the WMGC manager, David Prather, it was clear that he had some notion of blockchain, at least regarding its connection to Bitcoin. He was not sure that blockchain would be an appropriate technology for the WMGC to adopt. Despite the WMGC website not making it clear who produced the lamb it sold, Prather did state that buyers could purchase from a specific lamb supplier if they wanted, and if the lamb was available.

Although David Prather thought it would be great in some ways to have information flows via blockchain to the ultimate consumer, he had mixed feelings, speculating that many consumers would not want many details about their food. Those buying from the WMGC seem to have trust in the brands being sold (as long as those brands are identified). They seemed to care more about localness than how the food was produced. David Prather did not believe that being certified organic is a critical issue to the WMGC’s customers.

Though it’s not the subject of this publication, it’s worth noting that WMGC sale of produce is even more complicated, as the sources are many and not all products are branded. There seems to be even greater translation loss with produce than with lamb, making it appear that blockchain technology may be very valuable to organizations like food hubs, even if only for improving transaction costs and distribution efficiency.

For outlets such as food hubs and intermediated markets, third-party verification can be important for establishing trust. Apparently, the WMGC’s customers value producer cooperation, appropriate technology, land stewardship, and social equity (the WMGC values listed earlier). Incorporating pictures demonstrating appropriate technology use, such as a soil sensor detecting soil quality, placed into a blockchain, may be valuable to the WMGC’s customers.

Results: The NR Experience

The final case study explores blockchain use with the traditional generic lamb supply chain, illustrated by a “natural, grass-fed” lamb label created by a major national grocery chain. Major themes include the following:

Deliberate Confusion? Lamb is an international commodity, and most lamb in the United States is imported from Australia (AU) and New Zealand (NZ). Despite the distance from AU and NZ to the United States, lamb ranchers there can produce lamb, year-round, at such a competitive price that they dominate the U.S. lamb market. Interestingly, sheep and lamb coming from outside the United States are required to have a country of origin label (COOL) attached. Even when the meat is differentiated by country of source, most American consumers do not seem to mind only having foreign lamb available for purchase. In our interview with the meat manager of a national retail grocery chain in Montana, it became clear that this national grocery chain has not purchased American lamb for at least 20 years. Its current lamb is sold under an exclusive in-store natural label with defined attributes: raised without antibiotics, no added hormones, animals fed an all-vegetarian diet, and no artificial preservatives. As previously discussed, the consumer has to assume honesty because, unlike the organic label, these attributes are not, nor do they have to be, independently third-party verified. (No added hormones does not apply to beef products under this label, which the grocery chain makes semi-clear by an asterisk on its label.) So why, as Robyn Metcalfe asks in her recent book, Food Routes, does a major grocery chain or even a restaurant in Maine order lamb from NZ or AU (2019)?

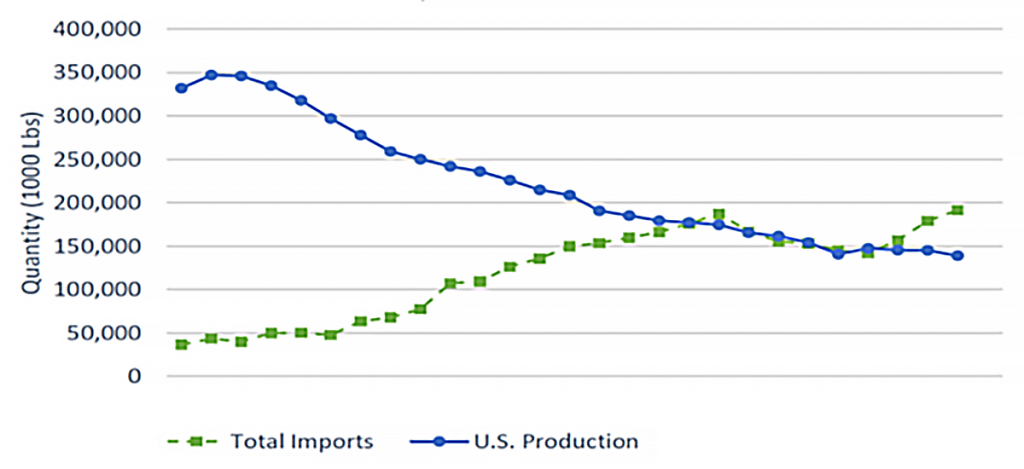

Figure 3 demonstrates the reality of U.S. loss of the lamb market to AU and NZ (Ufer, 2017). The major reasons for this loss of market are: (1) the year-round pasture-based (grass-finished) production system in AU and NZ; (2) U.S. livestock farmers shifting to higher-value livestock production products such as beef; (3) COOL labeling actually highlights the quality of AU and NZ lamb products; (4) the U.S. economic power concentration of the slaughter/processing industry makes lamb processing relatively more expensive here than it is in AU and NZ; and finally, (5) the cost of production is simply higher in the United States, perhaps principally due to the higher relative cost of rangeland (Ufer, 2017). In short, in economic terms, AU and NZ lamb has a “comparative competitive advantage” compared to U.S.-produced lamb. While it is hard to point to any one of these reasons as a definitive cause for loss of U.S. domestic lamb production, even when they are taken together, blockchain could theoretically help in changing this current economic reality.

Figure 3. Annual Lamb Imports vs. U.S. Lamb Production. Source: Ufer, 2017

A fundamental issue is that perhaps consumers are confused. Without good and “truthful” information (beyond simply the important price basis) for making a purchasing decision, they are truly at a loss to really consider other reasons for buying American lamb. Other possible reasons exist: the top four food retailers sell more than 60% of the total groceries bought in the United States and because these four only sell AU or NZ lamb, choice is simply not an option. Perhaps the natural grass-fed lamb label from AU or NZ may seem to be a better product, although all lamb eats some grass during its short life cycle (they are ruminants). Nonetheless, many consumers believe that eating “grass-fed” lamb is healthier, and because all AU or NZ lamb is “grass-finished” and because grazing is less expensive than feed grains, AU and NZ lamb has a built-in added economic advantage.

Blockchain Applicability to the NR Supply Chain. The major grocery retailers in the United States may find blockchain useful for very different reasons than one might initially think. In our interview with the 20-year meat manger in the major grocery chain in Butte, Montana, there was obvious disappointment with the corporate decision to only sell foreign lamb. When told what blockchain technology might do to better inform the lamb consumer about the product, the meat manager did seem to have faith that the natural-branded lamb chop from AU was truthfully labeled. He felt that the consumer was well informed and had all the information they would want to know about the product. He also related that the COOL labeling was handled well for lamb by this national grocery chain, as compared to his experience with trying to apply the same COOL requirements to beef and pork. (COOL labeling of beef and pork was implemented for a brief period in the United States, ending in 2015.) Indeed, he did think that if blockchain technology could be applied to help with COOL labeling of beef and pork in the future, this would be very helpful and assure greater support for American beef and pork farmers.

Though consolidated grocery retail businesses might be interested in blockchain for purposes of tracing contaminated product, it does not seem yet to be of significant interest for improving provision of consumer information about the lamb they are purchasing. One slight exception to this more general rule is the example of Whole Foods, which prides itself on offering lamb possessing similar attributes to the national grocery chain’s natural in-store brand, but goes even further to provide information on some American brands of lamb products they sell, along with various AU lamb products. Whole Foods has introduced an animal-welfare standard that seems positive and is third-party verified.

Thus, blockchain may not be of interest to the NR lamb supply chain, even if ultimately useful, because of the desire not to expose the economic power embedded in this global food supply system. Although this may not be an intentional desire to keep consumers confused, it might be inherent to the structure of the kind of unsustainable capitalism that we find ourselves a part of today (Henderson et al., 2017). Recent authors spoke to this issue:

“Increasing consolidation and vertical coordination in the food chain have made the prospect of market power abuses by powerful food manufacturers and retailers an issue and a policy concern worldwide, in terms of potential impacts on farmer and consumer welfare and sector efficiency. A key conclusion is that considerations that go beyond the bounds of standard models likely can cause market power to be less than would be predicted based on the highly concentrated structures of many modern agricultural and food markets. These considerations include downstream buyers who rationally internalize long-run implications of their pricing decisions to farmers, powerful food manufacturers and retailers who countervail each other’s market power, and the complex pricing decisions of multistore and multiproduct food retailers.” (Sexton and Xia, 2018)

Discussion and Conclusion

From this qualitative analysis, we would suggest that blockchain technology has great potential to be a truly disruptive technology if applied to all three examples of the lamb supply chain considered here. However, the closer consumers are to the actual producer of their food, the less valuable blockchain technology will be, because “real” trust does not need to be embedded in a blockchain.

Companies use information systems, supported by centralized databases, to track significant aspects of their processes and products effectively. Blockchain technology shines when processes involve multiple organizations. Tracking where and when produce was contaminated, finding niche markets for contaminated grains in the case of Grain Discovery, and even understanding the carbon intensity behind grain production cannot be easily captured in a single centralized database.

Most products move through multiple phases before consumers purchase them. In our example, lambs are born and raised on a farm, shipped, processed, shipped again, and marketed, before customers purchase them. Typically, no centralized database can track the process a lamb goes through from the farm to the consumer because each organization uses different informational systems.

Blockchain technology provides a distributed database that each participant in the process can access, both to read and to write. The consumer purchases a product whose significant aspects have been recorded and can be perused. Furthermore, at each step in the process, once information was recorded into the distributed database, it could not be changed. Whatever story was recorded as the lamb went through the various phases on its way to the consumer could not be changed later, in order to cover up a problem or create fraudulent information. This transparency allows customers to trust their products, executives to improve their processes, researchers to understand processes, and workers along the product’s journey from farmer to processor to see the big picture.

Future research could include the use of more quantitative research methods that would explore whether food-retail distributors truly want to provide consumers with knowledge of attributes such as the value returned to the farmer who truly undertakes sustainable farming practices. Also, will such knowledge communicated to the consumer be the basis of a new competitiveness between products? In other words, will a consumer buy apple A versus apple B if they know for certain apple A was not only sustainably produced but that the farmer received a fair share of the true value (not just price) of apple A?

Solving technical issues such as the need and cost for greater distributed immutable ledgers that could keep the chain of information “trustworthy” through the supply chain might actually make consumers “kings” in the simple economic neoclassical models taught in so many introductory economic courses. As earlier suggested by Adam Smith in An Inquiry into the Nature and Cause of the Wealth of Nations:

“Consumption is the sole end and purpose of all production; and the interest of the producer ought to be attended to, only so far as it may be necessary for promoting that of the consumer. The maxim is so perfectly self-evident, that it would be absurd to attempt to prove it.” (Birmingham, 1969, p. 377)

The structure of the current industrial system, because of its lack of any semblance to a free market, and the exercise by a few of significant economic market power over the industrialized food system does contradict the perfectly self-evident truth of consumer sovereignty over our food choices (Henderson et al., 2017).

Producers should benefit from blockchain as well: in this case, the American lamb farmer. How interesting would it be if, sitting down at a fancy restaurant, we could take out our smartphones and read a “code” on the menu that would provide not only truthful information about how the rack of lamb we are about to order was raised, but also how much of the value we pay for the item is returned to the farmer? Although food tracking systems have been around for some time, blockchain provides the added technological means to assure trust in the product one is purchasing at the final stage of the supply chain: the consumer.

Could a new era of product competition be emerging where we can buy products with complete assurance of the multiple important values the consumer desires, including supporting our regional economy and the lamb rancher who truly did the bulk of work to provide us with something so very good? Perhaps we need to reassess what is both the real—and just—price of lamb. Maybe blockchain technology could help enormously with that assessment. We share with others the hope that “the perception of value, within a certain techno-economic context, is instrumental to unlock the potential for societies to prosper” (Pazaitis et al., 2017). So think hard the next time you buy your lamb chops.

Further Resources

Agriculture and Food Blockchain Examples

Provides blockchain software to manage agriculture supply chains.

Uses blockchain technology to support beef ranchers in recapturing the value now realized by third-party feedlots and processors.

Provides improved grain supply-chain management with greater transparency and traceability.

Brings greater transparency to complex international supply chains of several agricultural products.

A digital platform that empowers participating branded products to provide greater supply-chain transparency. The participating businesses can easily gather and present verifiable information and stories about their products and their supply chains.

Brings long-lasting trust and confidence in food supply chains through a software platform where any consumer can access transparent and reliable information on the origin and quality of her food.

Acknowledgements

The author would like to thank Dave and Jenny Scott for extensive conversations about supply chains, lamb production, and Montana Highland Lamb. The author also thanks WMGC manager David Prather and the chain grocery meat manager in Butte, Montana.

Knowing the Real Value of Food: Blockchain in a New Sustainable Food Economy

By Jeff Schahczenski, NCAT Agriculture and Natural Resource Economist, and Emily Post, NCAT Agricultural Specialist

Published November 2019

© NCAT

IP592

Slot 617

Version 112119

Related Publications

- Direct Marketing

- Direct Marketing Lamb: A Pathway

- Food Hubs: A Producer Guide

- New Markets for Your Crops

- Tips for Selling on the Internet

- Tips for Selling through CSAs – Community Supported Agriculture

- Tips for Selling to Aggregators/Grower Marketing Co-ops

- Tips for Selling to: Wholesale Buyers at Terminal Markets