Selling to Local and Regional Markets: Barriers and Opportunities for Beginning Farmers

Monadnock Food Coop display. Photo: NCAT

By Michelle Hughes, New York University; Andy Pressman, NCAT; Lydia Oberholtzer, Penn State University; Carolyn Dimitri, New York University; and Rick Welsh, Syracuse University

Abstract

New and beginning farmers often face challenges in gaining access to certain markets, forcing many to focus on direct-to-consumer outlets. With the growing interest in regional and local food, intermediated market channels tend to be underutilized by new and beginning farmers. Intermediated markets include sales to grocery stores, restaurants, regional aggregators, such as food hubs, as well as schools, universities, hospitals, and other institutions. This publication presents the findings of a national survey on the use of intermediated and direct-to-consumer marketing channels by farmers, particularly new and beginning farmers, participating in local and regional food systems.

Introduction

Beginning farmers are crucially important to the future of agriculture and domestic food security in the United States, particularly as the current population of farmers continues to age (Ahearn, 2011). This need for beginning farmers to both enter the field and enjoy continued success has influenced federal policy: former Agriculture Secretary Vilsack previously set a goal of increasing the number of beginning farmers by 100,000 by the year 2012 (USDA, 2013). To support this effort, the Farm Acts of 2008 and 2014 appropriated $175 million for the Beginning Farmer and Rancher Development Program to educate, train, and mentor beginning farmers. If measured strictly by growth in the number of beginning farmers, these efforts have resulted in mixed success. In 2012, 25% of the 2.1 million farmers in the United States were beginning farmers, a decrease of 20% from 2007 (USDA NASS, 2014b). Between 2012 and 2017, USDA changed the way it collected data, which resulted in a 7% increase in the number of beginning farmers during this period (USDA NASS, 2020). Many beginning farmers operate small and medium-sized farms, often with fewer than 50 acres and annual sales below $50,000 (USDA NASS, 2014b). However, the 2012 Census of Agriculture also showed an increase in the number of beginning farmers with gross sales in the $50,000 to $999,999 range. According to the 2017 Census of Agriculture, 18% of beginning farmers had sales in excess of $50,000, which is the highest sales class category reported for 2017 (USDA NASS, 2020).

In addition to the traditional marketing, production, and price risks inherent in farming, beginning farmers face market access challenges. Many focus primarily on direct-to-consumer marketing outlets, but as the demand for regional and local foods has increased, new market channels have emerged. Intermediated marketing channels, according to USDA Economic Research Service (Low et al., 2015), include sales to grocery stores, restaurants, regional aggregators such as food hubs, as well as schools, universities, hospitals, and other institutions, are becoming more important outlets. Intermediated market channels are an underutilized marketing opportunity for beginning farmers, although they are not without challenges.

Intermediated marketing channels include sales to grocery stores, restaurants, regional aggregators such as food hubs, as well as schools, universities, hospitals, and other institutions.

This publication presents the findings of a national survey on the use of intermediated and direct-to-consumer marketing channels by farmers participating in local and regional food systems. The focus is on new and beginning farmers – those within their first 10 years of farming. Within this category, two groups of farmers are considered: new beginning farmers, defined as those farming five years or less, and more experienced beginning farmers, who have farmed six to 10 years.

Wild Hill Farm, New York. Photo: Lee Rinehart, NCAT

Survey Overview

A nationwide survey of farmers was undertaken in early 2017 to examine the opportunities and risks of four main marketing opportunities for farmers—direct-to-consumer, direct-to-institution, direct-to-retail, and selling to intermediaries (such as distributors or food hubs), who in turn sell the products as local food. The web-based survey was comprised of 54 questions covering farm practices for 2016. The questions inquired about operation characteristics such as gross farm income and types of products produced, the four main marketing opportunities for farmers and their future plans for marketing, technical assistance needs, and farmer demographics. Most farmer respondents did not complete the entire survey, often skipping sections that did not pertain to their specific farm operation. All questions were voluntary.

In total, 226 farmers responded to the survey. Of these respondents, 106 are new and beginning farmers who have operated their current farm for 10 or fewer years. These 106 farmers, 61 of which are in their first five years of farming and 45 have been farming for six to 10 years, are the focus of this report

Marketing of Farm Production by New and Beginning Farmers

Market channels that serve local and regional food systems include direct-to-consumer, direct-to-institution, direct-to-retail, and direct-to-intermediate. Of these four channels, direct-to-consumer is the oldest and most well established, as farmers markets, pick-your-own operations, and farm stores were the first channels used by farmers seeking to reach local foods markets.

Neighborhood Farm, Massachusetts. Photo: Neighborhood Farm

Direct-to-Consumer

Direct-to-consumer channels, which include farmers markets, on-farm stands, community supported agriculture (CSA), and the online marketplace, are widely used by beginning farmers. Overall, 88% of beginning farmers reported using the direct-to-consumer market channel. Of those in their first five years of farming, 82% sold directly to consumers, while 96% of those in their second five years of farming reported direct sales. The bulk of the more experienced beginning farmers (48%) reported participating in the direct-to-consumer market for five to seven years. A smaller share (24%) reported selling directly for eight to 10 years, and 21% for two to four years.

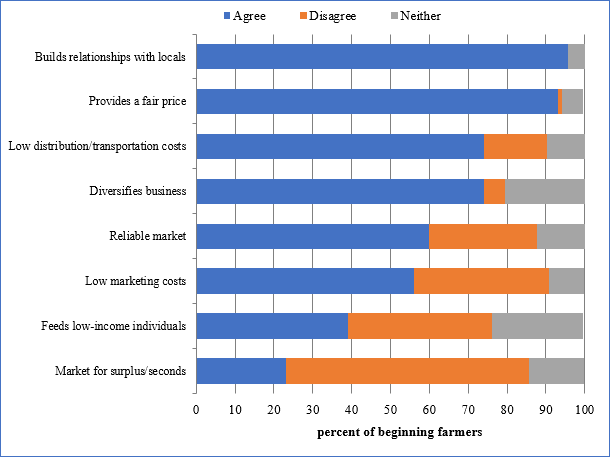

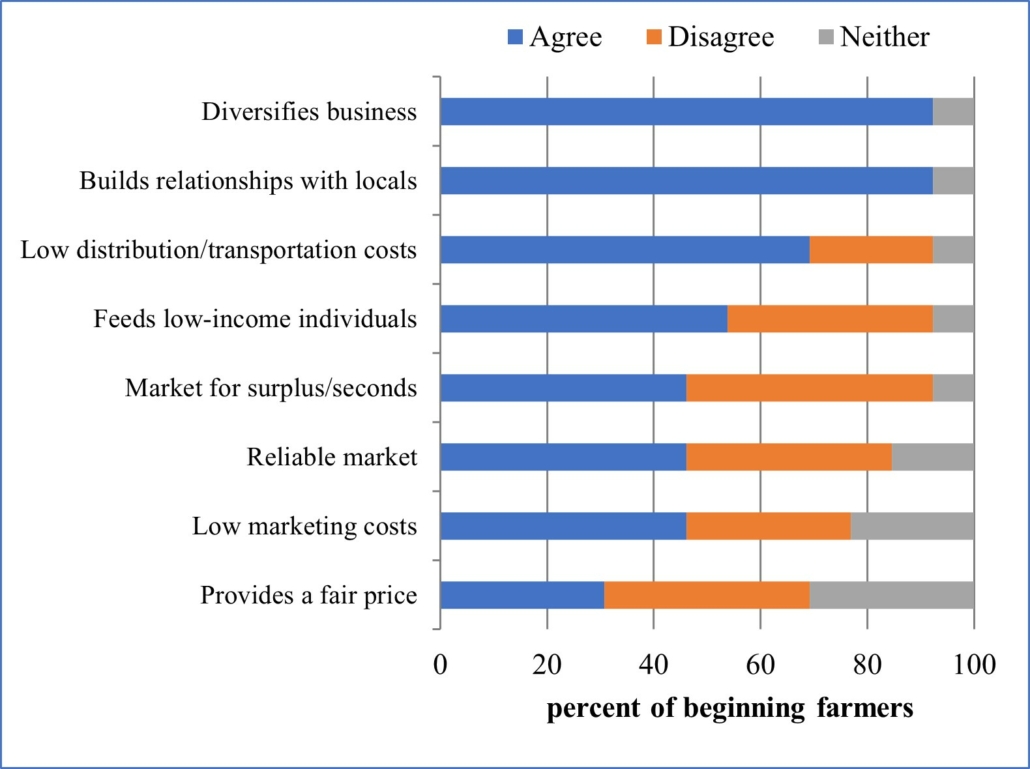

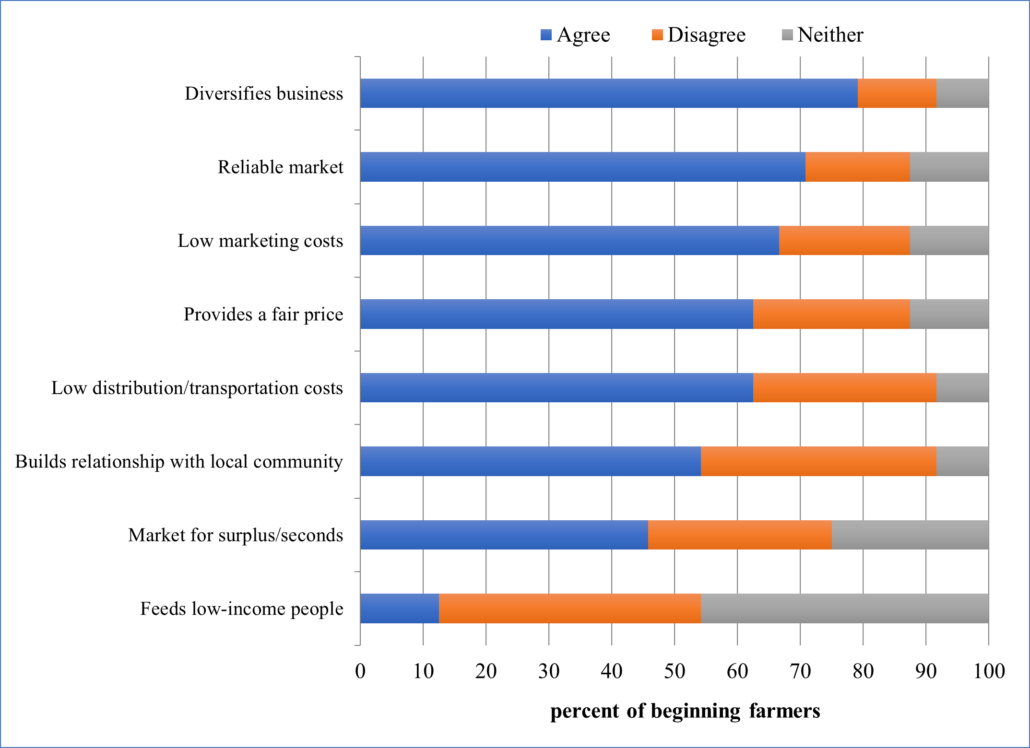

The main motivations given by all farmers for selling directly to consumers include: (1) helps build relationships with the local community (96%); (2) provides a fair price for their products (93%); and (3) has low distribution and transportation costs (74%). See Figure 1. Those in their first five years of farming reported that direct marketing helps diversify their business, while more experienced farmers were less likely to report this (81% versus 65%). Farmers who have been in business for more than five years find direct-to-consumer markets more reliable than farmers who have been in business for less than five years (67% versus 53%).

Figure 1. Beginning Farmer Reasons for Participating in Direct-to-Consumer Market

Number of responses for each question ranges from 89 to 93 for all beginning farmers

For all beginning farmers, direct-to-consumer sales accounted for 76 to 100% of total gross sales (58% of farmers), 51 to 75% percent of total gross sales (7% of farmers), 26 to 50% (10% of farmers), and 25% or less (25% percent of farmers). A greater share of more experienced farmers (69% versus 50%) reported that direct-to-consumer sales accounted for 76 to 100% of their total gross sales in 2016. Over a third of farmers in their first five years (35%) and 11% of more experienced farmers received 25% or less of their total gross sales from direct markets. These findings suggest that farmers improve their knowledge of how to successfully use direct markets over time. Most beginning farmers – 73% of those in their first five years of farming and 83% percent of those in their second five years – ranked the direct-to-consumer marketing outlet as most profitable.

Direct-to-Consumer Market Barriers

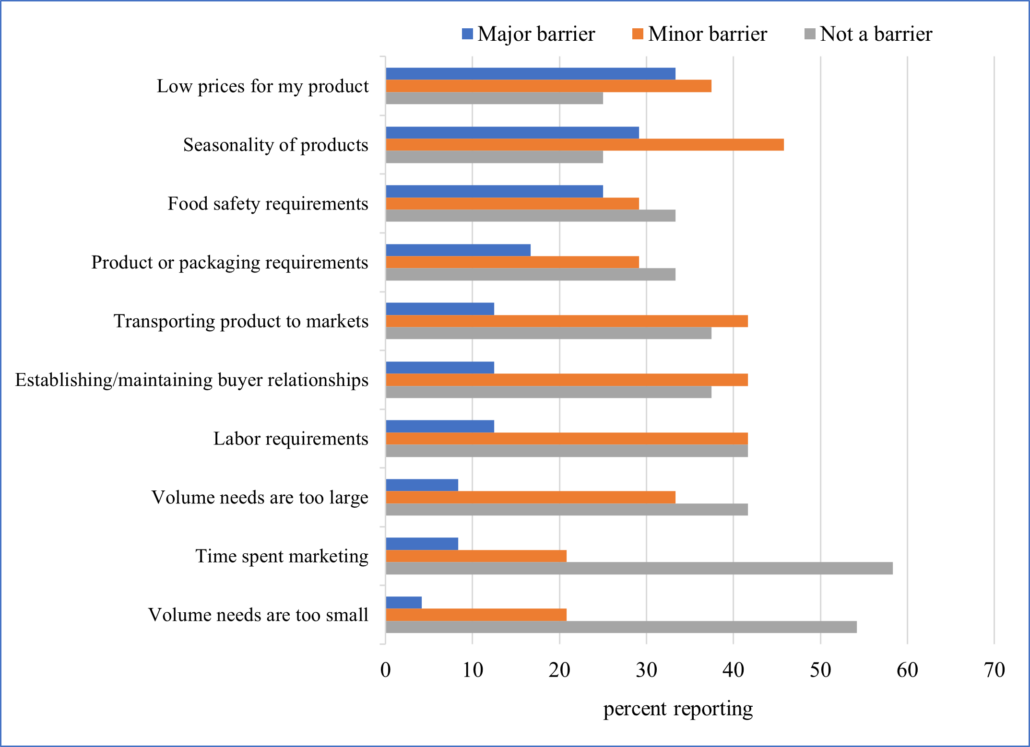

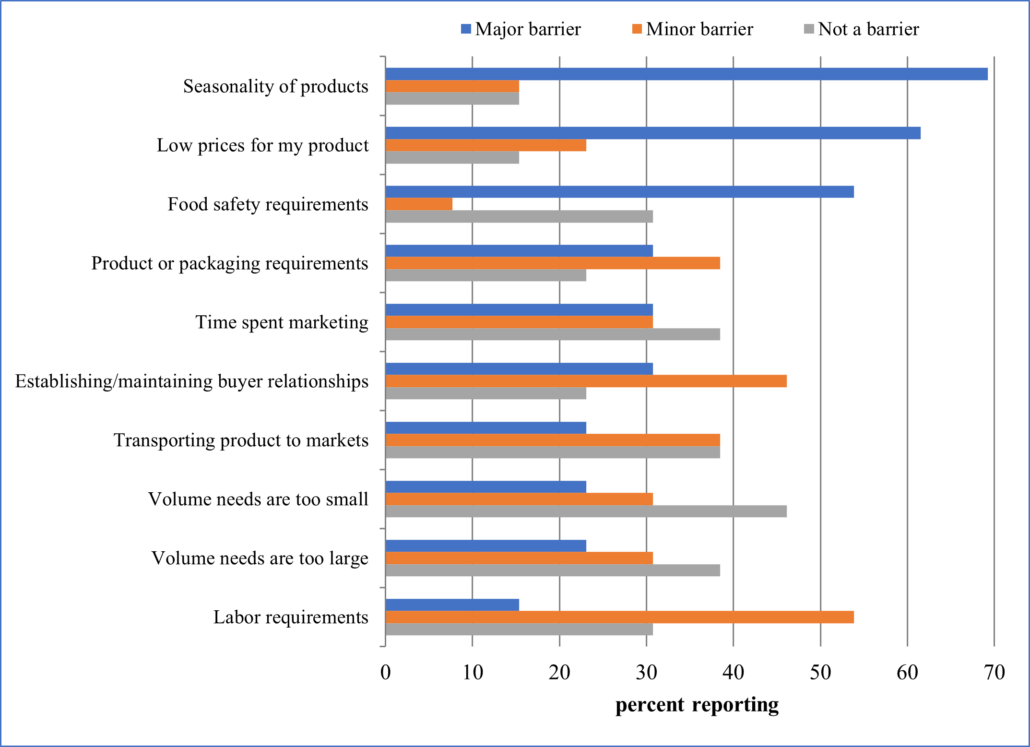

Few beginning farmers reported any major barriers to selling in the direct-to-consumer market (see Figure 2). Approximately half of beginning farmers in their first five years of farming reported seasonality of products (55%), transporting product to markets (52%), and labor requirements (48%) as minor barriers to selling in this market. Farmers in their second five years of farming generally did not identify any major or minor barriers to selling directly to consumers, suggesting that, over time, experienced farmers learned how to successfully access direct-to-consumer markets.

Figure 2. Beginning Farmer Reported Barriers to Marketing Direct to Consumers

Number of responses for the questions ranges from 91 to 93 for all beginning farmers.

Direct-to-Institution

St. Olaf College, Minnesota. Photo: St. Olaf College

Few beginning farmers market their products directly to institutions, such as schools, colleges or universities, hospitals, workplace cafeterias, food banks, prisons, and preschools. Overall, only 12% percent of beginning farmers reported marketing direct-to-institutions, which, when broken down by experience level, includes 15% percent of less-experienced farmers and 9% in their second five years. Of those marketing directly to consumers, 67% of those in their first five years have been selling to institutions for two years or less. The more experienced farmers have been active in the market for a longer time period (50% for five to seven years), but a large share has been participating for two years or less (50%).

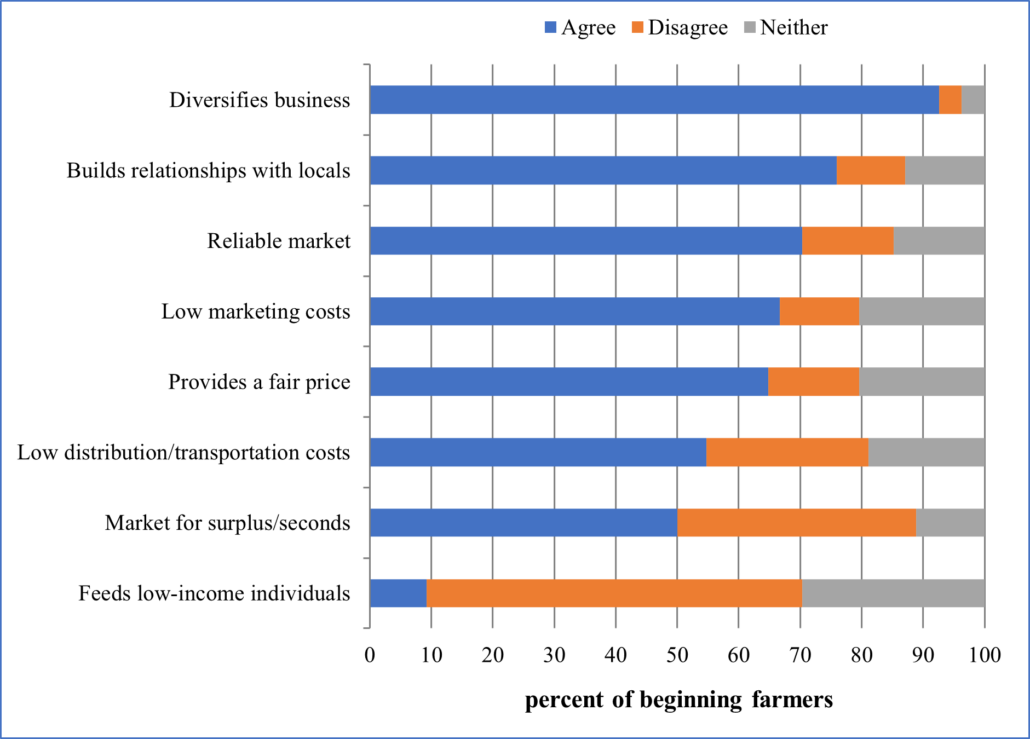

New and advanced beginning farmers report using the direct-to-institution market channel because it helps diversify business (92%) and builds relationships with the local community (92%). Those in their second five years also report this market having low distribution and transportation costs (100%).

Figure 3. Beginning Farmer Reasons for Participating in Direct-to-Institution Market

Number of responses is 13 for all beginning farmers

For beginning farmers who reported selling directly to institutions, the channel accounted for less than 25% of total gross sales in 2016 (97% of farmers). In terms of profitability, almost no beginning farmers (3% of new farmers and 0% in their second five years) reported this marketing outlet as most profitable. Evenly spread, about a fourth of beginning farmer respondents in both groups found the direct-to-institution market to be the second-to-least profitable outlet.

Direct-to-Institution Market Barriers

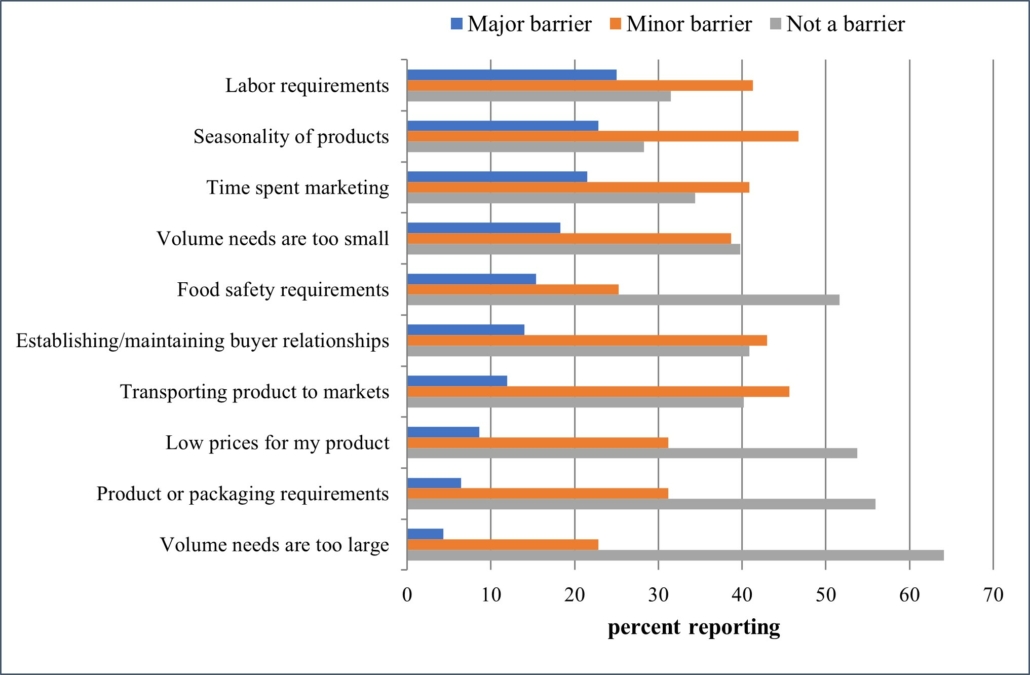

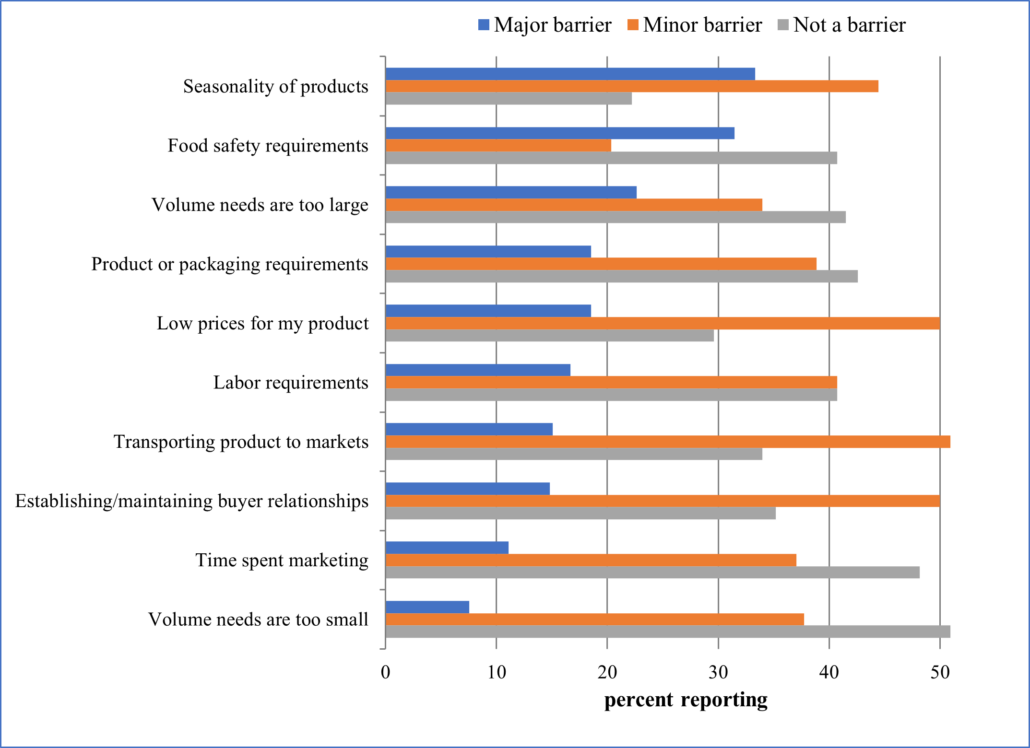

Seasonality of products (69%), along with low prices for product (62%), were the highest reported major barriers by both groups of beginning farmers selling directly to institutions. Over half (56%) of the less experienced beginning farmers also reported labor requirements as a minor barrier. Farmers in their second five years of farming reported food safety requirements (75%) and establishing and maintaining buyer relationships (50%) as major barriers. Approximately half of these more experienced farmers also reported transporting products to markets, too-small volume needs, too-large volume needs, product or packaging requirements, and labor requirements as minor barriers (all 50%). These findings suggest that both the number and complexity of obstacles to selling directly to institutions increases as farmers become more established. It is possible that these barriers are the reason for the low rate of sales and profitability in this direct-to-institution market.

Figure 4. Beginning Farmer Reported Barriers to Marketing Direct to Institutions

Number of responses is 13 for all beginning farmers

Direct-to-Retail

The direct-to-retail market includes outlets such as supermarkets, supercenters, restaurants, caterers, independently owned grocery stores, and food cooperatives. Approximately half (51%) of all beginning farmers reported participating in this market, with a slightly higher share of more experienced farmers (60%) than of those in the first five years of farming (46%). The more experienced beginning farmers have been in this market for more varied lengths of time: less than two years (19%); two to four years (19%); five to seven years (39%); and eight to 10 years (19%). Most of the respondents in their first five years have been in the market for four years or less (89%). The main reasons beginning farmers gave for selling direct-to-retail are diversifying business (93%) and building relationships with the local community (76%).

Figure 5. Beginning Farmer Reasons for Participating in Direct-to-Retail Market

Number of responses ranges from 53 to 54 for all beginning farmers

The direct-to-retail outlet makes up a small portion of overall gross sales. Some 83% of all beginning farmers reported that direct-to-retail sales accounted for less than 25% of total gross sales in 2016; this percentage is roughly equal for new and more experienced beginning farmers (83% and 84%, respectively). However, nearly half of beginning farmers in their first five years of farming (46%) and well over half in their second five years (63%) reported this as their second most profitable marketing outlet. These findings suggest that beginning farmers find this market to be profitable but may not have enough products moving successfully through the market for this channel to comprise a larger portion of overall gross sales.

Direct-to-Retail Market Barriers

Monadnock Food Coop, New Hampshire. Photo: Daniel Prial, NCAT

Accessing the direct-to-retail channel is challenging for beginning farmers. For all levels of experience, seasonality of products is the highest reported barrier (78%). Those in their second five years only reported food-safety requirements as a major barrier to selling directly to retailers (38%). The new farmers reported nearly every listed barrier as at least a minor barrier to selling in this market. Most notably, at least 50% of farmers in their first five years of farming reported transporting products to markets (50%), product and packaging requirements (54%), low prices for product (50%), and establishing and maintaining relationships with buyers (54%) as minor barriers. Those in their second five years reported as minor barriers transporting product to markets (52%), low prices (50%), and establishing and maintaining buyer relationships (46%). According to these results, the direct-to-retail market has the most barriers of the four markets featured, although still reported the second most profitable by many beginning farmer respondents. It is possible that these obstacles are an impediment to beginning farmers seeing higher sales in the direct-to-retail market.

Figure 6. Beginning Farmer Reported Barriers to Marketing Direct-to-Retailers

Number of responses ranges from 53 to 54 for all beginning farmers.

Western Montana Growers Cooperative (WMGC), Montana. Photo: WMGC

Direct-to-Intermediaries (local/regional branding)

Food distributors, food hubs, brokers, auction houses, wholesale and terminal markets, and food processors comprise the direct-to-intermediary market channel. Overall, just 24% reported participating in this market in 2016: 22% of new beginning farmers in their first five years and 27% of more experienced beginning farmers. Less established beginning farmers (years one through five) have generally participated in this market for two to four years (77%). Beginning farmers in their second five years of farming reported participating for four years or less (72%), with smaller shares for five to seven years (18%) and eight to 10 years (9%).

Seventy-nine percent of the beginning farmers that participate in this market channel report doing so because it diversifies their business. Many of them (71%) are also motivated by the reliability of this market. Advanced beginning farmers (72%) also reported selling to intermediaries because they have low marketing costs.

Figure 7. Beginning Farmer Reasons for Participating in Direct to Intermediaries Market

Number of responses is 24 for all beginning farmers

Products in the intermediated market channel can be sold with or without local and/or regional branding. For direct-to-intermediary sales, this survey separated out locally and regionally branded sales from sales not branded locally or regionally. Sales to intermediary markets with branding for most beginning farmers accounted for a small portion of total gross sales in 2016. In total, for 87% of beginning farmers (83% of new beginning farmers and 91% of more experienced farmers), sales from this market channel accounted for less than 25% of total gross sales. Half (50%) of new beginning farmers ranked the direct-to-intermediate marketing outlet as fourth most profitable. Almost half (47%) of beginning farmers in their second five years of farming reported this market as third most profitable, 37% as second most profitable, and 16% as fourth in the ranking. None of these farmers reported this outlet as either least or most profitable.

Direct-to-Intermediaries Market Barriers

The two most reported major barriers to selling to intermediaries reported by beginning farmers were seasonality of products (75%) and low prices for product (71%). Minor barriers for many new beginning farmers are volume needs being too large (38%) and product and packaging requirements (38%). Approximately half of advanced beginning farmers reported transporting products to market (55%) and establishing and maintaining buyer relationships (45%) as minor barriers. These results suggest that the direct-to-intermediary marketing channel may be the most unfamiliar market channel to beginning farmers.

Figure 8. Beginning Farmer Reported Barriers to Marketing Direct to Intermediaries

Number of responses is 24 for all beginning farmers

Marketing Labels

Marketing labels are important communication tools, allowing farmers to both differentiate their products from the competition and capture sales from consumers interested in purchasing local and regional foods or foods with unique attributes. The beginning farmers use a wide range of labels on their products, including state, federal, and third-party certifications (see Table 2). Sixty-five percent of all beginning farmer respondents promote their agricultural products as a combination of sustainably farmed (e.g., Certified Naturally Grown, Food Alliance Certified, or Demeter Certification); uncertified sustainably grown (e.g., NOFA-NY’s Farmer’s Pledge); locally/family/home grown; and others (but not certified organic). Roughly one-fourth of beginning farmers reported promoting a combination of certified organic and other labels. Organic certification is not widely used by the respondents, without an accompanying label, with just 3% of new beginning farmers and none of the more experienced farmers promoting their products solely as certified organic. The use of a locally grown label was reported by 7% of beginning farmers just getting started and 5% in their second five years. The remaining 2% of farmers in their first five years and 6% in years six through 10 reported other promotion, with no specific classification.

Marketing labels are important communication tools, allowing farmers to both differentiate their products from the competition and capture sales from consumers interested in purchasing local and regional foods or foods with unique attributes. The beginning farmers use a wide range of labels on their products, including state, federal, and third-party certifications (see Table 2). Sixty-five percent of all beginning farmer respondents promote their agricultural products as a combination of sustainably farmed (e.g., Certified Naturally Grown, Food Alliance Certified, or Demeter Certification); uncertified sustainably grown (e.g., NOFA-NY’s Farmer’s Pledge); locally/family/home grown; and others (but not certified organic). Roughly one-fourth of beginning farmers reported promoting a combination of certified organic and other labels. Organic certification is not widely used by the respondents, without an accompanying label, with just 3% of new beginning farmers and none of the more experienced farmers promoting their products solely as certified organic. The use of a locally grown label was reported by 7% of beginning farmers just getting started and 5% in their second five years. The remaining 2% of farmers in their first five years and 6% in years six through 10 reported other promotion, with no specific classification.

Number of responses is 59 for new beginning farmers, 43 for advanced beginning farmers, and 102 for all beginning farmers. ”Other combination” refers to use of two or more marketing labels by farmers who are not certified organic.

Characteristics of New and Beginning Farmers

Table 3 describes demographics of all beginning farmer respondents, both collectively and in their respective beginning farmer categories, including gender, age, race/ethnicity, and education level.

Gender

New and beginning farmers who responded to the survey, when compared to beginning farmers as reported by the Agricultural Census, are more likely to be female and less likely to be white (see Table 3). Overall, there are more female farmers in their first five years of farming than those in their second five years. Over half of respondents within their first five years of farming identified as female (62%) and a third identified as male (33%). The remaining 5% chose not to identify with either gender. Farmers in their second five years of farming almost evenly identified as female and male (47% and 40%, respectively); 2% identified as both genders, and 11% chose not to identify.

Two generations of farmers at Hillside Farm/Pearce’s Pasture Poultry, Vermont. Photo: Lee Rinehart, NCAT

Age

The average age of all beginning farmer respondents is approximately 48 years old, with new beginning farmers slightly younger (47 years old, on average) than the more experienced beginning farmers (50 years old, on average). The majority of beginning farmers just beginning their career are young, between the ages of 25 and 44 (40%). However, just over a fourth of them are significantly older, between 55 and 64 years old (29%). Just under a quarter fall between the ages of 45 and 54 (22%), and the remaining 9% are under 25 (2%) or 65 and older (7%). Farmers in their second five years of farming are slightly older, with 32% between the ages of 55 and 64, and 17% 65 and older. Seventeen percent of them are also between the ages of 25 and 34, but none are under 25. The remaining 3% are split evenly between 35-44, 45-49, and 50-54. In sum, beginning farmers in the earlier years of their career are younger than those in years six through 10, but there is still a significant number of older farmers just getting started in the industry.

Ohio City Farm, Ohio. Photo: Daniel Prial, NCAT

Ethnicity

Beginning farmers primarily reported being White/Caucasian (83%), Black-African- or Caribbean-American (7%), Hispanic/Latino (5%), two or more races (3%), American Indian/Alaska Native (1%), and Asian (1%). However, more beginning farmers just starting their career reported their ethnicity as Hispanic/Latino (7%), compared to their more experienced peers (3%). When compared to the overall population of beginning farmers, as reported by the Census of Agriculture, a higher share of survey respondents reported they were Black (for all experience levels) or Hispanic (for new beginning farmers).

Education

New beginning farmers are generally more educated than the more experienced beginning farmers. Almost half (47%) of beginning farmers in their first five years of farming are college graduates and a third (32%) hold a post-graduate degree. The remaining hold at least a high school diploma (12%) or an associate degree (9%). A smaller share of the advanced beginning farmers hold a four-year college degree (39%) but more hold a post-graduate degree (39%). Twelve percent hold an associate degree, 7% hold a high school diploma or GED, and 3% lack a high school diploma.

Key Take-Aways

Overall, farmers in their first five years of farming are slightly younger, more female-identified, and have more education than those in their second five years. The percentage of women respondents to the Intermediated Markets survey (55 percent) exceeds the Census of Agriculture’s report that 41 percent of beginning farmers are women. The average age of beginning farmer respondents, both those just starting and those more experienced, are nearly identical to the national averages for all beginning farmers in the United States. Similar to the entire agriculture sector, new and beginning farmers report minimal racial/ethnic diversity, although those responding to the survey exhibit more racial/ethnic diversity than the overall field.

About Farming Operations

This section provides detail about the farming operations of survey respondents, including details on total gross farm sales, operation size and ownership status, and overall farm income contribution.

Farm Gross Sales

Respondents generally operate small farms, with the majority reporting gross sales less than $10,000 in 2016 (see Table 4). However, the percentage of farmers with gross sales less than $10,000 declines with increased farming experience, dropping from 61% of those in their first five years to 47% of the more experienced farmers. Additionally, approximately one-fourth of less experienced beginning farmer respondents (23%) reported between $10,000 and $24,999 in total gross sales in 2016, while 15.6 percent of more experienced beginning farmers (years six through 10) reported total gross sales in this category. About 16 percent of new beginning reported sales exceeding $24,999, while 38 percent of more experienced beginning farmers report sales exceeding $24,999. Overall, total gross sales for more experienced farmers are higher than that of farmers just entering the farming sector, suggesting that sales increase as beginning farmers become more established, well beyond the $10,000 threshold that includes most beginning farmers in this study.

Land Access

In terms of operation size, most beginning farmer respondents reported having fairly small operations and owning their land. More than half of beginning farmers had 10 acres or less in production in 2016: 64% percent of those in their first five years of farming and 58% of those in their second five years (see Table 5). About a fourth had 11 to 50 acres in production (23% of beginning farmers and 27% of advanced farmers), and the remaining reported 51 or more acres. Over half of beginning farmers (64%) just entering the farming sector reported owning 100% of their farmland, and only 23% of farmers reported leasing 100% of their acreage in 2016. Ownership rates increased for advanced beginning farmers (years six through 10), as almost three-fourths (71%) of farmers in this group reported owning all their acreage, and only 12% reported leasing all of their farmland acres in 2016. These findings suggest that as farmers become more experienced (and potentially more profitable), they are able to purchase their own land instead of leasing from landowners.

Farm Ownership and Access to Capital

The majority of beginning farmer respondents reported that their primary farm owner spends 50% or more of their work time on the farm or ranch: 76% in their first five years and 86% of more experienced farmers. However, many also reported that farm income does not greatly contribute to their overall income. Just over half (51%) of less-experienced beginning farmer respondents reported that farm income did not contribute at all to their overall household income in 2016. Almost one-third (29%) reported that it contributed less than 25%, and the remaining (18%) reported that it contributed over 25%. Just 2% reported that farm income represented 100% of overall household income.

More advanced beginning farmer respondents are overall benefitting more from farm income than those just beginning their careers in the farming sector. While many respondents still reported that farm income contributes less than 25%, or not at all, to overall household income (37% and 30%, respectively), the remaining 33% reported that it contributes more than 25%, including 12% that reported it contributed 100% of their household income in 2016.

Alicia Seda operating farm equipment. Photo: NCAT

Notably, very few beginning farmer respondents have received a beginning farmer or rancher loan (17% of farmers in years one through five, and 27% of farmers in years six through 10). However, a majority of beginning farmers reported having a business plan, a major requirement to getting a farm loan. Three-fourths (75%) of respondents in the first five years of their career and more than half (57%) of their more experienced counterparts have a business plan.

Summary

This publication presents the findings from a national survey that focused on the opportunities for new and beginning farmers to access intermediated market channels and finds that intermediated market channels are an underutilized marketing opportunity for new beginning farmers. Research from this study shows that beginning farmers who participate in intermediated markets do so because it diversifies their business. Many of them are also motivated by the reliability of this market while also taking advantage of their low marketing costs. The survey results also reveal the biggest challenges new and beginning farmers face when selling into intermediated markets. The two most reported major barriers to selling to intermediaries reported by beginning farmers were seasonality of products and low prices for product. These results suggest that the direct-to-intermediary marketing channel may be the most unfamiliar market channel to beginning farmers. But, with information regarding how to navigate intermediated markets, along with more farming experience, beginning farmers may have a promising new market channel in intermediated markets.

Selling to Local and Regional Markets: Barriers and Opportunities for Beginning Farmers

By Michelle Hughes, New York University; Andy Pressman, NCAT; Lydia Oberholtzer, Penn State University; Carolyn Dimitri, New York University; and Rick Welsh, Syracuse University

Published July 2022

©NCAT

IP595

This publication is produced by the National Center for Appropriate Technology through the ATTRA Sustainable Agriculture program, under a cooperative agreement with USDA Rural Development. This publication was also made possible in part by funding from USDA AFRI, grant #2016-68006- 24739. ATTRA.NCAT.ORG