Risk Management in the Real World

Print This Post

Print This Post

By Nina Prater, NCAT Sustainable Agriculture Specialist

It is always challenging to be a farmer, with so many things outside our control: the weather, of course, but customers, markets, and supply chains can also shift as unpredictably as the summer rain. If the past year of the pandemic has taught us anything, it’s that farm businesses need to be agile and resilient to withstand unforeseen upheavals of all kinds.

The Southern Risk Management Education Center (SRMEC), funded by the USDA National Institute of Food and Agriculture (NIFA), is an organization that helps teach farmers in the South about risks they may not have considered. Its mission is “educating America’s farmers and ranchers to manage the unique risks of producing food for the world’s table.” Looking back on a year of everyone in the food supply chain adjusting and readjusting and then readjusting again to the challenges of the pandemic, the need for a wide range of risk-management strategies is more clear than ever.

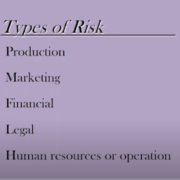

But what is risk management on a farm? Broadly and simply speaking, it’s anything you do to reduce risk in your operation. To make it easier to think about, risk can be broken down into five categories: production risk, marketing risk, financial risk, legal risk, and human-resource risk.

Guardian dog. Photo: Nina Prater, NCAT

An easy example of production risk is crop loss due to weather, such as a hail storm wiping out all your tomato plants, or a flood washing out your corn crop. On my family’s farm, we raise meat goats and cattle, so our production risks revolve around pasture and livestock health. We have had predation losses from neighboring dogs attacking our goat herd. We reduced that risk by purchasing livestock guardian dogs that live with our herd. That’s one real-world example of production risk management.

Here’s an example of marketing risk: We used to sell our meat at the local farmers market, but bad weather on weekends often led to fewer customers and a loss of income that week. Relying on an outdoor farmers market to sell our products meant there was always a risk that we wouldn’t be able to maintain a steady cash flow. After a few years of experience and much analysis, we chose to market our live animals at auction instead. Now the marketing risk we face is not knowing exactly what price our animals will get at the auction, but it has consistently been more reliable than marketing directly to customers.

An example of financial risk is taking out loans to pay for operating costs. Debt is a risk most farmers take on – but how much debt you take on in relation to your estimated income is a decision you have to make, and one you should make carefully.

An example of legal risk is inviting people onto your farm. Many farmers host tours, and when people come onto your farm, there is potential for injury for which you could be found liable. Or, since farmers are mostly selling food (rather than, say, cut flowers or fiber), someone getting sick after eating a product could open farmers up to legal risk. Understanding those risks and taking measures, such as having a good insurance policy, can help protect your farm business from possible lawsuits. The National Agriculture Law Center is a great resource for information on legal risks farmers face.

Human-resource risk refers to the risk we put ourselves in (or our family or employees). Farming is one of the most dangerous jobs out there. It is sad to say, but important to recognize, that suicide rates for farmers are very high compared to other professions. It is a risky and stressful profession and can take a toll both physically and mentally. But if those human risks and stresses are managed thoughtfully, it is a job with immense rewards.

Photo: Nina Prater, NCAT

So how do you make your farm resilient? There’s no avoiding risk completely, but you can take steps to reduce the impact of potential problems so that when you do encounter them, they don’t put you out of business. This summer, the National Center for Appropriate Technology (NCAT) is hosting two in-person workshops, with support from SRMEC, for participants to learn from both farmers and NCAT specialists about different production strategies, insurance options, business practices, and other risk-management tools you can use to protect your farm. The dates of these workshops are to be determined, so make sure to sign up for our Weekly Harvest newsletter so that you don’t miss out on this great learning opportunity.

It’s not fun to focus on all the bad things that could happen when you’d rather be focusing on your dream farm. But I think it is important to do both: to plan for challenges while working hard to make the vision you have for your farm a reality. Whether you dream of an heirloom fruit orchard, a grass-fed beef operation, or a diverse farm with a little of everything, it is critical to plan for bumps in the bumpy road that is farm life.

Related Resources:

Crop Insurance and Risk Management

SRMEC’s Introduction to Risk Management

This blog is produced by the National Center for Appropriate Technology through the ATTRA Sustainable Agriculture program, under a cooperative agreement with USDA Rural Development. ATTRA.NCAT.ORG.

Chelsea Green Publishing

Chelsea Green Publishing

USDA photo by Lance Cheung

USDA photo by Lance Cheung

USDA

USDA