Planning for Profit in Sustainable Farming

By Jeff Schahczenski, NCAT Agricultural Economist

Abstract

Achieving and maintaining profitability is a challenge for all agriculture businesses. This introductory publication discusses some basic questions that will help you plan for profitability. Understanding your financial capability, your costs of production, and the potential profitability of alternative ways to market products are examined. A list of additional resources is included for further study.

Contents

Introduction

The Challenge of Farming Profitably

Asking the Basic Questions

Summary

References

Further Resources

Introduction

A failure to plan is a plan to fail. While the basic concept of profit is very simple, assuring profitability in a sustainable farming business requires careful planning. Simply put, profit is a situation where income is greater than expenses over time. While careful planning will not absolutely assure that you will operate at a profit in your farming business, it certainly increases your chances. This publication provides an introduction to assessing and planning for farm profitability and includes additional resources that can provide further assistance. While this publication is primarily directed toward active beginning farmers, it should be helpful to anyone considering starting a farming business.

In this publication, there will be little discussion of how to improve farming production techniques even though such improvements can certainly improve profitability. While a discussion of the importance of knowing a farm’s production costs is included, specific products and production techniques are not covered.

The topic of obtaining farm land—even though the cost of land is one of the most important costs impacting profitability—is not covered in this publication. (See the ATTRA publication Finding Land to Farm: Six Ways to Secure Farmland for more information.)

Finally, since this publication is intended for beginning farmers and those considering farming, it will assess the advantages and limitations of different approaches to profitably marketing farm products. The diversity, location, and complexity of profitable farms in the United States vary widely and the goal of this publication is to give the reader an overview of some of the alternative ways to farm and make a profit.

The Challenge of Farming Profitably

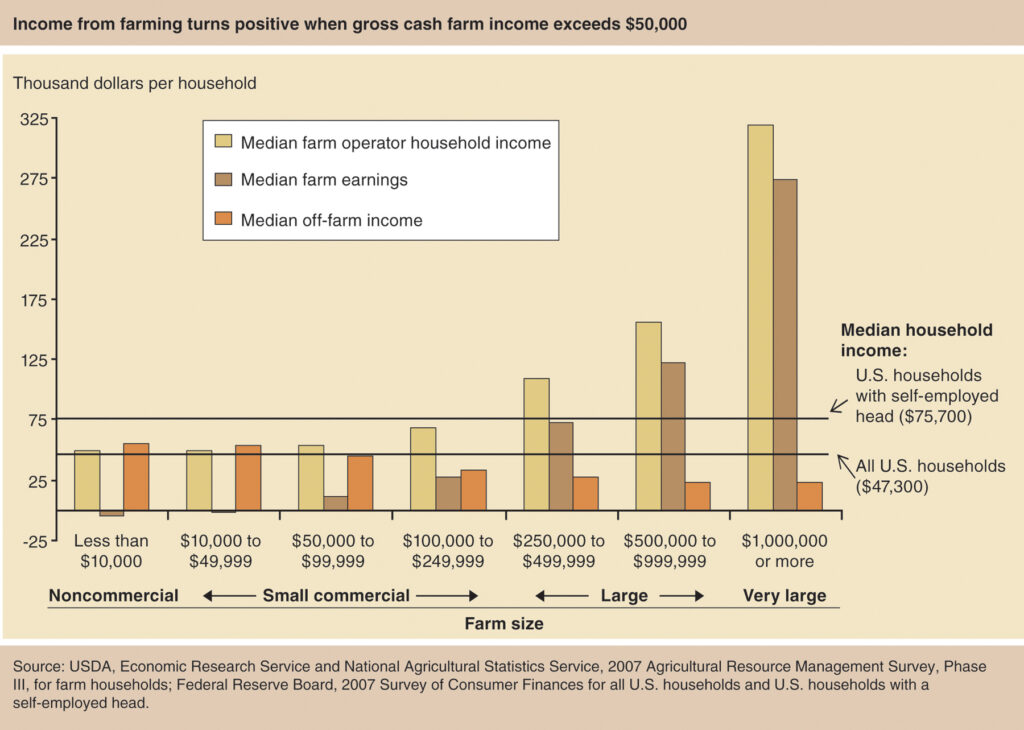

Achieving year-to-year profitability in farming is not easy, and most farms in the United States do not do so. While high levels of profit in agriculture are possible, recent historical records show mixed success in profitable farming. In 2007, 64% of farms had negative operating profits (Hoppe et al., 2010). In the United States, farms that were more likely to operate with a positive profit were those that are larger, fewer in number, less diverse, and highly federally subsidized. Many smaller, more diverse farms were experiencing more difficulty being profitable (Hoppe et al., 2010).

Generating a livable income from farming alone is difficult. Most farms depend on some level of off-farm income. It may be necessary to retain an off-farm income source until the farm business reaches the desired level of income. Recent data presented in Table 1 indicates that, in 2007, farming was a profession that did provide average income levels comparable to other occupations. However, the data in Table 1 also shows that smaller farms are more dependent on off-farm income to remain in the farming business and that a level of gross sales greater than $50,000 may be needed to begin to see positive net income. This is important information as you consider starting to farm or expanding your early efforts at improving your farm business.

Profit Is Not Required to Farm

Profit is not a requirement to be a farmer. In 2007, almost 900,000 farms with total gross annual cash income of $10,000 or less also had negative operating profits (Hoppe et al., 2010). These farms were in the category of farms defined by the U.S. Department of Agriculture (USDA) as noncommercial. Most of these farms continue to operate despite negative profits and low incomes because the farmers had alternative sources of income. USDA researchers speculate that these non-commercial farms had less concern for profitability:“Operating a profitable farm is less likely to be a major goal for the operators. They also may engage in farming to secure long-term capital gains, shelter off-farm income from taxation, live a rural life-style, or pass the farm—which can be valuable, depending on location and acres involved—on to their heirs” (Hoppe, 2010).

Profit is not the only reason people produce and sell food, and many beginning farmers accept that profitability and higher income will takes several years to achieve. Even well-established commercial farms have several years where profits are negative. Planning to be able to weather the storm of difficult, unprofitable years is important if profitability and higher income is your ultimate goal.

Asking the Basic Questions

Planning for profitable farming requires careful investigation in order to answer some basic questions:

- Why do I really want to run a farm business?

- What is my financial capacity to farm profitably?

- What are my costs of production?

- What price and revenue can I count on?

- What are profitable alternative market strategies?

- Why do I need a business plan?

- What is my capacity to adapt and change?

These questions serve as the basis for the remainder of this publication. See the Further Resources section at the end of this publication to continue your efforts at planning for a successful and profitable farming business.

Do I Really Want to Run a Farm Business?

Many people like to cook and are really good at it, but being a good cook doesn’t necessarily mean you can successfully run a restaurant business. Similarly, being good at growing crops and enjoying being outdoors and digging in the earth will not ensure that you can run a successful farm business. While there is a great deal of wonderful and inspiring romanticism around growing food and the beauty of rural living, farming is neither a simple nor an easy way to make a living. The combination of skills required to be successful at farming are many and diverse. The most important skills are those related to finance (sometimes limited to accounting), production, and marketing.

It is a rare individual who has sufficient skill and passion in these areas. Many people love to grow crops and rear animals but hate bookkeeping tasks or marketing products. Could it be that farmers of all sizes and types are failing to generate consistent positive profits because they cannot supply all the necessary skills and passion to garner success? After all, small businesses rarely operate with all of the critical skills embodied in a single person. For example, a successful restaurant business rarely operates in an environment where the chef is responsible for both production of the meals and the restaurant’s financing and marketing. While the traditional view of the family farm is that each member of the family will be able to provide the quality of skills and motivation necessary for a successful farm business, this assumption should, at the very least, be carefully examined.

The idea that a lack of motivation or passion in all necessary skill areas can be a cause for small business failure is drawn from the work of Ernesto Sorelli in his award-winning book, Ripples from the Zambezi: Passion, Entrepreneurship, and the Rebirth of Local Economies. While this book focuses on rural economic development, the key point is that successful businesses need to be more about people who are not only good at what they do but who also are truly passionate about working together to achieve success. In your early farm business planning, it is important to evaluate your ability to provide motivation, passion, and skills in production, finance, and marketing, which are all vitally important for success and profitability.

The bottom line is that you may need to plan for or have financing available to quickly reach a level of business at which you can hire the necessary skill and passion for the critical work at hand. At the very least, you should make sure you budget for training so that you can improve those skills you don’t perform as effectively as you could. No business can maintain profitability if there is a critical shortage of the basic skills and motivation necessary for success.

What Is My Financial Capacity to Farm Profitably?

A farming business could operate with a checking account and a credit card, provided that you have sufficient money in the account and a large enough credit limit. However, it is risky to bet that you can continually replenish the checking account and avoid high interest payments on the credit card debt. Nonetheless, this is a bet that many farmers make every year. In 2011, the USDA Farm Service Agency (FSA), which is a lender of last resort, will provide over $1 billion dollars in subsidized direct operating loans to farmers (Slattery, et al., 2011). In other words, these farms cannot even start another year of farming without a federally subsidized loan.

How can you know your financial capacity to farm? To help answer this basic question, we will use the following example farm business.

This rural Pennsylvania farm business operates on 30 acres of land owned by the farmer, and 15 acres of this land is farmed. The current value of the land is about $300,000 ($10,000 per acre). The farmer has a very old tractor, which runs fine right now but already has been fully depreciated and has a salvage value of about $2,000 (more about depreciation later). She also has an assortment of implements, tools, saved seed, etc. that have an estimated value of about $10,500. She owns a house on the property worth about $85,000 on the current real estate market and a late-model pickup truck worth about $5,000. She has been farming for three years and only in the third year has she made a small profit. She has decided that the local wholesale markets for tomatoes, melons, green beans, and lettuce represent the best opportunity for her operation. The growing season has just ended, with $20,000 in the business checking account and $10,000 in savings. Gross revenue from the sale of the crops was $250,000. She has just received her credit-card bill and has a $5,000 bill to pay. All other bills are paid in full.

Using this very simplified example, how might we understand this farmer’s financial capacity to farm?

Three broad assessments are helpful:

- Historical Experience. Knowing that this farm has had a history of generating net farm income creates some confidence in the financial capability of the operation. Since one of the critical requirements to receive a federally subsidized farm-operating loan is that the farmer applicant has at least three years of experience managing a farm, the farmer in our example would likely be eligible for an FSA operating loan. However, the farm has had only one profitable year out of three.

- Liquidity. Liquidity is the ability of the farm business to have enough cash available to meet immediate financial obligations. Solvency, which is discussed below, is a related measure but is more about the ability to meet long-term debt. Three simple measures of liquidity can be easily generated. These are known as current ratio, working capital, and working capital to gross revenue.

Current Ratio: The current ratio is the result of dividing your current total assets by current total debt. For our example farm business, this ratio would be calculated as follows:

Current Total Assets = Land $300,000 + Tractor $2,000 + Truck $5,000 + Tools $10,500 + Cash (checking and savings) $15,000 = $332,500

Current Total Debt = Credit-card debt $5,000

Current Ratio = $332,500 / $5,000 = 66.5

Clearly, this farm has positive liquidity by this measure because the total current debt is so low in relation to the farm’s assets. Many farms operate with a much lower current ratio, commonly in the range of 1.5 to 2. A current ratio of less than 1.5 is often considered a financially vulnerable situation for a farmer.

It is important to note, however, that asset values are estimates and are never fully known until they are actually sold. Also, the house owned by the farmer was not included in the asset estimation because it is not necessarily a business-related asset. Such a technical distinction may not be a practical, though, because it is often very hard to separate the sale of the house from the sale of the land if needed for the payment of debt. It is probably best to separate your personal assets from business assets in determining financial viability of the farming business.

Working capital: Working capital is simply the cash or short-term credit readily available for use in the business. It is an important measurement because of the need to know whether it is sufficient to continue business operation. Clearly, the $30,000 in the business checking and savings accounts would be working capital. However, the credit-card debt of $5,000 could be immediately paid, leaving only $25,000 in working capital. An alternative would be to carry the credit-card debt forward at a high interest cost, leaving $30,000 for working capital. Indeed, working capital could also include the ability to access more credit, depending on credit limit of the card.

Nothing in the discussion of credit-card debt should imply any recommendation to use credit cards to finance business operations. Credit-card debt is very expensive debt, and any business in need of working capital should work with a bank or FSA to obtain an operating loan at more favorable credit terms, rather than relying on credit-card debt. The point here is determining whether you have sufficient capital as the season begins and until sales income starts coming in. If working capital is not sufficient, then an operating loan may be necessary.

Working capital to gross revenues: This measure is the ratio generally expressed as a percentage of working capital to historic gross revenues. In our example, this is $25,000 / $250,000 = .10 or 10%. This is a fairly low percentage and suggests some financial vulnerability because farm businesses more commonly operate with levels of working capital to gross revenues of 15% to 20%.

- Solvency. Solvency is an assessment of the ability of the farmer to pay all debts in full. A farm with very high debt is less likely to able to continue to borrow or stay in business long. Three measures to assess solvency are: farm debt-to-asset ratio, farm equity-to-asset ratio, and farm debt-to-equity ratio.

Farm debt-to-asset ratio: This is a simple measure of indebtedness. It compares farm debt to total farm assets and is expressed as a percentage. In our example, this is $5,000 / $332,500 = .015 or 1.5%. This clearly indicates a low level of indebtedness compared to most farms, where it is not uncommon to have debt-to-asset ratios of 30% to 40%. A debt-to-asset ratio above 60% indicates serious financial vulnerability.

Farm equity-to-asset ratio: This is the farmer’s share of the business and the inverse of the debt-to-asset ratio. Farm equity is total farm assets value minus debt—in our example, $332,500 minus $5,000 = $327,500. Thus, the equity-to-asset ratio is $327,500 / $332,500 = minus .985, or 98.5%. Note as a check on your estimation that farm equity-to-asset ratio plus farm debt-to-asset ratio equals 100%. Having a least a 60% share in your farm business indicates a strong financial capacity.

Farm debt-to-equity ratio: This measure compares your debt—what the bank or creditor share of the business is compared your ownership stake. In our example, this measure would be $5,000/ $327,500 = .015. This again indicates a strong financial capacity of the farm. Many farms operate with levels of debt-to-equity ratios of .43 to 1.5.

While the assessments of financial capacity (experience, liquidity, and solvency) are relatively straightforward, it is a good idea to track them annually as you proceed with your farming business. Doing so can provide you with early warning signs of possible business failure. Finally, and perhaps more important, documenting these measures is useful if and when you need to pursue an operating loan or if you want to purchase additional farm land to expand your business. And keep in mind that these simple assessments, while useful, are not of the only ways to assess financial capacity and management of your farm business.

What Are My Costs of Production?

It is very likely that any successful farmer can tell you with a fair degree of accuracy how many dollars per bushel, pound, row foot, dozen, head, carton, etc. it costs to produce every crop or livestock product he grows. Without tracking costs per unit of production for each enterprise, it is hard to answer some very basic and important questions, such as these: Does crop X cost more to produce than crop Y? Does crop X use more of my limited labor than crop Y? Do I spend more tractor expenses producing crop X or Y? The answers to these types of questions can only come from keeping good records and carefully analyzing costs. Also, accumulating cost information over time can ultimately provide the basis from which to undertake important estimations of how potential changes in costs will affect profitability and income in the future. For example, with a good system of cost tracking, you might be better able to understand how a dramatic change in diesel prices will impact your bottom line and the relative costs of every crop or livestock product you produce. Thus, in planning for a given production year, you will be able to adjust what you produce to limit the impact of a sudden dramatic changes in any input cost.

Enterprise Budgets

Establishing and tracking enterprise budgets for each product sold by the farm is an important way to understand the total cost of production of the farm. There are many readily available examples of crop or livestock enterprise budgets. However, these examples are not always particularly useful and may not fit your specific farming operation. It is best to first look for examples of enterprise budgeting from your own local agricultural Extension offices or state land grant university. For example, the Iowa State University Extension Service has many enterprise budgeting and other agricultural business decision-analysis tools for various types of cropping and livestock systems, including vegetables and fruits, based on Iowa-specific information. These could be adapted for your use, but your may need to adjust them for your location and operation.

These adjustments are particularly important for crop-yield information, which is highly variable unless it is fairly specific to the location you are farming. It is only over time and with experience that you can more accurately estimate yields and costs on your farm. The first-year farmer may have to use estimates that are less than ideal, but getting estimates that are realistic and relevant to crop and location is worth the effort.

The Iowa State University Extension enterprise budget for carrots is shown below in Table 2. This table demonstrates some of the complexities and area-specific information needed for proper adaptation to your farm. Also, it is important and necessary to repeat each of these specific crop-based enterprise budgets for each crop you intend to produce and then bring them together to analyze the whole-farm enterprise. This approach is often overlooked by beginning farmers. A whole-farm enterprise budget, if not based on a separate analysis of each product, will only provide a general overview but will not provide the kind of detail necessary for careful cost analysis of each intended crop or livestock product. Some further important details that can be gleaned from this enterprise budget are area of production, revenue estimates, planning and harvest costs, ownership costs, and total costs and rate of return. Each is addressed in the following discussion.

Area of Production

As you examine the carrot enterprise budget, you will notice first that area of production (or more simply, the size of the field/bed) is included. There are several important considerations related to this measurement. First, in order to use this budget, you would need to set up a recordkeeping system based on the designated unit of production—in this case, carrot yields and costs per 100-foot by 4-foot bed. This unit of production is, of course, arbitrary and needs to be established according to your specific situation. For instance, the unit area of production could be acres, if your production of carrots were in fields where acreage was known, or row feet. If a bed unit of production is utilized, it might be useful to establish an easy translation into to a more common unit, such as acres. For example, in this carrot budget, 70 beds measuring 100 feet by 4 feet totals about one acre of production. The important point is to make it relatively easy to collect yield data in whatever unit of production makes sense for your operation and can be kept consistent over the years.

| Table 2. Iowa Carrot Enterprise Budget | ||||

| Ag Decision Maker — Iowa State University Extension

See extension.iastate.edu/agdm/crops/html/a1-17.html for more information. |

||||

| Assumptions: 100′ x 4′ bed | ||||

| Quantity | Unit | $/Unit | Total | |

| Receipts | ||||

| Carrot Sales | 170 | lbs | 0.80 | $136.00 |

| Total Receipts | $136.00 | |||

| Planting Year Costs | ||||

| Supplies | ||||

| Seed – cover crop | 0.75 | lbs | 0.60 | $0.45 |

| Seed | 3 | packet | 1.50 | 4.50 |

| Burlap | 3 | bags | 1.80 | 5.40 |

| Fertilization | 10 | lbs | 0.15 | 1.50 |

| Other | 0 | lbs | 0.00 | 0.00 |

| Labor Costs | ||||

| Cover crop | 0.05 | hrs | 10.00 | 0.50 |

| Bed preparation | 0.20 | hrs | 10.00 | 2.00 |

| Fertilizer spreading | 0.10 | hrs | 10.00 | 1.00 |

| Planting, laying burlap | 0.20 | hrs | 10.00 | 2.00 |

| Irrigation set up | 0.25 | hrs | 10.00 | 2.50 |

| Weeding | 0.75 | hrs | 10.00 | 7.50 |

| Other | 0 | lbs | 0.00 | 0.00 |

| Interest on Preplant Costs | 27.35 | dollars | 0.035 | 0.96 |

| Total Pre-Harvest Costs | $28.31 | |||

| Harvest | Quantity | Unit | $/Unit | Total |

| Bags (1 lb) | 170 | bags | 0.03 | $5.10 |

| Labor | ||||

| Harvest labor | 3.50 | hrs | 10.00 | $35.00 |

| Packaging | 0.30 | hrs | 10.00 | 3.00 |

| Other | 0.00 | hrs | 0.00 | 0.00 |

| Total Harvest Costs | $43.10 | |||

| Total Variable Costs | ||||

| Per bed | $71.41 | |||

| Per lb | 0.42 | |||

| Ownership Costs (Annual) | ||||

| Irrigation system | $1.14 | |||

| Machinery | 7.14 | |||

| Land | 2.29 | |||

| Total Ownership Costs | $10.57 | |||

| Total Costs (Annual) | ||||

| Per bed | $81.98 | |||

| Per lb | 0.48 | |||

| Annual Returns Over Variable Costs | $64.59 | |||

| Annual Returns Over Total Costs | $54.02 | |||

Revenue Estimates

While price and revenue issues will be discussed in greater detail below, it is useful to have information in an enterprise budget that tracks yield (pounds per bed) and expected price. Here, too, units of production can be an issue as you may wish to measure yield in cartons, heads, or bunches depending how the product is most often sold. Again, consistency is important.

Planting and Harvest Costs

While the carrot budget in Table 2 is a straightforward breakdown of supplies, labor, and ownership costs, it is important to understand the details of these categories. First, costs are broken down into variable and fixed costs. As the terms imply, variable costs can usually be adjusted within a production cycle, whereas fixed costs (“ownership costs” in this example) are not easily changed within the production year. It may be useful to provide this distinction because you can often adjust variable costs and remain profitable, but ultimately the business will need to cover fixed costs as well.

Second, it is important to note that there is a separation between “planting” and “harvest” costs. This level of detail is not always provided in other examples of crop enterprise budgets, but it is very useful in analyzing production costs for fruit and vegetables because of the significant differences that often exist between planting and harvesting horticultural crops. For example, knowing what the harvest-cost differences are between pea and lettuce production may be useful for ultimately choosing which crops to grow and seeing the implications of that choice on profitability.

Also note the interest charged on total “pre-plant” costs, which reflects an assumption of some level of borrowing to pay for what are termed “sunk costs”—costs that will be incurred even if the entire crop is lost. This could also be thought of as what is known as “opportunity cost” of the crop—that is, if you had not invested money in the planting of the carrots, that money could have been earning interest in a bank or put into an alternative crop. Some crops may have greater “sunk” costs than others—one of many factors to consider in choosing what to plant.

Third, note that the supplies for planting reflect a very specific type of production system that utilizes burlap and cover crops, probably as mulch/weed, erosion, or fertility management. In other words, the supply costs are very specific to the particular kind of production system used and would have to be established differently than if you used a different carrot-production system. This also is important when and if you try to evaluate the costs of a carrot-production system different than your own. For example, if you wanted to control weeds in carrot production using flame weeding, additional cost categories, such as propane, would have to be created and examined. Flame weeding might have other cost implications, too, such as lower labor costs. The point is that different production systems have different cost implications, and without this level of detailed data collection, it is hard to determine which is less costly.

Fourth, note that labor costs are quite detailed and would require careful recordkeeping of very specific phases of work spread across each bed in carrot production. Also, labor is charged as a constant rate ($10/hour in the example) across all forms of labor even if greater skill and therefore higher labor costs may be appropriate. It is also important that the labor rate incorporates the costs of labor beyond direct compensation far(workers compensation, employee taxes, individual retirement accounts, etc.).

This also raises the difficult issue of what labor rates to charge for your own work. Do you charge your labor differently you would for a hired employee? Do you incorporate a management-labor cost to your labor, or are you making the assumption that profit is the sole reward to management? If farm profit is your return to management, then your management time and skill may be evaluated at a very low level if you end up with a negative profit. There is no correct answer here, but it is important that, whatever you answer, you establish a consistent way to evaluate labor costs.

Finally, it important to note what is missing from this enterprise budget. For example, there are no operational costs for machinery. Planting, weeding (cultivation), and fertilizer spreading are only tracked in this budget example as labor expenses. If tractors and tractor implements are used, one could first calculate an average hourly cost of operation for each piece of machinery and multiply that by the hours used for a specific function, such as bed preparation, weeding, and harvesting. Also, since this is a production enterprise budget, overhead costs that are spread across all products produced are not appropriated specifically to this budget. Finally, costs of marketing the carrots also are not included separately in this example, but they could be if you expected that marketing carrots led to specific marketing costs that could not be generally allocated across the whole farm’s production.

Ownership Costs

Ownership costs look simple but actually are very tricky to estimate. The Iowa State University Extension specialist who created the carrot enterprise budget views ownership costs as the cost of using an asset either owned or in the farmer’s control (in other words, the bank may own at least part of it). The concept of “using up” an asset is perhaps most clear when the costs of machinery or tool ownership are estimated because, as we all intuitively know, tools and machinery wear out and need to be replaced. Depreciation is another concept that is widely used to capture the idea of using up an asset. However, depreciation is often considered an accounting term, rather than the actual using up of an asset. For instance, a tractor may be financially used up but still able to render service beyond its financial life.

Machinery in the carrot budget is treated as an investment with a three-year life expectancy. The total machinery investment is assumed to be $1,500 per acre, or $500 per year per acre, and because there are 70 beds per acre, the annual ownership cost is estimated to be $7.14 per bed ($500 divided by 70 beds). The irrigation system is very similar to the machinery calculation, with a total irrigation investment of $240 spread over three years at an annual ownership cost of $80 per acre per year divided by 70 beds per acre, or $1.14 per bed. Whether it is realistic to assume a three-year life expectancy for machinery and irrigation equipment is debatable, but again it is important to establish and fully understand the assumptions that you make for your budget.

Land ownership costs are perhaps even more complicated to understand. In the carrot budget, there is a land-cost assumption of $160 per acre per year. Ownership-cost evaluation is concerned with accounting for the opportunity cost of land. In this budget, ownership cost is assumed to be the rental rate for agricultural use of the land. The justification is that if the land is not used by the farmer, then it could be rented to another farmer for this estimated per-acre rate. If you were leasing/renting land for agriculture production, this could be a reasonable estimate of land ownership costs. If you had a mortgage for the land, then a better ownership cost estimate would be your annual mortgage payment. In this specific estimate, the annual land ownership cost is estimated to be $2.29 per bed ($160 per acre divided by 70 beds per acre).

If the land was fully owned, then the decision of how to best capture land ownership costs may be complicated. One could simply charge no cost for land ownership or use the rental rate proxy. The rental rate cost may be useful because the idea of knowing how the cost of land impacts your profitability may be important if, for instance, you were considering purchasing additional land to expand the business. Also, neither of these options for assessing costs has taken into account costs such as property taxes, which could still be significant even if the land is owned outright. However, these costs are best incorporated as part of operational costs rather than as a true ownership cost.

Total Costs and Rate of Return or Profitability of Carrot Production

The final analysis in this crop enterprise budget is an estimate of total annual costs per bed and per pound of carrots. Also, because revenue estimates are provided, the rate of return per bed for carrot production also is estimated relative to variable and total costs. In this example, the rate of return on variable costs is $64.59 per bed (total revenue of $136 per bed minus variable costs of $71.41 per bed). The rate of return on total costs is $54.02 per bed (total revenue of $136 per bed minus total costs of $81.98 per bed). Although not shown, an additional measure that might be useful is an estimate of operating profit margin, which is the ratio of total operating income (return per unit of production) divided by total sales revenue, usually expressed as a percentage. In this example, the profit margin per bed would be estimated by dividing operating income (the rate of return on variable costs per bed) of $64.59 by total revenue per bed ($136), or 47.5%. By comparing these estimates for each crop or livestock product produced, you can better analyze the relative profitability of each enterprise.

Finally, this crop enterprise budgeting can help you identify the break-even price for your carrots both by costs per pound or beds. In this example, if you cannot get at least $0.42 per pound for your carrots, you will not be covering your variable costs. In the long run, a price of at least $0.48 would be needed to cover total costs. The break-even cost of your product is a very critical estimate to know and will be discussed further in the discussion of pricing and revenue below.

The Whole-Farm Budget

Once you have determined each crop and livestock enterprise budget, you can bring them together in a whole-farm budget relatively easily. However, it is likely that some costs were not captured by individual enterprise budgets. For instance, marketing costs, property taxes, farm insurance, office expenses, phone bill, and other similar expenses are general to the whole farm but need to be accounted for if not already captured in the enterprise budgets. Such costs could alternatively be incorporated by creating a new category of expenses such as “overhead expenses.”

Table 3 provides a basic outline of a whole-farm budget. The major distinction between an enterprise budget and a whole-farm budget is that a whole-farm budget shows the impact of each individual enterprise (in this case, carrots, snow peas, and cherry tomatoes) on the overall farm business. It also accounts for expenses that are not attributed to a single enterprise.

| Table 3. Sample Annual Whole-Farm Budget | |||

| Enterprise | Units-Beds (100’x4’) | Estimated Annual Net Return per Unit (from enterprise budget) |

Total Net Return |

| Carrot | 30 | $54 | $1,620 |

| Snow Peas | 40 | $58 | $2,320 |

| Cherry Tomatoes | 46 | $181 | $8,326 |

| Total Net Return from enterprises (A) | $12,266 | ||

| Operating Overhead Costs: | |||

| Farm Management Labor | $7,000 | ||

| Accounting Labor | $500 | ||

| Insurance | $2,000 | ||

| Phone | $500 | ||

| Property Taxes | $1,000 | ||

| Advertising | $300 | ||

| Total Operating Overhead Costs (B) | $11,300 | <$11,300> | |

| Net Farm Income (A-B) | $966 | ||

| Source: NCAT | |||

It is important to note that machinery (including depreciation), labor, and other operating costs are factored into each enterprise budget separately and thus are not treated as overhead operating costs in Table 3, though this could have been an alternative way to budget these items. Again, the advantage of allocating these costs to each enterprise is that you can track the relative profitability of each enterprise separately. Finally, note the inclusion of farm management and accounting labor as part of overhead, the assumption being that these labor costs are not specific to any one enterprise.

One problem in creating a whole-farm budget is that if you have a highly diverse farm where you intend to grow 20 to 30 separate crops and livestock products, then analyzing the relative profitability of each enterprise could be a daunting task. But there are resources that can help. For instance, in his book The Organic Business Handbook, Richard Wiswall provides a way to link up to 24 separate crop enterprise budgets into a whole-farm budget and even includes a companion CD to help with the task. The tool could be modified to add additional enterprises.

An alternative to tracking costs, production, and sales for each enterprise in a highly diverse farm is to pick those enterprises that you expect will be your most valuable crops or which represent a significant part of your expected income, attributing other enterprise costs in a broad “other” cost category in overhead operating costs. The disadvantage of this approach is that knowing the relative profitability of each enterprise is helpful in deciding what can be profitably produced.

Finally, once you have developed both enterprise budgets and a whole-farm budget for your farm, you can continue to improve the quality of the information as you track changes in costs over time. You also will have the ability to analyze what-if scenarios to see how changes in costs impact profitability of individual crops and the whole farm.

What Price and Revenue from My Production Can I Count On?

Pricing your farm products for profitability depends on many variables not always easily assessed. The variables include the nature of the market that you can sell your products into (for example, wholesale or retail), how your costs compare to those of your competitors, how you differentiate your product from your competitors (a special variety, organic, or conventional, for example), and your location (New York City farmers market or a grain elevator in eastern Montana).

To illustrate the information and analysis needed for product pricing, let’s consider a local banana market in Maine. Let’s imagine that you can grow bananas in Maine in the winter at a lower cost than your Central American competitors. As such, you might imagine that you could make a profit as a banana grower, even in Maine. However, this is not necessarily true. Whether you can make a living at banana production in Maine also depends on the volume of production you can sell at that price. You might assume that all your volume would easily be sold. However, maybe consumers would think that winter bananas grown in Maine are just too strange a product and would therefore not buy them, despite your lower price. Your competitors may even be suggesting that local Maine bananas are “unnatural,” which could hurt your product’s reputation and sales. Also, retail vendors of bananas may not want to buy your bananas even though they’re less expensive because they do not want to disrupt their more regular, larger-volume purchases of bananas from Central America. The lack of a local farmers market in Maine in December may also be a serious problem for getting your product sold. While Maine-grown bananas are admittedly hard to envision, the point is that determining the appropriate price for your product, the volume you can expect to market, and whether your product will work for your target market is critical for a successful farm business.

Prices for agricultural products are highly variable over time. To expect stability in product prices is a risky assumption if you want to stay profitable. A critical part of being a profitable farmer is to assess the nature of the particular market or markets you plan to enter as best you can. For example, selling tomatoes wholesale for processing will likely result in a lower price but perhaps a higher volume of sales than would result from selling whole tomatoes at a farmers market. Recent data that explored the changes in conventional and organic apple production can serve as a good illustration of the difficulty of profitable pricing.

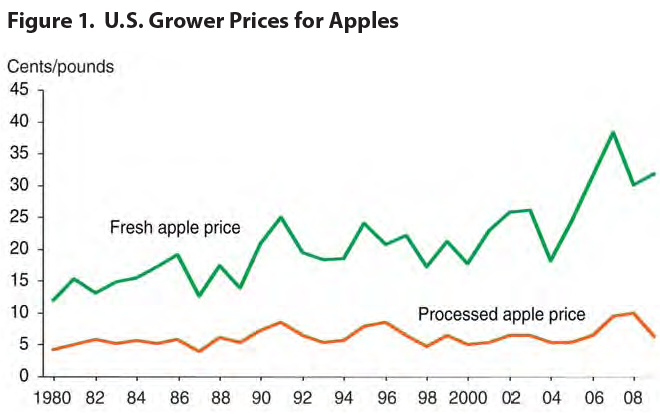

As Figure 1 shows, the price of fresh apples has changed significantly over time, with a low of $0.13 per pound in 1980, a high of over $0.35 a pound in 2007, and lots of variation in between. Processing apples are priced considerably lower than fresh apples and also experience less volatility. Apple producers should analyze whether they can remain profitable in the apple market by selling mostly to the processed market or to the fresh-apple market, considering both the production costs and the price volatility of each market.

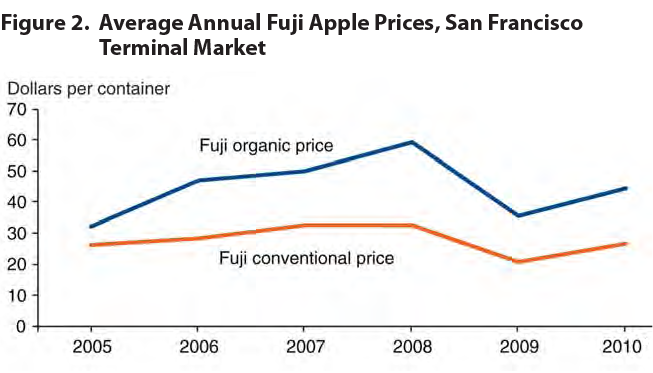

Figure 2 illustrates how product differentiation can impact price. The graph compares conventional and organic apples sold at a wholesale terminal market in San Francisco. Both the prices and volatility of the two related apple products are different. Determining your product pricing requires a careful investigation into the very specific types of crops or livestock products you intend to sell and also where and when you intend to sell them. The USDA Agricultural Marketing Service and the USDA Economic Research Service provide some of the best general information, but more locally specific information from resources such as local farmers markets or retail stores can also provide useful insight.

Finally, there is a tendency to accept the price in a given market, leading farmers to believe that the only ways to stay profitable or even maintain a consistent income from farming is to specialize, grow more because of an assumed lowering cost-to-price margin, and/or lower costs of production. While none of these alternative approaches should be discounted, there are creative ways to market what you sell that could allow you to be more of a “price maker” rather than a “price taker.”

What Are Profitable Alternative Market Strategies?

Much of the information available on farm profitability focuses more on understanding and tracking farm income and expenses than on the broader topic of marketing. While these topics are very important, under-emphasizing marketing may be counterproductive. Marketing is directly related to profitability and helps establish a strategy for selling farm products over both the short and long term. Knowing how much you can produce, what it costs to produce it, and the expected price of your products matters little if you don’t have a market that will buy what you produce.

Marketing is often not a great concern for many farmers who have simplified their operations to grow generic, undifferentiated commodities like corn, wheat, soybeans, cotton, and beef cattle. This is because farm profitability for these commodities largely depends on market prices, which are almost completely outside of these farmers’ control. In order to maintain farm profitability, such basic-commodity farmers generally depend on production-cost efficiencies, production expansion, and publicly subsidized crop price and export subsidies, as well as crop-insurance programs.

However, for the beginning farmer who chooses to produce more diverse products, marketing strategy is more complicated—and potentially more profitable, too, if it is well-researched, planned, and carried out.

In general, a marketing strategy identifies the best approach to maximize the probability that your products are sold at the highest possible price year after year. Five marketing alternatives are discussed below.

Diversity vs. Specialization

In his book The Organic Farmer’s Business Handbook: a Complete Guide to Managing Finances, Crops and Staff—and Making a Profit, Richard Wiswall identifies the relative profitability of 24 organic crops that could be produced on an example farm. Five of those organic crops were estimated to have a net profitability over $16,000 per acre. Those crops are (in order of profitability) parsley, basil, lettuce, tomatoes, and cilantro. Three crops were actually estimated to have negative net profit per acre: bush beans, snap peas, and sweet corn (in order of least profitability). Why, then, would a farmer plant more than, say, five different crops and perhaps include those with negative net profit? It is because the specific crops are less important than successfully determining the level of diversity that is best for profitability.

From a marketing-strategy perspective, the question is pragmatic: Is it easier to market five profitable products or 20 marginally profitable products? The answer is not simple. Certainly, management and marketing efficiency could be gained through some degree of specialization. However, the sustainability of production that comes from integrating a variety of crops and livestock could also lead to operational efficiencies and lower input costs (having farm-generated manure for compost and general fertility, for example). In his book You Can Farm, Joel Salatin suggests the idea of developing a “centerpiece enterprise” and then building other income-generating enterprises around it (see the ATTRA publication Evaluating a Farming Enterprise). Again, there is no single, simple, or correct answer to this question, but it nonetheless needs to be considered carefully.

Direct Marketing

Directly marketing to consumers appears to be an important and expanding option for farm businesses. However, whether direct marketing is profitable is not easily determined. A 2010 study of the linkage between direct marketing and farm income found that that the number of farmers implementing direct marketing as part of their marketing strategy increased 17% between 2002 and 2007, while the value of those directly marketed products increased 49% over the same time period (Detre et al., 2010). In addition, the study found that those adopting a direct-marketing strategy are “typically those with organic crops and those located in regions (of the United States) with access to a large metropolitan customer bases” (Detre, et al., 2010). This same positive view about direct marketing’s success in relation to metropolitan markets has been voiced by Michael Olson, who attributes the expansion of the direct-marketing movement to those farmers he terms “metrofarmers” because they are “tightly focused on producing for a metropolitan marketplace” (Olson, 1994 and 2011). While it is certainly possible to market directly without being organic or close to a metropolitan area, these two factors should be evaluated.

However, recent evidence also suggests that direct marketing may not be as profitable as many have suggested. In a 2011 study, researchers found that the “intensity of adoption of direct marketing strategies” was not strongly associated with gross farm income (Uematsu and Mishra, 2011). Besides noting that the sample size of the study was less than ideal and that gross income is only a proxy measurement for profitability, the researchers did suggest two reasons for this unexpected result. First, the researchers suggested that the adoption of a direct-market strategy “is a risk management tool rather than a profit-maximizing strategy” and that “direct-market strategies may require additional labor requirements and a unique set of skill and abilities.” In other words, profitability is higher for those farmers who have expertise in a unique set of skills and abilities, which is not true of all farmers.

Perhaps even more interesting was the researchers’ finding that participation in farmers markets demonstrated a negative impact on gross farm income. Some reasons suggested for this unexpected result were growing competition among farmers at particular markets, competition between farmer markets, low profit margins for products sold at the markets, and the intermittent operation of the markets themselves. Another way to say this is that many farmers markets may be saturated markets, making it more difficult for newer farmers to profitably adopt this particular form of direct-market strategy.

Community Supported Agriculture (CSA)

The CSA approach to marketing agricultural products has been widely discussed in many research and general publications. It is certainly a relatively new and unique way to market agricultural and livestock products (see the ATTRA publication Community Supported Agriculture). There are basically two broad types of CSAs: those that are organized by having members share in the management, work, and output of the farm; and those that merely set an annual subscription or fee for set share of the farm’s production. One unique aspect of CSAs is that some or all of the production of the farm is sold in advance of its production. Also, in the shareholder version of a CSA, the costs and profit rate are made transparent to the members and there is a general agreement that members share in the production risks of the farm. In the subscription version, the annual subscription fee is more like an offered market price for a total basket of goods that, at least in theory, would need to be set at a level that is competitive with other potential CSA farm competitors. The notion of pre-selling all production is clearly a great marketing advantage and potential opportunity for locking in a specific profit level. It should be noted, however, that many CSAs are organized as nonprofits so that there is an explicit legal obligation to make costs and income publicly available.

Managing a CSA farm may require additional management expertise, organizational skills, and marketing skills. Managing a CSA may require a willingness to engage your subscribers or shareholders in a more direct, personable way than is typical in alternative “impersonal” markets. Indeed, building a food community is often considered one of the primary goals of many CSAs. However, building community may be even more difficult than just farming since it relies heavily on interpersonal skills.

One important question is whether the CSA model is profitable. The answer is likely to be yes, particularly in the case of the nonprofit and shareholder version because profitability is essentially guaranteed—at least to the extent that all costs were carefully analyzed and the share price was appropriately established for the expected number of shareholders. This is also true for subscription fee-based CSAs, but establishing a profitable subscription fee could be tricky because if the fee is too high, members may not join. And if the fee is too low, then costs may not be covered.

The authors of a 2011 study of CSA farms in the Central Valley of California found that while “most CSAs are profitable, CSA is like other forms of farming in the U.S., which often require farm partners to work off-farm to maintain sufficient income” (Galt et al., 2011). Specifically, of the 74 CSAs surveyed in this study, 54% reported being profitable, 32% were breaking even, and 15% were operating at a loss. However, the authors noted that CSA farmers are less dependent on off-farm income than the general U.S. farmer population and that CSAs appear to “be supporting a new generation of farmers that aspires to start farming who don’t have a great deal of capital.” Clearly, CSA marketing provides a unique potential opportunity for profitable farming.

Cooperative Marketing

While the history of the cooperative marketing effort in the United States is extensive, new efforts offer another way to improve profitability. Of course, the notion of cooperative marketing in agriculture is what one expert describes as the “American farmers’ struggle to achieve as a group what they are not able to achieve as individuals in the marketplace” (Hilchey, 2011). Most often, cooperative marketing centers around efforts to add value to agricultural products, but at other times the focus is on the inability to enter higher-volume markets and achieve better prices without a group effort.

Market aggregator organizations are a slight variation of cooperative marketing that take advantage of volume sales. These organizations often pool unique types of farm products like organic or locally grown. Though they are buying wholesale to sell retail to markets needing larger volumes, they are different in that they are often farmer owned. One example of such an aggregator is Eastern Carolina Organics, which specializes primarily in the sale of horticultural products and offers delivery service to retailers. In terms of profitability, the farmer benefits from owning part of the distribution chain and also from better wholesale prices from the aggregator. Another example of a more formal cooperative marketing effort is a small organic grass-finished beef marketing cooperative in Montana. This marketing cooperative formed because its members wanted to sell more of a unique product (grass-finished and certified organic beef) at a better price than they could individually. The members, many of whom had developed their own local and even privately labeled beef products, realized that they all needed a higher volume of sales to meet income goals. They also realized that collectively having a higher volume to offer buyers gave them greater market power to demand higher prices.

The cooperative is successfully getting higher prices for higher volume sales of a unique product, but the individual profitability of each member is still not necessarily assured. Research conducted by the National Center for Appropriate Technology (NCAT) showed that some of the members with higher costs of production were still operating at a loss because the average price for the product was not high enough to cover their costs (Schahczenski, 2008). An advantage of this unique cooperative was that the members continued to sell some of their product outside the cooperative market, and they began sharing production techniques to assist each other with lowering costs. Finally, they lowered marketing costs in part because the cost of a cooperative marketing specialist was shared among members. While cooperative marketing requires greater organizational effort, its potential for improving profitability could be significant.

Value-Added Marketing

It is possible to convert your current products into higher-valued processed food products and improve profitability. If you are marketing fresh apples already, creating apple cider as an additional product is one option. The issue, of course, is that added-value marketing increases costs and requires analysis of a new and different market (apple cider, for example). Caution is advised because value-added product development is really the creation of an additional business, with all the added work, planning, marketing effort, and capital-investment needs of any business. If, for example, creating a new added-value business requires additional business loans, then the original farm business may put at risk.

Of course, this works both ways—a value-added business may be more profitable than farming. In a recent example, a farmer added value to the farm by creating a bed-and-breakfast tourist business (Neuman, 2011). After seven years, the operators of these two connected businesses decided to drop the agricultural business in favor of the tourism, retaining enough of the ambiance of a farm to keep it attractive to bed-and-breakfast customers.

Why Do I Need a Business Plan?

If you carefully address and document the answers to the above questions, developing a business plan is simply a system to put it all together in an organized way. A business plan is a map of where you are and where you want to go. Unfortunately, maps often can be either too detailed or too simple to be of use. Ultimately, the usefulness of the plan is the most important criteria to consider. Too often, newer farmers get so bogged down in developing formal business plans that creating the plan becomes more important than its content. Often, a formal business plan is needed to obtain financing, but before you develop such a document, it is better to develop a plan for your own business that is useful and serves your purposes rather than the potential lender’s. In other words, before you bother to submit a rigid business planning format required by a lender, make sure you have done enough planning to know whether obtaining a loan is a good idea to begin with.

There are many templates available for creating business plans, and some are identified in the Further Resources section of this publication. The basic outline provided by Wiswall (2009) is a good overview of the basic elements of a business plan. These are:

- Cover Page

- Table of Contents

- Summary

- Description (of the business)

- Analyses (organizational, management, market, enterprise budgets)

- Planning (propose strategy and implementation)

- Financial Statements

- Summary

Summary: What is My Capacity to Adapt and Change?

We are witnessing an exciting time for American agriculture, when creative people both young and old are seeking to engage or perhaps re-engage in producing high-quality food for themselves and others. This is driven in part by an entrepreneurial spirit that seeks new ways to own land, market products, and connect with the consumers of their products.

Profit is only one part of the sustainable-agriculture equation. One vision of sustainable agriculture is encapsulated in the following statement:

“Sustainable agriculture is one that produces abundant food without depleting the earth’s resources or polluting its environment. It is agriculture that follows the principles of nature to develop systems for raising crops and livestock that are, like nature, self-sustaining. Sustainable agriculture is also the agriculture of social values, one whose success is indistinguishable from vibrant rural communities, rich lives for families on the farms, and wholesome food for everyone” (Earles and Williams, 2005).

However, no matter how noble and important our vision, a viable sustainable farming business cannot ignore profitability entirely. Too many farms go out of business on a daily basis due to lack of profitability. Remember, good evidence suggests that profitability is very elusive for the American farmer. Creative adaptation and capacity to change are essential to achieving profitability in farming. This can happen through planning and careful attention to the performance and profitability of your farm. Expect setbacks but be prepared to learn from them and do better going forward.

References

Detra, Joshua et al. 2011. Linkage Between Marketing and Farm Income: A Double-Hurdle Approach. Agribusiness. Vol. 27, No. 1. p 19-33.

Earles, Richard and Paul Williams. 2005. Sustainable Agriculture: An Introduction. National Center for Appropriate Technology, Butte, MT.

Farm Service Agency. 2011. Farm Loan Programs. U.S. Department of Agriculture.

Galt, Ryan et al. 2011. Community Supported Agriculture (CSA) in and around California’s Central Valley. University of California Davis, Davis California.

Hilchey, Duncan. 2011. New Generation Cooperatives—Adding Value and Profits. Cornell University Small Farms Program, Ithaca, NY.

Hoppe, Robert A., James M. MacDonald, and Penni Korb. 2010. Small Farms in the United States, Persistence Under Pressure. EIB-63. Economic Research Service, U.S. Department of Agriculture.

Hoppe, Robert A. 2010. U.S. Farm Structure: Declining, but Persistent, Small Commercial Farms. Amber Waves. Economic Research Service. United States Department of Agriculture. September.

Neuman, William. 2011. Small U.S. Farms Find Profit in Tourism. The New York Times. June 9.

Olson, Michael. 1994. Metrofarm: The Guide to Growing for Big Profit on a Small Parcel of Land.

Olson, Michael. 2011. Metrofarm: The Guide to Growing for Profit in or Near the City.

Salatin, Joel. 1999. You Can Farm. Chelsea Green Publishing, White River Junction, VT.

Schahczenski, Jeff. 2008. Building a Montana Organic Livestock Industry. National Center for Appropriate Technology, Butte, MT.

Slattery, Edward, Michael Livingston, Catherine Greene, and Karen Klonsky. 2011. Characteristics of Conventional and Organic Apple Production in the United States. FTS 347-01. Economic Research Service, U.S. Department of Agriculture.

Sorelli, Ernesto. 1999. Ripples from the Zambezi: Passion, Entrepreneurship, and the Rebirth of Local Economies. New Society Publishers, Gabriola Island, BC, Canada.

Wiswall, Richard. 2009. The Organic Farmer’s Business Handbook: a Complete Guide to Managing Finances, Crops and Staff—and Making a Profit. Chelsea Green Publishing, White River Junction, VT.

Uematsu, Hiroki and Ashok K. Mishra. 2011. Use of Direct Marketing Strategies by Farmers and Their Impact on Farm Business Income. Agricultural and Resource Economics Review. Vol. 40, No. 1. p. 1-9.

Further Resources

Publications

Aubery, Sarah Beth. 2011. The Profitable Hobby Farm. Wiley Press, Hoboken, NJ.

Chase, Craig. 2011. Iowa Fruit & Vegetable Production Budgets. Iowa State University Extension and Outreach, Ames, IA.

Grubinger, Vernon P. 1999. Sustainable Vegetable Production from Start-up to Market. Natural Resource, Agriculture, and Engineering Service. Ithaca, NY. NRES-104.

Macher, Ron. 1999. Making Your Small Farm Profitable. Storey Publishing, North Adams, MA.

Minnesota Institute of Sustainable Agriculture. 2002. Building a Sustainable Business.

Salatin, Joel. 1998. You Can Farm: The Entrepreneur’s Guide to Start & Succeed in a Farming Enterprise. Polyface Press. Swoope, VA.

Walters, Charles. 2002. A Farmer’s Guide to the Bottom Line. Acres U.S.A, Austin, TX.

Software Tools

B Systems Inc. has offered software for production agriculture operations for more than 30 years.

Center for Farm Management at the University of Minnesota provides educational programs and software tools for real-world farming situations.

Farm Books Accounting Software covers such tasks as payroll, invoicing, bill tracking, check writing and inventory management.

Farm Works Software offers software for farmers and agribusinesses, including accounting, mapping, field, and livestock records, and many other options.

Iowa Farm Business Association has farming software called PcMars, which is available at no cost to association members.

QuickBooks is a standard accounting program that some agriculture experts recommend for making the transition to computerized record keeping.

Red Wing Software offers CenterPoint Accounting for Agriculture software, which covers taxes, production, inventory, payroll, and financing, as well as “what if” growth scenarios and other topics.

Specialized Data Systems develops agriculture software for farms and ranches.

Vertical Solutions offers EasyFarm recordkeeping software for farms and ranches.

Planning for Profit in Sustainable Farming

By Jeff Schahczenski, NCAT Agriculture Economist

Published October 2011

© NCAT

IP419

This publication is produced by the National Center for Appropriate Technology through the ATTRA Sustainable Agriculture program, under a cooperative agreement with USDA Rural Development. ATTRA.NCAT.ORG.