Renewable Energy Opportunities on the Farm

By Cathy Svejkovsky, NCAT Energy Specialist

Abstract

Renewable energy represents an important option for agricultural producers. This publication introduces three renewable energy resources that can be attractive and economically feasible for the farm: solar, wind, and renewable fuels. This is not a technical guide for designing or installing renewable energy systems but, instead, an overview that provides information on wind, solar, and renewable fuel technologies, cost and savings, site planning, and financial incentives. A list of resources follows the narrative.

Table of Contents

Renewable Fuels for Transportation

Introduction

Renewable energy — such as solar, wind, and biofuels — can play a key role in creating a clean, reliable energy future. The benefits are many and varied, including a cleaner environment. Electricity is often produced by burning fossil fuels such as oil, coal, and natural gas. The combustion of these fuels releases a variety of pollutants into the atmosphere, such as carbon dioxide (CO2), sulfur dioxide (SO2), and nitrogen oxide (NOx), which create acid rain and smog. Carbon dioxide from burning fossil fuels is a significant component of greenhouse gas emissions. These emissions could significantly alter the world’s environment and contribute to global warming.

Renewable energy, on the other hand, can be a clean energy resource. Using renewables to replace conventional fossil fuels can prevent the release of pollutants into the atmosphere and help combat global warming. For example, using solar energy to supply a million homes with energy would reduce CO2 emissions by 4.3 million tons per year, the equivalent of removing 850,000 cars from the road.

Equally important, renewable energy technologies contribute significantly to local economies, creating jobs and keeping energy dollars in the local economy.

This guide will introduce you to solar, wind, and renewable fuel technologies. Note that it is not a technical guide for designing or installing renewable energy systems. For that information, consult a professional who will have detailed technical specifications and other necessary information.

This is also not intended to be a complete guide to all of the renewable energy opportunities available to agricultural producers. Among the options not covered here are hydro-electric generators, geothermal energy, methane digesters, and various other “biomass” energy systems.

Solar Energy

Throughout the United States, people are showing increased interest in capturing the sun’s energy for their farm operations, homes, and businesses. These systems allow you to produce your own electricity and heat water with no noise and no air pollution while using a clean, renewable resource — the sun.

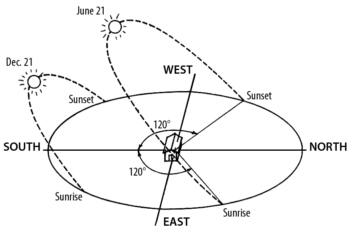

In general, the sun should be unobstructed from 9 a.m. to 3 p.m. for solar collectors. PV applications are more sensitive to minor solar obstructions than solar thermal applications. Illustration: NCAT

Is My Site Suitable for Solar Energy?

A well-designed solar energy system needs clear and unobstructed access to the sun’s rays for most or all of the day, throughout the year. Most farms and ranches have rooftops or open, sunny locations that are well-suited to solar energy, and you can make an initial assessment yourself. If the location looks promising, your solar installer or equipment dealer can determine whether your home or business can effectively use a solar energy system.

The orientation of your system (the compass direction that your system faces) affects its performance.

In the United States, the sun is always in the southern half of the sky but is higher in the summer and lower in the winter. Usually, the best location for a solar energy system is a south-facing roof, but roofs that face east or west may also be acceptable. Flat roofs also work well for solar electric systems, because solar modules can be mounted flat on the roof facing the sky or bolted on frames tilted toward the south at an optimal angle. They can also be attached directly to the roof as “PV shingles.”

If a rooftop can’t be used, your solar modules can also be placed on the ground, either on a fixed mount or a “tracking” mount that follows the sun to orient the modules. Other options include mounting structures that create covered parking, or that provide shade as window awnings.

Photovoltaic (PV) shingles are an attractive solar option, since they look much like ordinary roofing shingles, but they also generate electricity. Photo: NREL

Photovoltaics

What is a solar electric, or photovoltaic, system? Photovoltaic (PV) systems convert sunlight directly to electricity. They work any time the sun is shining, but more electricity is produced when the sunlight is more intense and strikes the PV modules directly (as when rays of sunlight are perpendicular to the PV modules). Unlike solar thermal systems for heating water, PV does not use the sun’s heat to make electricity. Instead, electrons freed by the interaction of sunlight with semiconductor materials in PV cells are captured in an electric current.

PV allows you to produce electricity — without noise or air pollution — from a clean, renewable resource. A PV system never runs out of fuel, and it won’t increase U.S. oil imports. Many PV system components are manufactured right here in the United States. These characteristics could make PV technology the U.S. energy source of choice for the 21st century.

Solar electric power comes in very handy on farms and ranches, and is often the most cost-effective and low-maintenance solution at locations far from the nearest utility line. PV can be used to power lighting, electric fencing, small motors, aeration fans, gate-openers, irrigation valve switches, automatic supplement feeders. Solar electric energy can even be used to move some sprinkler irrigation systems.

PV systems are also extremely well-suited for pumping water for livestock in remote pastures, where electricity from power lines is unavailable. PV is often much less expensive than the alternative of extending power lines into these remote areas. Depending on the depth of the well (if any) and the volume of water needed, a simple pumping system can often be installed for as little as $2,500, including the cost of a pump especially designed for PV power.

The basic building block of PV technology is the solar “cell.” Multiple PV cells are connected to form a PV “module,” the smallest PV component sold commercially. Modules range in power output from about 10 watts to 300 watts. A PV system connected or “tied” to the utility grid has these components:

- One or more PV modules, which are connected to an inverter

- Inverter, which converts the system’s direct-current (DC) electricity to alternating current (AC)

- Batteries (optional) to provide energy storage or backup power in case of a power interruption or outage on the grid.

AC electricity is compatible with the utility grid. It powers our lights, appliances, computers, and televisions.

Cost/Savings

A photovoltaic (PV) system can be a substantial investment. Cost-effectiveness will depend on system installation cost, system performance, and local electric rates. As with any investment, careful planning will help you make the right decisions for your farm, home, or business. Before you decide to buy a PV system, there are some things to consider.

First, PV produces power intermittently because it works only when the sun is shining. This is not a problem for PV systems connected to the utility grid, because any additional electricity required is automatically delivered to you by your utility. In the case of non-grid, or stand-alone, PV systems, batteries can be purchased to store energy for later use. Second, if you live near existing power lines, PV-generated electricity is usually more expensive than conventional utility-supplied electricity. Although PV now costs less than 1 percent of what it did in the 1970s, the amortized price over the life of the system is still about 25 cents per kilowatt-hour. This is double to quadruple what most people pay for electricity from their utilities. A solar rebate program and net metering can help make PV more affordable, but neither can match today’s price for utility electricity — in most cases.

Finally, unlike the electricity you purchase monthly from a utility, PV power requires a high initial investment. This means that buying a PV system is like paying years of electric bills up front. Your monthly electric bills will go down, but the initial expense of PV may be significant. By financing your PV system, you can spread the cost over many years, and rebates can also lighten your financial load.

How much energy will a grid-connected PV system produce?* |

|||||

| System Size |

1-kW |

2-kW

|

3-kW

|

4-kW

|

5-kW

|

| Seattle, WA |

970

|

1940

|

2910

|

3880

|

4850

|

| Sacramento, CA |

1399

|

2799

|

4198

|

5597

|

6996

|

| Boulder, CO |

1459

|

2917

|

4376

|

5834

|

7293

|

| Minneapolis, MN |

1286

|

2571

|

3857

|

5142

|

6428

|

| Des Moines, IA |

1292

|

2584

|

3876

|

5168

|

6459

|

| Houston, TX |

1220

|

2440

|

3660

|

4879

|

6099

|

| Pittsburgh, PA |

1099

|

2197

|

3296

|

4395

|

5494

|

| Jacksonville, FL |

1286

|

2571

|

3857

|

5142

|

6428

|

| *Estimated annual output in kWh/year (source: PV WATTS). A typical home uses an average of 9,400 kWh per year. Contact your utility to request a printout of your last 12 months of electrical energy consumption. | |||||

The value of your PV system’s electricity depends on how much you pay for electricity now and how much your utility will pay you for any excess power that you generate. With net metering, the PV system’s electricity is metered back to the utility, which offsets the electricity coming from the utility. You can use the calculation box on this page to estimate how much electricity your PV system will produce and how much that electricity will be worth. Actual energy production from your PV system will vary by up to 20 percent from these figures, depending on your geographic location, the angle and orientation of your system, the quality of the components, and the quality of the installation. Also, you may not get full retail value for excess electricity produced by your system on an annual basis, even if your utility does offer net metering. Be sure to discuss these issues with your PV provider. Request a written estimate of the average annual energy production from the PV system. However, even if an estimate is accurate for an average year, actual electricity production will fluctuate from year to year because of natural variations in weather and climate.

Area of Solar Array Needed in Square Feet |

|||||||

|

PV Module |

PV Capacity Rating (Watts)

|

||||||

|

100

|

250

|

500

|

1,000

|

2,000

|

4,000

|

10,000

|

|

|

4

|

30

|

75

|

150

|

300

|

600

|

1,200

|

3,000

|

|

8

|

15

|

38

|

75

|

150

|

300

|

600

|

1,500

|

|

12

|

10

|

25

|

50

|

100

|

200

|

400

|

1,000

|

|

16

|

8

|

20

|

40

|

80

|

160

|

320

|

800

|

| For example, to generate 2,000 watts from a 12%-efficient system, you need 200 square feet of roof area. | |||||||

How Much Does a PV System Cost?

PV works best in an energy-efficient building. So, measures such as adding insulation and sealing air leaks, as well as purchasing energy-efficient lighting, and appliances, are essential to reduce your building’s overall electricity use before installing a PV system.

Net Metering

For state-by-state net metering information, see Net Metering Rules for Energy Efficiency on the Database of State Incentives for Renewables & Efficiency.

Solar Space Heating

Solar space-heating systems can be used in livestock, dairy, and other agriculture operations that have significant space heating requirements. For example, modern pig and poultry farms raise animals in enclosed buildings with carefully controlled temperatures that help maximize animal health and growth. In addition, these facilities often have high ventilation needs in order to remove moisture, toxic gases, odors, and dust. Properly designed solar space-heating systems can help meet both of these needs.

Solar Greenhouse Heating

Solar greenhouses are designed to collect solar energy during sunny days and also to store heat for use at night or during periods when it is cloudy. They can either stand alone or be attached to houses or barns. A solar greenhouse may be an underground pit, a shed-type structure, or a quonset hut. Large-scale producers use free-standing solar greenhouses, while attached structures are primarily used by home-scale growers.

Solar greenhouses differ from conventional greenhouses in the following ways. Solar greenhouses:

- have glazing oriented to receive maximum solar heat during the winter

- use heat-storing materials to retain solar heat

- have large amounts of insulation where there is little or no direct sunlight

- use glazing material and glazing installation methods that minimize heat loss

- rely primarily on natural ventilation for summer cooling

Passive solar greenhouses are often good choices for small growers, because they are a cost-efficient way for farmers to extend the growing season. In colder climates or in areas with long periods of cloudy weather, solar heating may need to be supplemented with a gas or electric heating system to protect plants against extreme cold. Active solar greenhouses use supplemental energy to move solar heated air or water from storage or collection areas to other regions of the greenhouse. Use of photovoltaic heating systems for greenhouses is generally not cost-effective unless you are producing high-value crops.

Solar Crop Drying

Farmers have been using the sun to dry crops for centuries. You can take advantage of this technology simply by allowing crops to dry naturally in the field, or by spreading grain and fruit out in the sun after harvesting. Today’s solar dryers are designed to provide protection from insects, rodents, birds, as well as weather. A basic solar dryer consists of an enclosure or shed, screened drying trays or racks, and a solar collector. The design of a solar crop drying system needn’t be complicated — it can simply be a glazed box with a dark-colored interior to collect solar energy, which heats the air inside the box. The heated air is then moved through the crop material either by natural convection or with a fan.

For more information, see Solar Energy in Agriculture – Resources.

Solar Water Heating

Water heating can account for as much as 25 percent of a typical family’s energy costs and up to 40 percent of the energy used in a typical dairy operation. A properly sized solar water-heating system could cut those costs in half. Hot water is also needed for pen and equipment cleaning and a host of other agricultural uses.

Solar Water Heater Basics

Solar water heating systems use the sun to heat either water or a heat-transfer fluid, such as a water-glycol antifreeze mixture, in collectors most commonly mounted on a roof. The heated water is then stored in a tank similar to a conventional gas or electric water tank. Then, when water is drawn from the water heater, it is replaced with the solar-heated water from that tank. Some systems use an electric pump to circulate the fluid through the collectors.

Solar water heaters can operate in any climate. Performance varies depending, in part, on how much solar energy is available at the site, but also on the temperature of incoming water. The colder the water, the more efficiently the system operates. In almost all climates, you will need a conventional backup system. In fact, many building codes require you to have a conventional water heater as the backup.

Types of Solar Water Heaters

There are four basic types of solar water-heating systems available. These systems share three similarities: a glazing (typically glass) over a dark surface to gather solar heat; one or two tanks to store hot water; and associated plumbing with or without pumps to circulate the heat-transfer fluid from the tank to the collectors and back again.

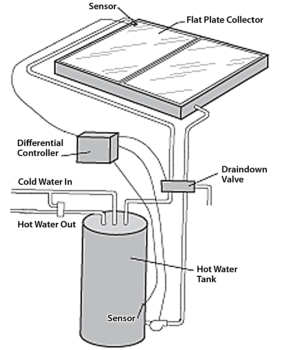

Draindown systems pump water from the hot water tank through the solar collectors, where it is heated by the sun and returned to the tank. Valves automatically drain the system when sensors detect freezing temperatures.

Draindown solar water system. Illustration: North Carolina Solar Center

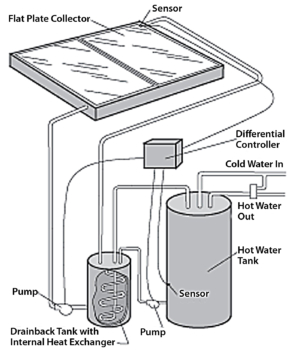

Drainback systems use a separate plumbing line, filled with fluid, to gather the sun’s heat. These systems operate strictly on gravity. When the temperature is near freezing, the pump shuts off and the transfer fluid drains back into the solar storage tank. Antifreeze closed-loop systems rely on an antifreeze solution to operate through cold winter months.

Drainback solar water system. Illustration: North Carolina Solar Center

Antifreeze solutions are separated from household water by a double-walled heat exchanger.

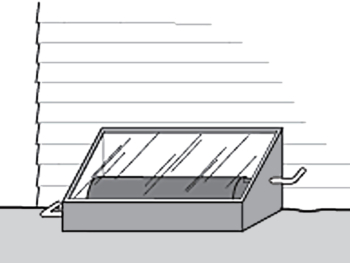

Breadbox batch systems are passive systems in which the storage tank also functions as the collector. One or two water tanks, painted black, are placed in a well-insulated box or other enclosure that has a south wall made of clear plastic or glass and tilted at the proper angle. This allows the sun to shine directly on the tank and heat a “batch” of water. An insulated cover can provide freeze protection.

Breadbox batch solar water system. Illustration: North Carolina Solar Center

Sizing Your System

Just as you have to choose a 30-, 40-, or 50-gallon conventional water heater, you need to determine the right size solar water heater to install. Sizing a solar water heater involves determining the total collector area and the storage volume required to provide 100 percent of your building’s hot water during the summer. Solar equipment experts use worksheets or special computer programs to assist you in determining how large a system you need.

Solar storage tanks are usually 50-, 60-, 80-, or 120-gallon capacity. A small (50- to 60-gallon) system is sufficient for one to three people, a medium (80-gallon) system is adequate for a three- or four-person household, and a large (120-gallon) system is appropriate for four to six people.

Cost/Savings

How much does a solar water-heating system cost? A solar water-heating system can cost anywhere from $1,500 to more than $5,000. Cost depends on a number of variables, such as:

- the presence or type of freeze protection

- size of family, business, or agricultural operation to be served

- size and type of solar system

- type of roof on which the collector is to be installed

- building code requirements

- installation costs

The less expensive solar water-heating systems lack freeze protection and are applicable primarily for summer recreation homes. A solar energy supplier or installer in your area can help you determine specific costs for your system.

How Much Will I Save?

Savings from solar water heating depend on specific climate, conventional fuel costs, and other factors. However, a study by the Florida Solar Energy Center (FSEC) concluded that solar water heaters could reduce water heating costs by as much as 85 percent annually, compared to the cost of an electric water heater. Paybacks vary widely, but you can expect a simple payback of four to eight years on a well-designed and properly installed solar water heater. (Simple payback is the length of time required to recover your investment through reduced or avoided energy costs.)

If you are constructing a new building or undergoing a major renovation, the economics are even more attractive. The cost of including the price of a solar water heater in a new 30-year mortgage is usually between $13 and $20 per month. The portion of the federal income tax deduction for mortgage interest attributable to the solar system reduces that amount by about $3 to $5 per month. If your fuel savings are more than $15 per month, the investment in the solar water heater is profitable immediately.

First Things First

Before investing in any solar energy system, it is more cost-effective to invest in energy-efficiency measures for your building. Taking steps to use less hot water and to lower the temperature of the hot water you use reduces the size and cost of your solar water heater. Good first steps are installing low-flow showerheads or flow restrictors in faucets, insulating your current water heater, and insulating any hot water pipes that you can see. You’ll also want to make sure your site has enough available sunshine to meet your needs efficiently and economically. Your local solar equipment dealer can perform a solar site analysis for you or show you how to do your own.

Remember: Local zoning laws or covenants may restrict where you can place your collectors. Check with your city and county to learn about any restrictions.

Be a Smart Consumer

Take the same care in choosing a solar water heater that you would in the purchase of any major appliance. Your best protection is to consider only certified and labeled systems. One such label is put on by the Solar Rating & Certification Corporation (SRCC), a nonprofit, independent third-party organization formed by the state energy officials, and consumer advocates to certify and rate solar water heaters.

Find out if the manufacturer offers a warranty, and, if so, what the warranty covers and for how long. If the dealer you are buying the equipment from goes out of business, can you get support and parts from the manufacturer, or from a local plumbing contractor?

Make sure that the workers who are actually installing the system are qualified to do the work. In many states, an installer of a solar water heater must have a plumbing license. Ask the installation contractor for references and check them. When the job is finished, have the contractor walk you through the system so you are familiar with the installation. And be sure that an owner’s manual with maintenance instructions is included as part of the package.

A solar water heater is a long-term investment that will save you money and energy for many years. Like other renewable energy systems, solar water heaters minimize the environmental effects of enjoying a comfortable, modern lifestyle. In addition, they provide a hedge against energy price increases, help reduce our dependence on foreign oil, and are investments in everyone’s future.

Financial Incentives

The following information identifies federal financial incentives. For more information on these, as well as state incentives, see the Database of State Incentives for Renewable Energy (DSIRE).

Residential Solar and Fuel Cell Tax Credit

Enacted by the Energy Policy Act of 2005 (Section 1335), this credit applies to solar water heating, photovoltaics, and fuel cells. Incentive amount is 30 percent, with maximums of $2,000 for photovoltaics and solar water heating and $500 per 0.5 kW for fuel cells. (Subject to funding limitations.) Effective date: 1/1/2006. Expiration Date: 12/31/2007. For more information on the Energy Policy Act of 2005 and what it means to you, visit the American Council for an Energy Efficient Economy (ACEEE).

Business Energy Tax Credit

Enacted by the Energy Policy Act of 2005 (Section 1336 – 1337), this credit applies to renewables including solar water heating, solar space heating, solar thermal electric, solar thermal process heat, geothermal electric, fuel cells, and solar hybrid lighting for commercial and industrial applications. The industrial tax credit is currently 10 percent for geothermal electric and solar; from January 1, 2006, until December 31, 2007, the credit is 30 percent for solar, solar hybrid lighting, and fuel cells, and 10 percent for microturbines. The geothermal credit remains at 10 percent. Maximum incentive is $550 per 0.5 kW for fuel cells; $200/kW for microturbines; no maximum specified for other technologies. (Subject to funding limitations.) Effective date: 1/1/2006. Expiration date: 12/31/2007.

Renewable Energy Systems and Energy Efficiency Improvements Program

This federal grant program applies to solar water heating, solar space heating, photovoltaics, wind, biomass, geothermal electric, geothermal heat pumps, hydrogen, anaerobic digestion, renewable fuels, and fuel cells in commercial and agricultural applications. Grants amount to 25 percent of eligible project costs; guaranteed loans are 50 percent of eligible project costs (pending). Maximums are $500,000 per renewable-energy project for grants, and $10 million for guaranteed loans. (Subject to funding limitations.) Effective date: 10/5/2004. Expiration date: 10/1/2007.

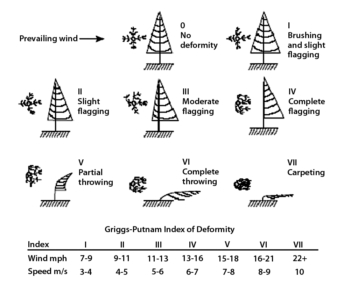

Flagging, the effect of strong winds on area vegetation, can help determine area wind speeds. Illustration: NREL

Wind Energy

More and more people are considering wind energy as they look for affordable and reliable sources of electricity. Small wind electric systems can make a significant contribution to our nation’s energy needs. Although wind turbines large enough to provide a significant portion of the electricity needed by the average U.S. farm or home generally require one acre of property or more, approximately 21 million U.S. homes are built on one-acre and larger sites, and 24 percent of the U.S. population lives in rural areas. Many of these rural areas, particularly in the western U.S., also have sufficient wind speeds to make wind an attractive alternative.

This section will provide you with basic information about small wind electric systems to help you decide if wind energy will work for you. Note that this discussion only covers small-scale wind electric systems. Two other options, not covered here, are of great importance to agricultural producers: First, landowners in windy locations often lease farmland to developers who want to install large wind turbines or wind farms. These “turnkey” operations, where the landowner receives an annual payment, can generate an attractive income stream while often allowing farming and livestock grazing to continue in close proximity to the wind turbines. Second, farmers in some parts of the country have formed cooperatives, pooling their financial resources in order to purchase and operate their own large wind turbines.

Why Should I Choose Wind?

Under certain circumstances, wind energy systems can be a cost-effective renewable energy system. Depending on your wind resource, a small wind energy system can lower your electricity bill, help you avoid the high costs of having utility power lines extended to remote locations, prevent power interruptions, and it is non-polluting.

How Do Wind Turbines Work?

Wind is created by the unequal heating of the Earth’s surface by the sun. Wind turbines convert the kinetic energy in wind into mechanical power that runs a generator to produce clean electricity. Today’s turbines are versatile modular sources of electricity. Their blades are aerodynamically designed to capture the maximum energy from the wind. The wind turns the blades, which spin a shaft connected to a generator that makes electricity.

Is Wind Energy Practical for Me?

A small wind energy system can provide you with a practical and economical source of electricity if:

- your property has a good wind resource

- your farm, home, or business is located on at least one acre of land in a rural area

- your local zoning codes or covenants allow wind turbines

- your average electricity bills are $150 per month or more

- your property is in a remote location that does not have easy access to utility lines

- you are comfortable with long-term investments

Is There Enough Wind at My Site?

Does the wind blow hard and consistently enough at my site to make a small wind turbine system economically worthwhile? That is a key question and not always easily answered. The wind resource can vary significantly over an area of just a few miles because of local terrain influences on the wind flow. Yet, there are steps you can take that will go a long way towards answering the above question.

As a first step, consult resources such as the National Wind Technology Center and DOE’s Wind Powering America to estimate the wind resource in your region. The highest average wind speeds in the United States are generally found along seacoasts, on ridgelines, and on the Great Plains; however, many areas have wind resources strong enough to power a small wind turbine economically.

Another way to indirectly quantify the wind resource is to obtain average wind speed information from a nearby airport. However, caution should be used because local terrain influences and other factors may cause the wind speed recorded at an airport to be different from your particular location. Airport wind data are generally measured at heights about 20–33 feet (6–10 meters) above ground. Average wind speeds increase with height and may be 15–25 percent greater at a typical small wind turbine hub-height of 80 feet (24 meters) than those measured at airport anemometer heights. The National Climatic Data Center collects data from airports in the United States and makes wind data summaries available for purchase. Summaries of wind data from almost 1,000 U.S. airports also are included in Wind Energy Resource Atlas of the United States.

Another useful indirect measurement of the wind resource is the observation of an area’s vegetation. Trees, especially conifers or evergreens, can be permanently deformed by strong winds. This deformity, known as “flagging,” has been used to estimate the average wind speed for an area. For more information on flagging, you may want to obtain A Siting Handbook for Small Wind Energy Conversion Systems, by H. Wegley, J. Ramsdell, M. Orgill & R. Drake, Report No. PNL-2521.

Direct monitoring by a wind resource measurement system at a site provides the clearest picture of the available resource. A good overall guide on this subject is the Wind Resource Assessment Handbook. Wind measurement systems are available for costs as low as $600 to $1,200. This expense may or may not be hard to justify, depending on the exact nature of the proposed small wind turbine system. The measurement equipment must be set high enough to avoid turbulence created by trees, buildings, and other obstructions. The most useful readings are those taken at hub-height, the elevation at the top of the tower where the wind turbine is going to be installed. If there is a small wind turbine system in your area, you may be able to obtain information on the annual output of the system and also wind speed data if available.

Zoning Issues

Agricultural producers generally have greater freedom than residential homeowners in what they do on their own, agriculturally zoned land. Nonetheless, before you invest in a wind energy system, you should research potential obstacles. Some jurisdictions, for example, restrict the height of the structures permitted in residentially zoned areas, although variances are often obtainable. Most zoning ordinances have a height limit of 35 feet. You can find out about the zoning restrictions in your area by calling the local building inspector, board of supervisors, or planning board. They can tell you if you will need to obtain a building permit and provide you with a list of requirements. In addition to zoning issues, your neighbors might object to a wind machine that blocks their view, or they might be concerned about noise. Most zoning and aesthetic concerns can be addressed by supplying objective data. For example, the ambient noise level of most modern residential wind turbines is around 52 to 55 decibels. This means that while the sound of the wind turbine can be picked out of surrounding noise if a conscious effort is made to hear it, a residential sized wind turbine is no noisier than your average refrigerator.

What Size Wind Turbine Do I Need?

The size of the wind turbine you need depends on your application. Small turbines range in size from 100 watts to 100 kilowatts. The smaller or “micro” (100–500-watt) turbines are used in a variety of applications such as charging batteries for recreational vehicles and sailboats. One- to 10-kW turbines can be used in applications such as pumping water. Wind energy has been used for centuries to pump water and grind grain. Although mechanical windmills still provide a sensible, low-cost option for pumping water in low-wind areas, farmers and ranchers are finding that wind-electric pumping is a little more versatile and they can pump twice the volume for the same initial investment. In addition, mechanical windmills must be placed directly above the well, which may not take the best advantage of available wind resources. Wind-electric pumping systems can be placed where the wind resource is the best and connected to the pump motor with an electric cable.

Wind Turbine Sizes |

||

|

Size

|

Height

|

Diameter

|

|

1 kW

|

30-100 feet

|

4-8 feet

|

|

10 kW

|

60-120 feet

|

23-25 feet

|

|

100 kW

|

80-120 feet

|

56-60 feet

|

| Examples. Specific component sizes vary by manufacturer. | ||

Turbines used in residential applications can range in size from 400 watts to 100 kW (100 kW for very large loads), depending on the amount of electricity you want to generate. For residential applications, you should establish an energy budget to help define the size of turbine you will need. Because energy efficiency is usually less expensive than energy production, making your house more energy-efficient first will probably be more cost-effective and will reduce the size of the wind turbine you need. Wind turbine manufacturers can help you size your system based on your electricity needs and the specifics of local wind patterns.

A typical home uses approximately 9,400 kilowatt-hours (kWh) of electricity per year (about 780 kWh per month). Depending on the average wind speed in the area, a wind turbine rated in the range of 5 to 10 kilowatts (kW) would be required to make a significant contribution to this energy need. The manufacturer can provide you with the expected annual energy output of the turbine as a function of annual average wind speed. The manufacturer will also provide information on the maximum wind speed at which the turbine is designed to operate safely. Most turbines have automatic over-speed-governing systems to keep the rotor from spinning out of control in very high winds. This information, along with your local wind speed and your energy budget, will help you decide which size turbine will best meet your electricity needs.

A grid-connected wind turbine can reduce your consumption of utility-supplied electricity.

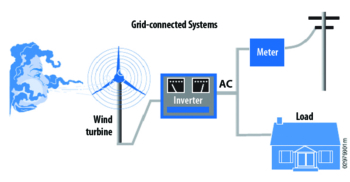

Grid-Connected Systems

In grid-connected systems, the only additional equipment required is a power conditioning unit (inverter) that makes the turbine output electrically compatible with the utility grid. Usually, batteries are not needed. Small wind energy systems can be connected to the electricity distribution system and are called grid-connected systems. A grid-connected wind turbine can reduce your consumption of utility-supplied electricity for lighting, appliances, and electric heat. If the turbine cannot deliver the amount of energy you need, the utility makes up the difference. When the wind system produces more electricity than the household requires, the excess is sent or sold to the utility. Grid-connected systems can be practical if the following conditions exist:

- You live in an area with average annual wind speed of at least 10 mph (4.5 m/s)

- Utility-supplied electricity is expensive in your area (about 10 to 15 cents per kilowatt-hour).

- The utility’s requirements for connecting your system to its grid are not prohibitively expensive.

- There are good incentives for the sale of excess electricity or for the purchase of wind turbines.

Federal regulations (specifically, the Public Utility Regulatory Policies Act of 1978, or PURPA) require utilities to connect with and purchase power from small wind energy systems. However, you should contact your utility before connecting to their distribution lines to address any power quality and safety concerns. Your utility can provide you with a list of requirements for connecting your system to the grid. The American Clean Power is another good source for information on utility interconnection requirements.

What Do Wind Systems Cost?

A small turbine can cost anywhere from $3,000 to $35,000 installed, depending on size, application, and service agreements with the manufacturer. A general rule of thumb for estimating the cost of a residential turbine is $3,000 per kilowatt for systems up to 10 kW. Smaller wind systems are more costly per kilowatt of installed capacity. Wind energy becomes more cost-effective as the size of the turbine’s rotor increases. Although small turbines cost less in initial outlay, they are proportionally more expensive. The cost of an installed residential wind energy system that comes with an 80-foot tower, batteries, and inverter, typically ranges from $13,000 to $40,000 for a 3- to 10-kW wind turbine. Although wind energy systems involve a significant initial investment, they can be competitive with conventional energy sources when you account for a lifetime of reduced or avoided utility costs. The length of the payback period — the time before the savings resulting from your system equal the cost of the system itself — depends on the system you choose, the wind resource on your site, electricity costs in your area, and how you use your wind system.

Financial Incentives

The following information identifies federal financial incentives. For more information on these, as well as state incentives, see the Database of State Incentives for Renewable Energy (DSIRE).

Renewable Energy Systems and Energy Efficiency Improvements Program

This federal grant program applies to solar water heating, solar space heating, photovoltaics, wind, biomass, geothermal electric, geothermal heat pumps, hydrogen, anaerobic digestion, renewable fuels, and fuel cells in commercial and agricultural applications. Grants amount to 25 percent of eligible project costs; guaranteed loans are 50 percent of eligible project costs (pending). Maximums are $500,000 per renewable-energy project for grants, and $10 million for guaranteed loans. (Subject to funding limitations.) Effective date: 10/5/2004. Expiration date: 2007.

Wind Energy Production Tax Credit

The Energy Policy Act of 2005 extends the tax credit for wind energy systems. The tax credit amounts to 1.9 cents-per-kilowatt-hour (kWh) tax credit for electricity generated with wind turbines over the first ten years of a project’s operations. (Subject to funding limitations.) Expiration date: 12/31/2007.

Photo: NREL

Renewable Fuels for Transportation

Transportation accounts for 65 percent of U.S. oil consumption and is the predominant source of air pollution. However, there are safe, environmentally friendly alternative fuels that can substitute for gasoline and diesel or be blended with them to reduce toxic air emissions. Using renewable fuels also reduces greenhouse gas buildup, dependence on imported oil, and trade deficits, while supporting local agriculture and rural economies.

What are renewable fuels?

Renewable fuels are not petroleum-based, so they’re cleaner burning. Renewable fuels include:

Biodiesel – a low-polluting diesel alternative fuel made from vegetable oils, animal fats, and even recycled cooking greases.Ethanol – an alcohol-based fuel derived from crops, usually corn, barley, and wheat. Ethanol can be blended with gasoline in varying concentrations. E85, for example, is a blend of 85 percent ethanol and 15 percent gasoline.

The Energy Policy Act of 1992 (EPAct) requires state and federal government fleets to purchase renewable fuel vehicles for three-quarters of their new light-duty vehicle purchases. Additionally, renewable fuel provider fleets covered by EPAct are required to purchase renewable fuel vehicles for 90 percent of their new vehicle purchases. Local government and private fleets are not covered by this rule, but the U.S. Department of Energy has the authority to include them at a future date.

Ethanol is an excellent renewable fuel (the standard is E85, a blend of 85 percent ethanol and 15 percent gasoline). Flexible-fuel vehicles designed to use E85 or other gasoline mixtures include modified oxygen sensors and different seals in the fuel system. Because ethanol has less energy per gallon than gasoline, E85 vehicles also need larger fuel tanks to keep the same range. E85 flex-fuel vehicles qualify as alternative fuel vehicles and Daimler-Chrysler, Ford, and General Motors all offer several models designed to use E85 or gasoline for the same price as gasoline-only models. Today, 92 state and alternative fuel provider fleets use E85 flex-fuel vehicles to help them meet their EPAct requirements.

Alternative-Fuel Vehicles

Alternative fuel vehicles (AFVs) can use renewable fuel instead of gasoline or diesel fuel. AFVs range in size and shape, from small commuter cars to large 18-wheeler trucks. A number of automobile manufacturers offer light-duty vehicles for personal transportation.

AFVs are well-suited for fleets in certain “niche” markets. Taxi fleets, for example, are high-mileage vehicles that drive fairly centralized routes and may benefit from using a less expensive alternative fuel such as natural gas or propane. Local delivery fleets with low mileage, and high-use vehicles that frequently idle in traffic or must often start and stop, may be good candidates for electric vehicles. Medium- and heavy-duty AFV applications include transit buses, airport shuttles, delivery trucks and vans, school buses, refuse haulers, and street sweepers.

AFV Types

Flex-Fuel Vehicles can be fueled with gasoline or, depending on the vehicle, with either methanol (M85) or ethanol (E85). The vehicles have one tank and can accept any mixture of gasoline and the alternative fuel.

Bi-fuel or Dual-Fuel Vehicles have two tanks — one for gasoline and one for either natural gas or propane, depending on the vehicle. The vehicles can switch between the two fuels.

Dedicated Vehicles are designed to be fueled only with an alternative fuel. Electric vehicles are a special type of dedicated vehicle.

Hybrid Vehicles combine the best features of two different energy sources, one of which is electric power. Until alternative fuels really catch on, hybrids can be a good choice.

Fueling

Alternative fuel stations are becoming increasingly popular across the country, as more consumers and agencies turn to clean fuels. Find out where these stations are using DOE’s Alternative Fuel Station Locator.

Ethanol and Local Resources

From Corn: In the United States, ethanol, also known as grain alcohol, is made from the starch in kernels of field corn. (Field corn is otherwise predominantly used as animal feed; in 2005 ethanol production used 15 percent of the feed corn crop). Modern fuel ethanol technology is highly sophisticated and efficient, and the process is similar to making alcoholic beverages. Starch is converted into sugars, the sugars are fermented to a “beer,” and then the beer is distilled to make pure ethanol. Of U.S. corn ethanol production, about half is in wet-mill plants and half is in dry-mill plants. The former are typically large operations that produce ethanol along with a slate of food products such as corn sweeteners, corn syrup, corn oil, and gluten feed. The latter are typically smaller facilities that produce ethanol as their primary product and a high-protein animal feed known as distillers dried grains as a co-product. The dry-mill plants are typically located in rural communities and often farmer-owned, which make them an excellent way to develop the local economy. In 2005, more than 80 U.S. ethanol plants produced about four billion gallons of ethanol. While ethanol accounts for about three percent of automotive fuel use in the United States, it is blended in one of out every eight gallons of gasoline for pollution reduction.

Ethanol made from corn is slightly more expensive than gasoline. To encourage ethanol use, however, the federal government exempts 5.3 cents per gallon of 10 percent ethanol blend (53 cents per gallon of ethanol) of the 18.3 cents per gallon federal fuel excise tax. In effect since 1979, this exemption makes ethanol competitive for fuel additive use. Several states also provide additional incentives. The federal subsidy, however, is more than offset by reduced agricultural price support payments, and increased employment taxes for an estimated net taxpayer savings of about $3.6 billion per year. The U.S. Department of Agriculture credits the sale of corn for ethanol production — about 600 million bushels per year — with increasing corn prices by 25 to 30 cents per bushel. (The typical price range of field corn is $1.80 to $2.30 per bushel.)

From Other Starch or Sugar: Even states with a small corn crop can benefit from building ethanol plants. Conventional ethanol technology can process any starch or sugar source. While corn certainly predominates, U.S. plants are currently making ethanol from barley, milo, wheat starch, potato waste, cheese whey, and brewery and beverage waste.

From Cellulose and Hemicellulose: Starches and sugars constitute only a small portion of plant matter. The bulk of most plants consists of cellulose, hemicellulose, and lignin. Cellulose and hemicellulose, though, are made of chains of sugars. Advanced bioethanol technology can break these chains down into their component sugars, and then ferment them to ethanol. This makes it possible to produce ethanol from virtually any biomass material. In the near-term, ethanol will probably be made from low- or negative-cost opportunity feedstocks such as municipal waste, wood processing waste, sugarcane bagasse, rice hulls, or rice straw. In the mid-term, ethanol sources will include agricultural and forestry residues such as corn stover — a huge potential source — or wood chips.

In the long-term, farmers may grow dedicated energy crops, such as switchgrass or fast-growing trees, just for fuel production. Because it requires sophisticated conversion technology, making ethanol from cellulosic biomass is currently more expensive than making it from corn grain — especially when using waste or residue feedstocks. However, cellulosic feedstocks would be inexpensive, so experts expect equal or lower costs in the long run. Advanced bioethanol technology will supplement rather than replace corn-grain ethanol by greatly expanding the potential feedstock supply and making ethanol production an option outside the Cornbelt. The U.S. Department of Energy National Biofuels Program is spearheading the effort to improve advanced bioethanol technology.

Biodiesel — Easily Produced

Many agricultural producers are taking a hard look at biodiesel these days, for reasons related to economics, air quality, and health. B100 (straight biodiesel) can cut carbon monoxide, hydrocarbons, particulates, and other pollutant emissions in half while reducing the cancer-risk contribution of diesel by about 90 percent. Emission reductions with B20 are roughly proportional. Biodiesel will even reduce the smelly oily smoke that makes it so frustrating to get caught behind a truck, tractor, or bus. Since it is biodegradable, biodiesel is far more benign than petroleum-based diesel fuels, should it be spilled on the ground.

From Fats or Oils: Fatty acid methyl ester, commonly known as biodiesel, is made by bonding alcohol (commonly methanol) to oils or fats (even animal fats or used cooking oil). The process is relatively routine, but must consistently achieve prescribed standards adopted by the American Society for Testing and Materials to minimize the risk of damaging expensive diesel engines.

From a Growing Industry: Biodiesel popularity is growing rapidly. According to the National Biodiesel Board, biodiesel production reached 75 million gallons in 2005, compared to 25 million gallons in 2004. As of April 2006, there are 65 commercial biodiesel production plants in the United States, with a combined annual production capacity of 395 million gallons per year. Another 50 plants are scheduled to be online by the end of 2007 and several plants are expanding, which will have a combined annual capacity of 713 million gallons.

Also, the detergent and fatty acid industries, which supply methyl esters to the biodiesel industry and can provide extra supplies when demand grows quickly, could provide another 30-50 million gallons of capacity, if needed to meet demand.

When purchased from commercial suppliers, biodiesel is generally more expensive than diesel fuel, but B20 typically costs only 8 to 20 cents more than regular diesel. Although usually used by centrally fueled fleets, biodiesel is becoming increasingly available at retail service stations across the country.

Farmers in some parts of the country are also successfully making their own biodiesel from waste oil, often collected from local restaurants. The cost of this “home-brewed” biodiesel is often far lower than the cost of conventional diesel fuel.

Financial Incentives

The following information identifies federal financial incentives. For more information on these, as well as state incentives, see the Database of State Incentives for Renewable Energy (DSIRE).

The Federal government exempts offers a 53 cents per gallon incentive to encourage ethanol use. A 10-percent ethanol blend fuel receives an exemption of 5.3 cents from the federal fuel excise tax (currently 18.3 cents per gallon).

The Energy Policy Act of 2005 will provide a federal excise tax credit for biodiesel as a tax incentive for petroleum distributors who blend biodiesel with diesel fuel into both on-road and off-road markets. The incentive equates to $1.00 per gallon of biodiesel made from virgin vegetable oils (like soy) and animal fats, and $0.50 per gallon for biodiesel made from recycled oils (subject to funding appropriation.)

Newly purchased, qualified electric vehicles and clean-fuel vehicles (including gasoline/electric hybrids) are eligible for federal income tax incentives:

- Purchasers of hybrid and advanced lean-burn diesel vehicles can receive a federal tax credit of up to $3,400. This will be capped at 60,000 vehicles per manufacturer and will expire in 2014. For medium and heavy hybrid trucks the tax credit will expire in 2009, and for lean-burn diesel vehicles, the tax credit will expire in 2010.

Further Resources

DOE Clean Cities Program

DOE’s Office of Energy Efficiency and Renewable Energy

DOE Wind and Hydropower Technologies Program

EERE Information Center

Interstate Renewable Energy Council

National Council for Solar Growth

National Renewable Energy Laboratory

National Sustainable Agriculture Information Service/ATTRA

Renewable Energy Opportunities on the Farm

By Cathy Svejkovsky

NCAT Energy Specialist

IP304

This publication is produced by the National Center for Appropriate Technology through the ATTRA Sustainable Agriculture program, under a cooperative agreement with USDA Rural Development. This publication was also made possible in part by funding from the USDA Risk Management Agency (RMA). ATTRA.NCAT.ORG